Submit your review | |

An Order Block Finder Indicator is a powerful trading tool that helps traders identify significant price levels where large institutional orders may have been placed, indicating potential reversal or continuation points in the market. This guide will cover the basics of using an Order Block Finder, effective trading strategies, and key tips for optimizing your trades.

Understanding Order Blocks

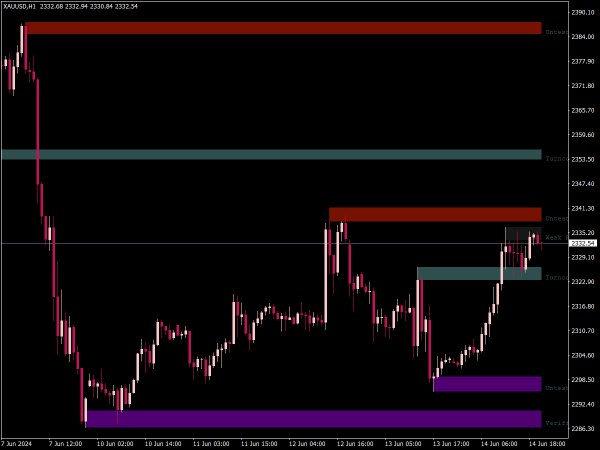

Order blocks are areas on a chart where a significant amount of buying or selling has occurred, often leading to large price moves. They signify the interest of institutional traders who can influence market direction, making these areas crucial for retail traders to watch.

Using the Order Block Finder Indicator

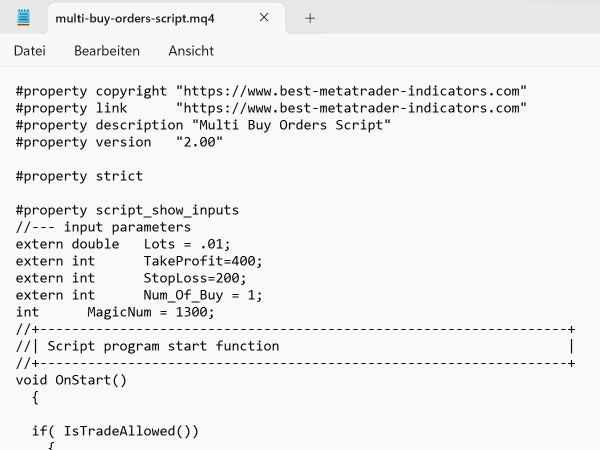

1. Setup: Install the Order Block Finder Indicator on your MT4 trading platform. Familiarize yourself with the interface and settings.

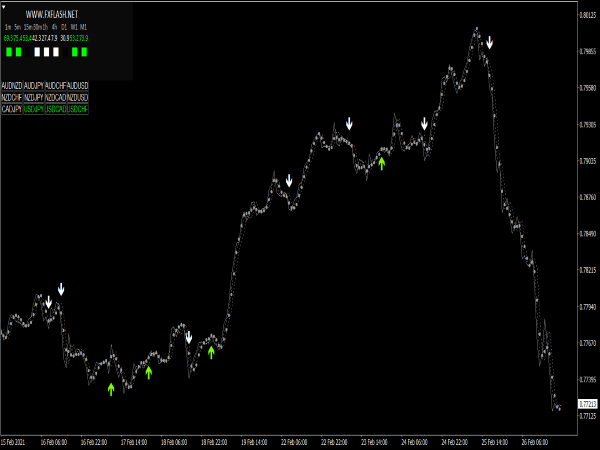

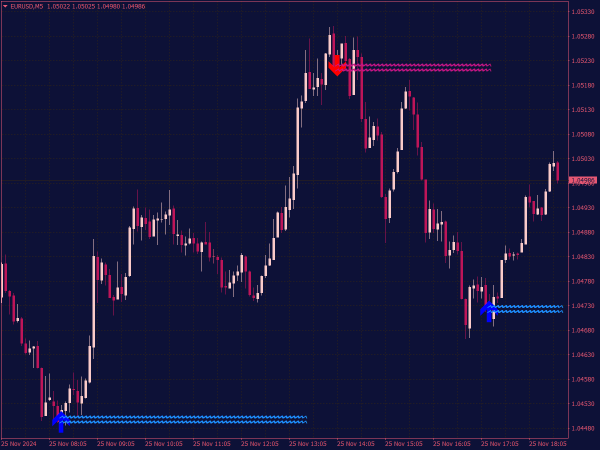

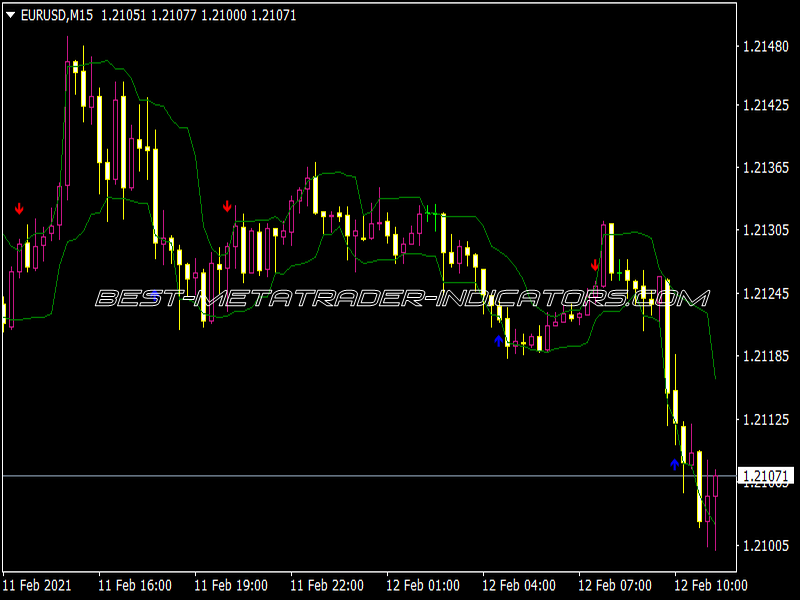

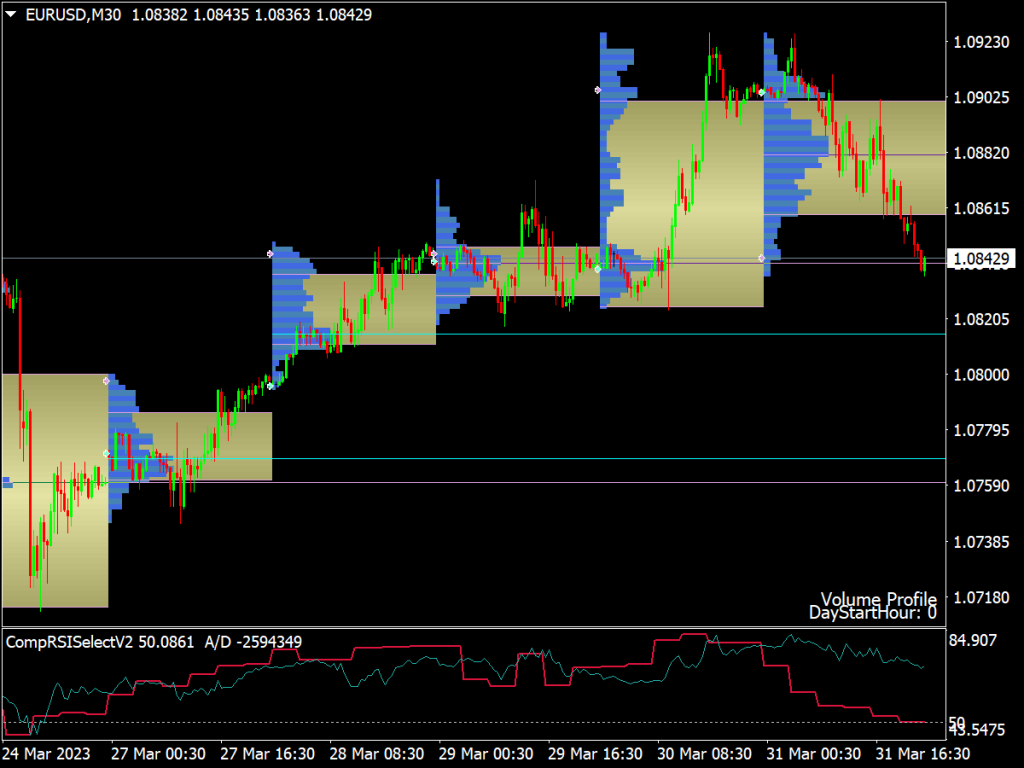

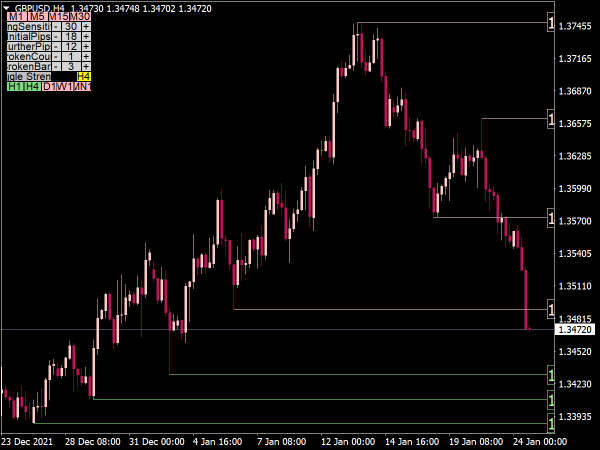

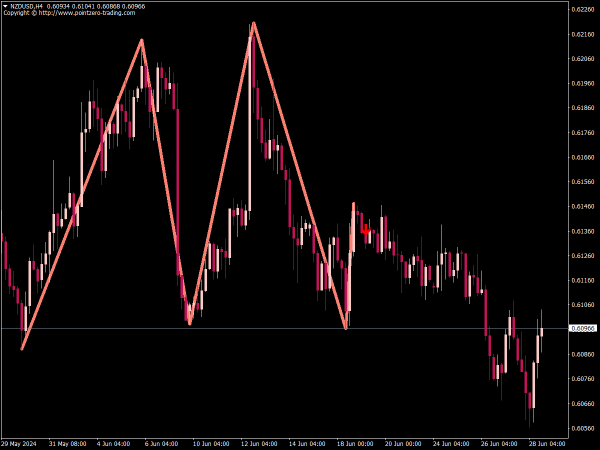

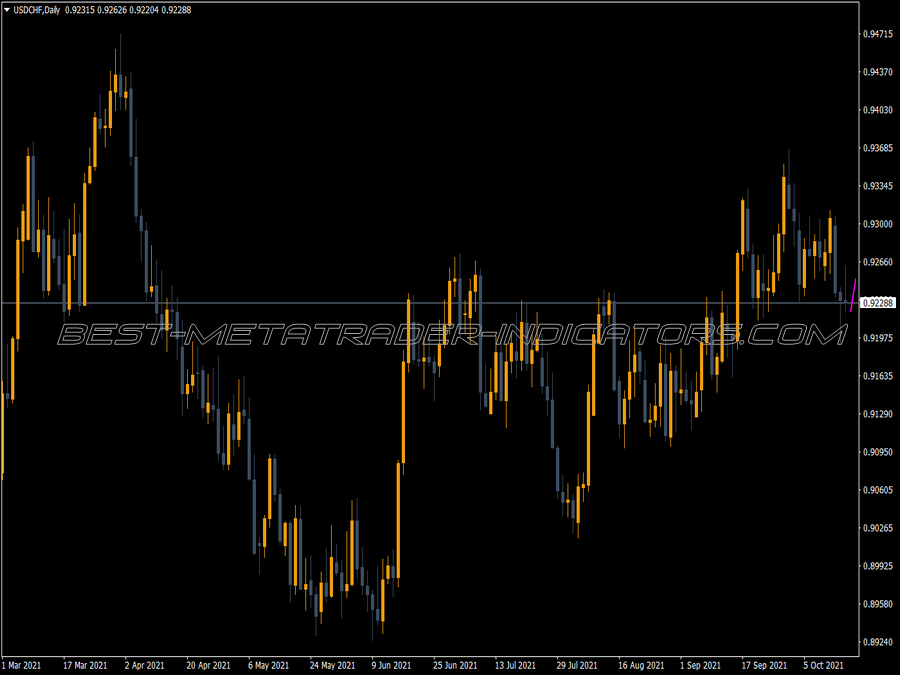

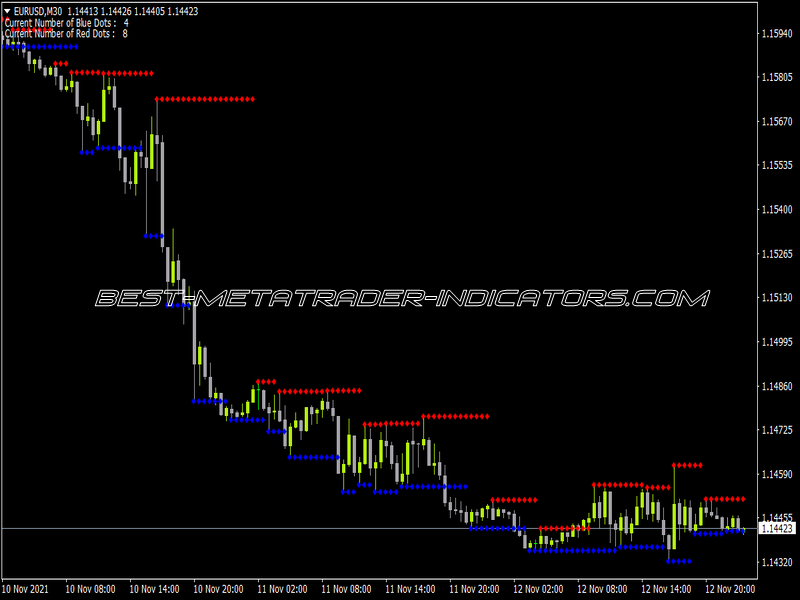

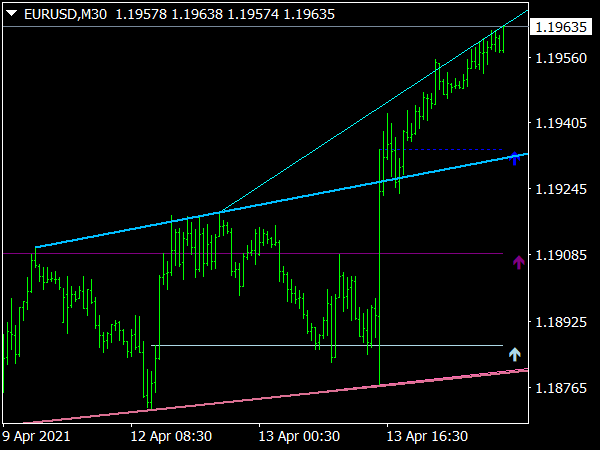

2. Identifying Order Blocks: Look for highlighted areas on your chart by the indicator, which represent potential order blocks. These usually correspond to sharp price movements followed by consolidation.

3. Confirming with Price Action: Once an order block is identified, observe the price action. Look for signs of rejection (like pin bars or engulfing candles) near the order block zone, which can indicate a potential reversal.

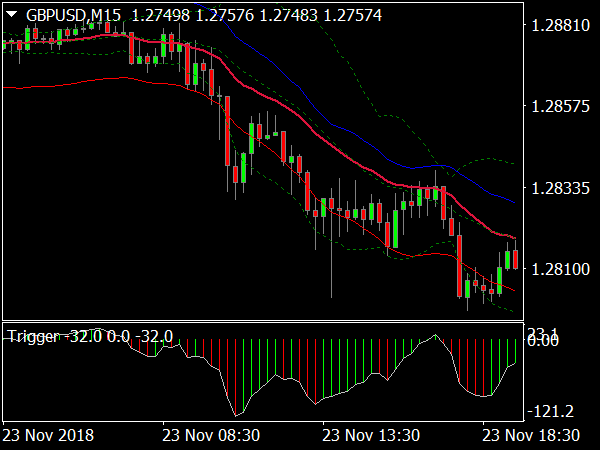

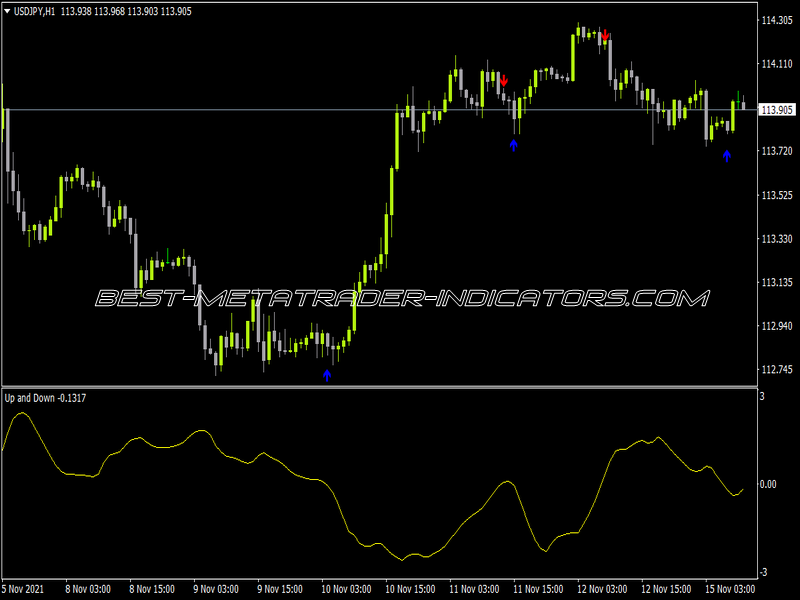

4. Timeframes: Different timeframes can yield different results. Daily charts can show significant long-term order blocks, while shorter timeframes (like 1-hour or 15-minute charts) can help refine entry and exit points.

Trading Strategies with Order Blocks

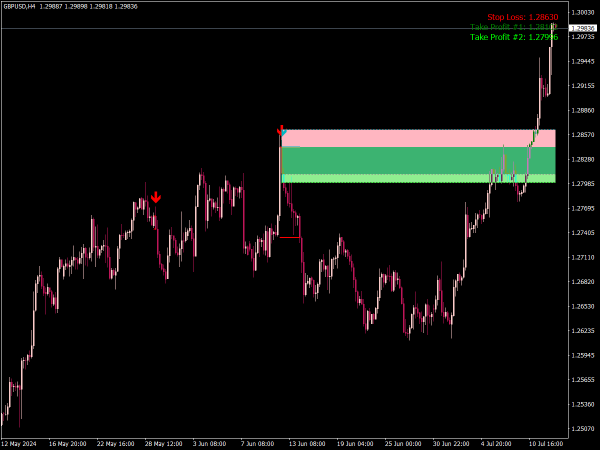

1. Reversal Trading: When price approaches a bullish order block from above, watch for bullish candlestick patterns. Conversely, if price nears a bearish order block from below, look for bearish patterns. Enter with a tight stop loss just outside the order block.

2. Breakout Trading: If price breaks through an order block, this can indicate a strong move in the direction of the breakout. Enter trades in the direction of the breakout, using the order block as a potential target area.

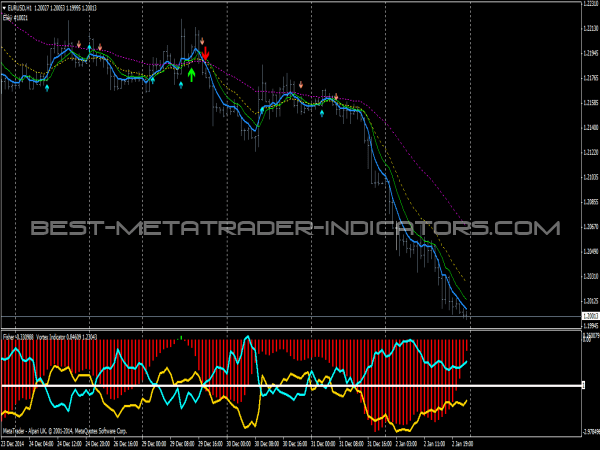

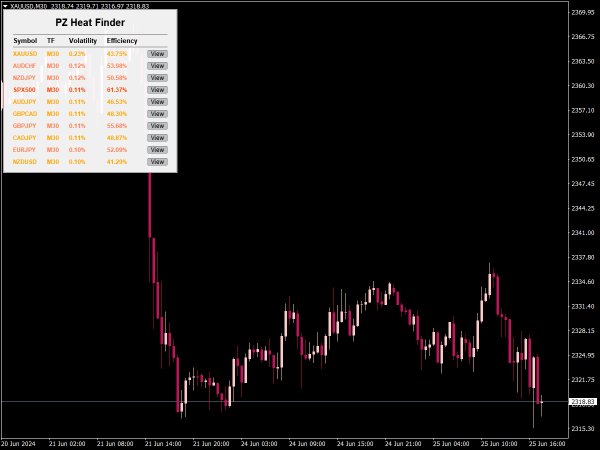

3. Confluence with Other Indicators: Use the Order Block Finder in conjunction with other technical tools like moving averages, RSI, or Fibonacci retracement levels for confirmation.

Risk Management

• Always implement stop-loss orders to protect your capital.

• Determine a risk-reward ratio before entering trades, ideally aiming for at least 1:2.

• Adjust your position size based on your account balance and risk tolerance.

Tips for Successful Trading

1. Practice with a Demo Account: Before trading with real money, practice using the Order Block Finder on a demo account to get familiar with its signals and how they align with price action.

2. Stay Informed: Keep abreast of market news and economic indicators that may influence price action and institutional behavior.

3. It's Not Perfect: Understand that this indicator is a tool, not a guaranteed method. Market conditions can change, and false signals can occur.

4. Journaling: Maintain a trading journal to track your trades and review what worked or didn’t. This can help identify patterns in your trading behavior and improve decision-making.

5. Patience is Key: Wait for clear setups and confirmations before entering trades; avoid impulsive decisions based on impatience.

6. Continuous Learning: Trading is an evolving discipline. Engage with trading communities, read books, and learn continuously about market dynamics and strategies.

By incorporating the Order Block Finder Indicator into your trading routine with the strategies and tips outlined above, you can enhance your decision-making process and potentially improve your trading outcomes. Remember to keep learning and adapting to market conditions for the best results.