Submit your review | |

The Hidden Gap Volume Indicator (HGVI) is a powerful tool for identifying potential trading opportunities by analyzing volume and price action patterns around gap formations. Trading with the HGVI involves several key rules and strategies:

1. Understanding Gaps: A gap occurs when a security opens significantly higher or lower than its previous close, creating a break in the price chart. These gaps can signify strong market sentiment and are often followed by increased trading volume, a crucial element for the HGVI.

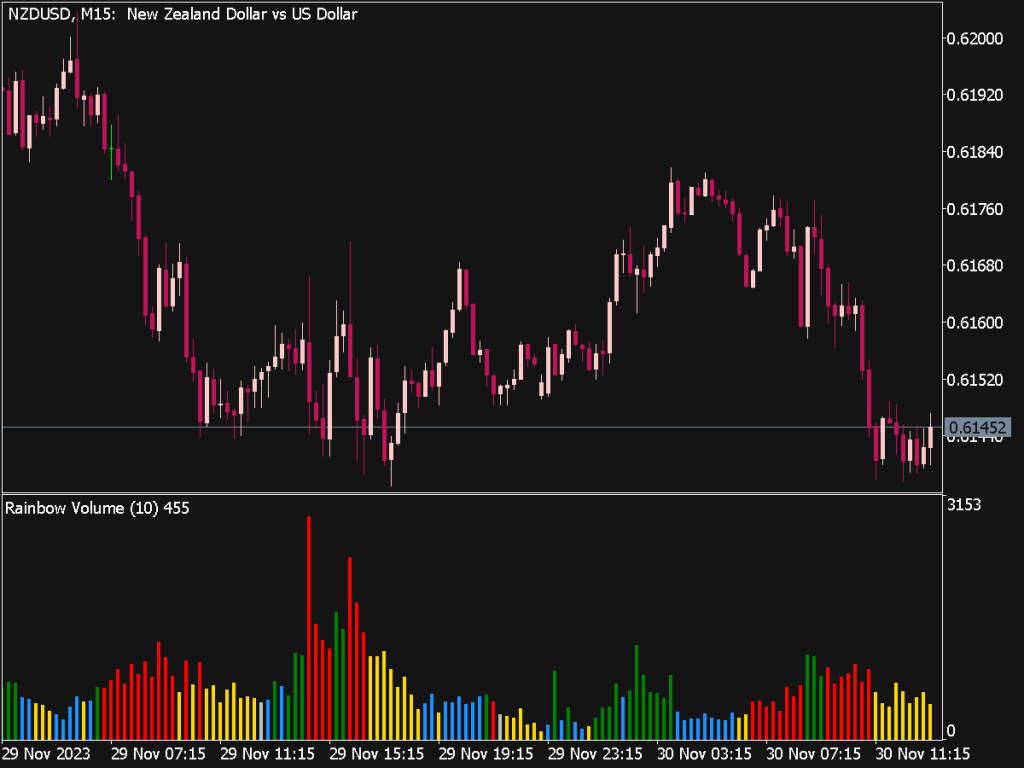

2. Utilization of Volume: The HGVI focuses on volume during these gaps. A higher volume when a gap occurs suggests institutional participation, which can validate the direction of the price movement. Traders should look for gaps accompanied by volume spikes of at least 50% above the average volume over the prior 20 days.

3. Types of Gaps: There are several types of gaps: common, breakaway, continuation, and exhaustion. Familiarizing yourself with these gaps is essential. Breakaway gaps, for example, often signal strong continuation trends, while exhaustion gaps can indicate the end of a current trend. The HGVI thrives on filtering out these conditions for proper entry and exit points.

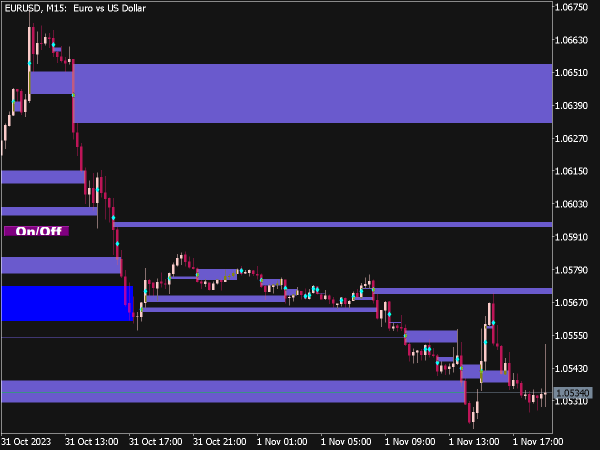

4. Entry Point Strategy: After identifying a valid gap with accompanying high volume, traders should wait for confirmation of the price direction. This could be indicated by a bullish or bearish candle pattern, established support/resistance areas, or using additional indicators like moving averages or RSI for momentum. A common strategy is to enter a trade once the price retraces to the gap fill level, as it often acts as a support or resistance zone.

5. Stop Loss Placement: Protecting capital is paramount. For long trades, stop-loss orders should generally be placed below the gap fill area or the recent swing low. For short trades, stop losses can be set above the gap fill or recent swing high. This strategy can help in managing risks while allowing room for trade fluctuations.

6. Target Setting: Setting profit targets involves analyzing previous price action, significant support/resistance levels, and the historical impact of similar gaps. A common method is to use a risk-reward ratio of at least 1:2; for instance, if risking $100, aim to make at least $200 in profit. Consider using trailing stops to lock in gains as the price moves favorably.

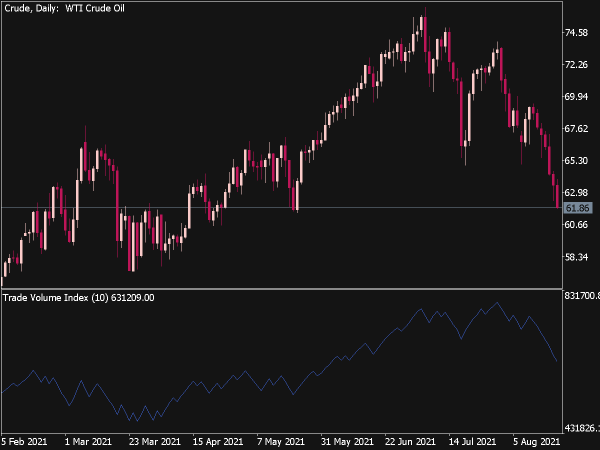

7. Volume Confirmation Post-Entry: Once in a trade, it’s essential to watch how the volume behaves post-entry. Continued heavy volume in the direction of the trade can indicate strength; however, if volume starts to dwindle, it may suggest a reversal or weakening trend. Traders can use the HGVI to gauge this interest.

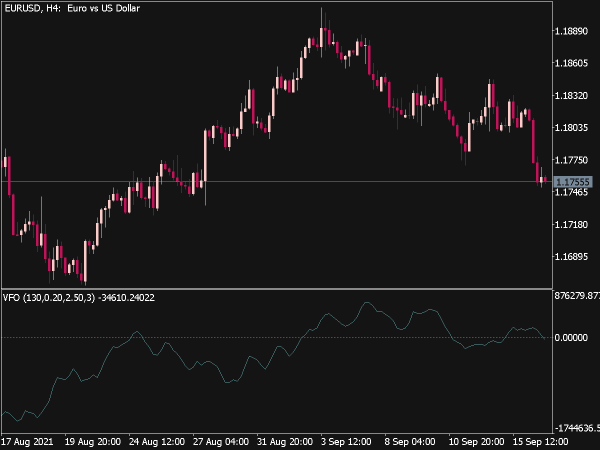

8. Combining with Other Indicators: The effectiveness of the HGVI can be enhanced by combining it with other technical indicators. For instance, integrating momentum indicators like MACD or stochastic oscillators can provide insights into whether a trend is likely to continue or exhaust. Additionally, analyzing broader market trends through indices or sector performance can yield comprehensive insights.

9. Backtesting for Effectiveness: Before fully committing capital, traders should backtest their HGVI strategies over different time frames and market conditions. Identifying the success rate and refining parameters based on historical data can enhance confidence in the trading approach and develop a deeper understanding of how the HGVI interacts with market dynamics.

10. Patience and Discipline: Like any trading strategy, the HGVI requires patience and discipline. Gaps don’t occur every day, and waiting for the right setups is crucial. Avoid forcing trades based on emotions or the desire to chase quick profits, as this can lead to significant losses.

In summary, the Hidden Gap Volume Indicator is a sophisticated resource for traders looking to capitalize on market gaps and volume dynamics. By adhering to rational trading rules, understanding market psychology, and applying diligent risk management, traders can harness the power of the HGVI to their advantage, potentially leading to more successful trading outcomes. As always, continuous learning and adaptation to market conditions are essential for long-term success.

If this indicator is broken,

If this indicator is broken,  Great Indicators, Trading Systems or EAs for MT4 and MT5

Great Indicators, Trading Systems or EAs for MT4 and MT5