Submit your review | |

The On Balance Volume (OBV) indicator is a popular momentum-based tool used by traders to assess buying and selling pressure based on volume flow. Here are several tips and strategies for effectively utilizing OBV in trading:

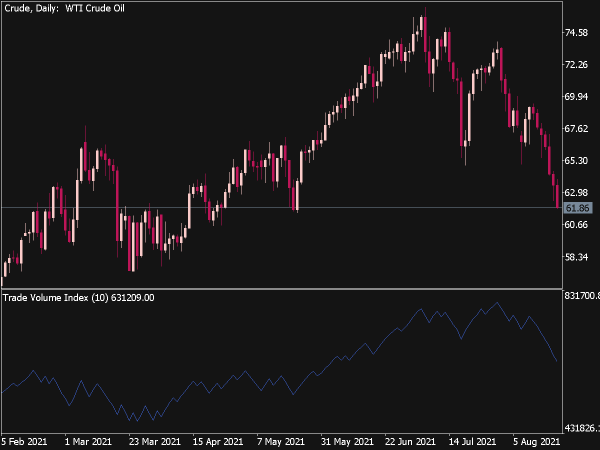

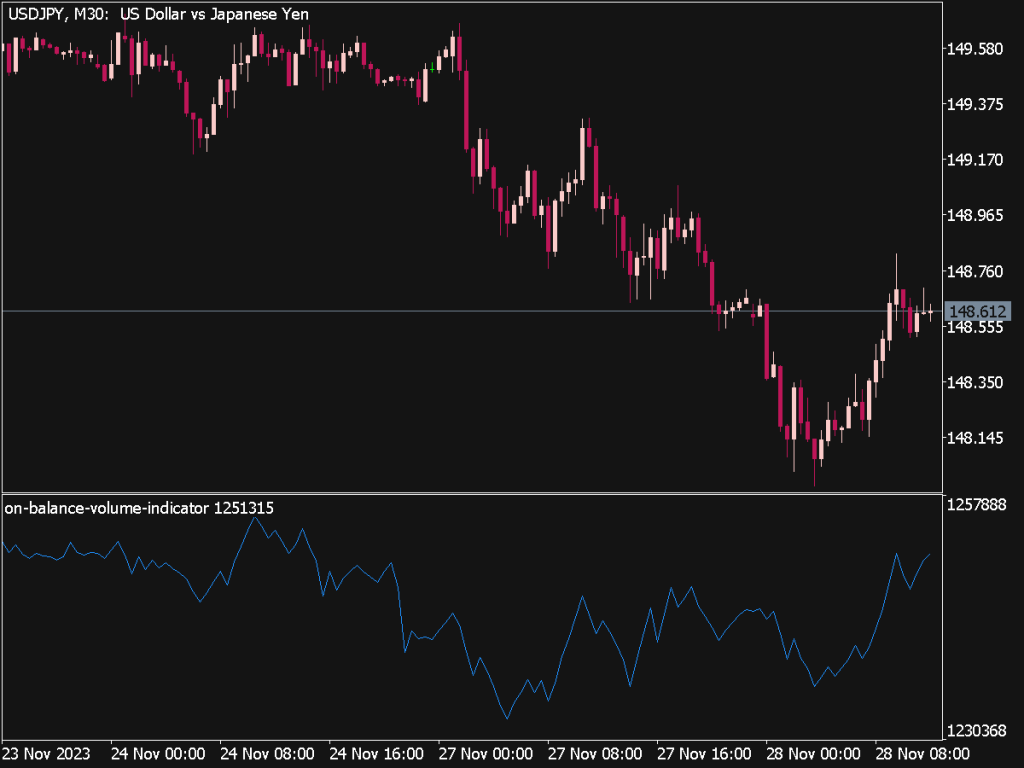

1. Understanding OBV Basics: OBV adds volume on up days and subtracts it on down days, providing insight into the cumulative volume trends. A rising OBV suggests strong buying pressure, signaling bullish momentum, while a declining OBV indicates selling pressure, suggesting bearish trends.

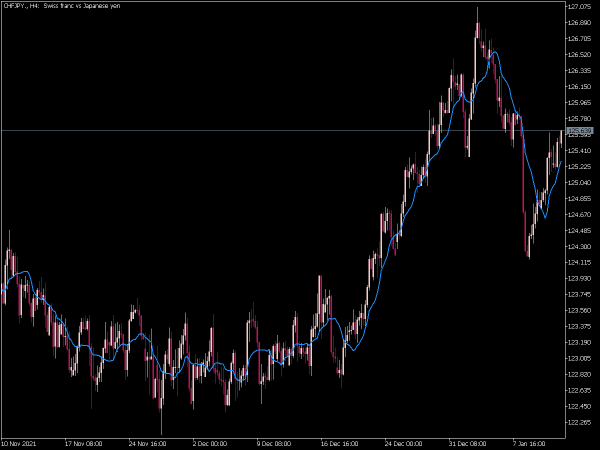

2. Confirming Price Trends: Use OBV to confirm price trends. For example, if the price is making new highs and OBV is also rising, it reinforces the bullish sentiment. Conversely, if prices are ascending but OBV is flat or declining, it may signal a potential reversal.

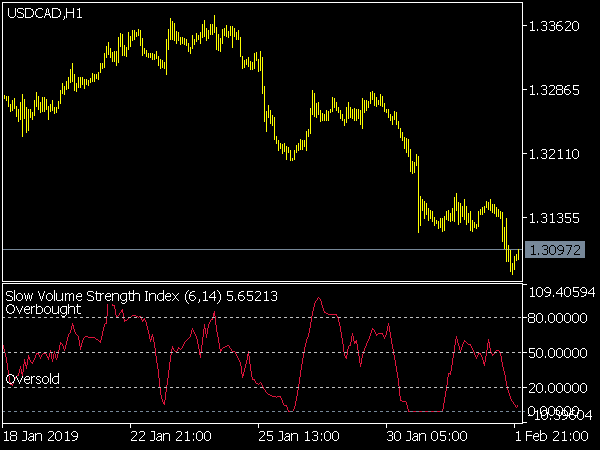

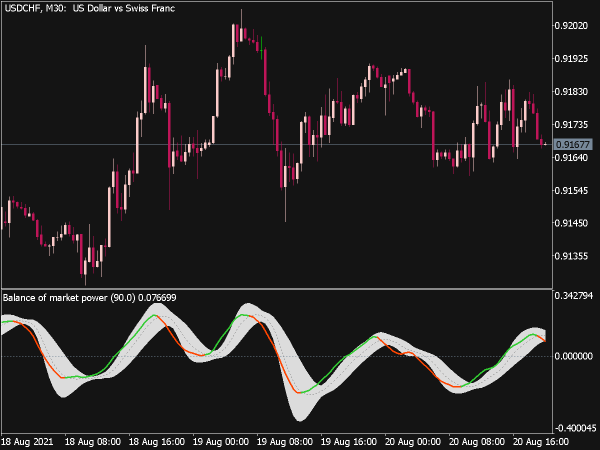

3. Identifying Divergences: Pay close attention to divergences between OBV and price movements. A bullish divergence occurs when prices drop but OBV rises, indicating potential buying interest. Conversely, a bearish divergence appears when prices rise but OBV falls, suggesting waning buyer interest.

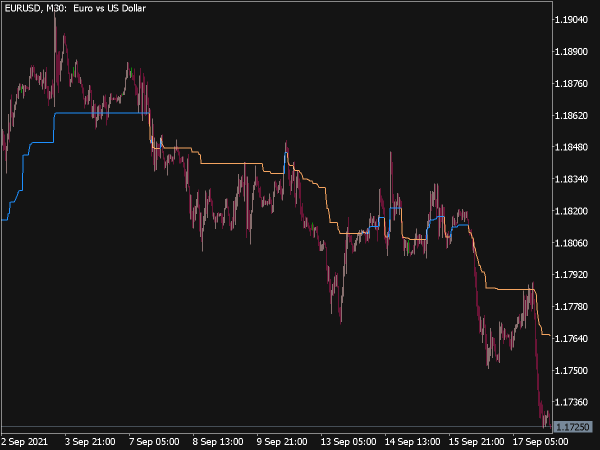

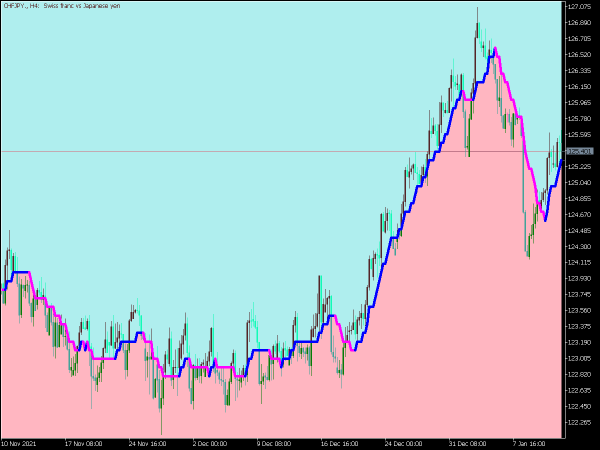

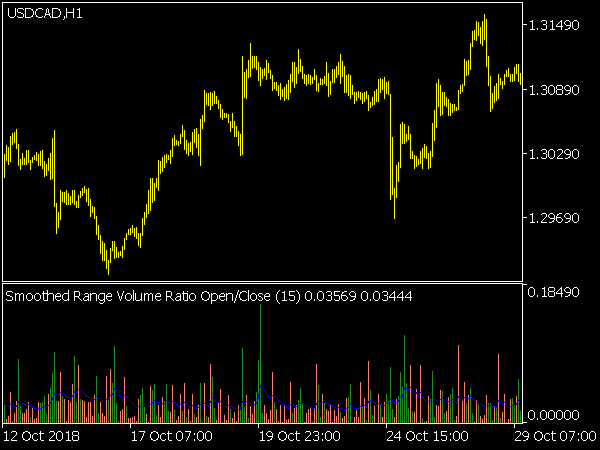

4. Integration with Other Indicators: Combine OBV with other technical indicators, such as moving averages or the Relative Strength Index (RSI), to create a more robust trading strategy. For instance, a crossover of the OBV line with a moving average can serve as an entry or exit signal.

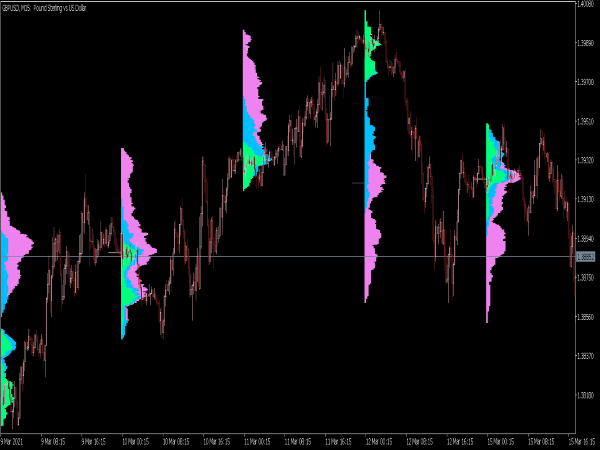

5. Setting Entry and Exit Points: Traders can set entry points when OBV confirms a breakout from a price pattern, such as a triangle or flag formation. Exit strategies can be derived by observing OBV trends; if OBV starts declining while the price is stable or increasing, it may be time to secure profits.

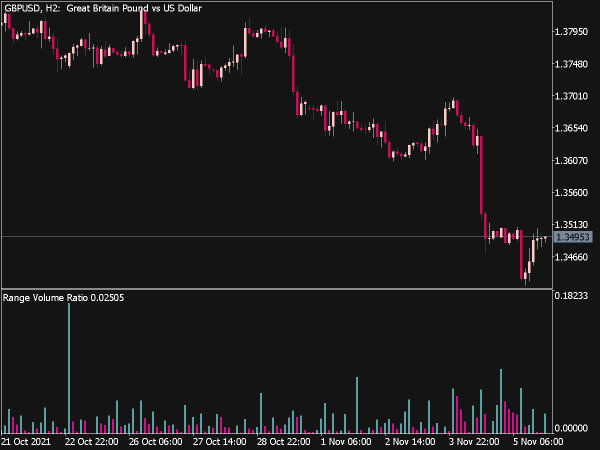

6. Monitoring Trend Strength: Analyze OBV along with price action to gauge the strength of trends. A strong uptrend will typically have a supporting OBV trend, while weak trends may show inconsistent volume changes. This can help traders decide when to enter or exit positions.

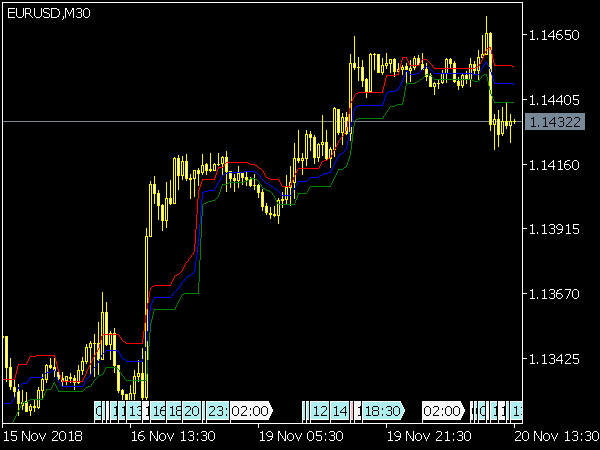

7. Using OBV in Different Timeframes: OBV can be effective on various timeframes, from intraday trading to long-term positions. Adapting your OBV analysis to match your trading style is essential, as day traders might focus on shorter intervals while swing traders might look at daily or weekly charts.

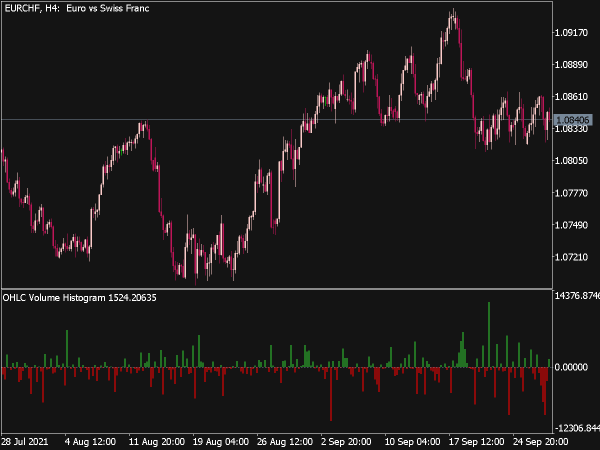

8. Volume Spikes: Watch for volume spikes accompanied by price movements. A significant increase in volume along with rising prices could indicate the beginning of a strong trend, while high-volume selling during uptrends may signal potential reversals.

9. Limitations of OBV: Understand the limitations of OBV as it does not predict market direction but shows what has already happened with volume. It can be deceptive during low volume markets where price movements may not reflect true market sentiment.

10. Psychological Factors: Recognize the psychological aspects behind volume. Increased volume often signifies greater participation and interest, making price movements more reliable. A decrease in volume could indicate a lack of conviction in price direction.

In summary, the On Balance Volume indicator is a powerful tool for traders looking to analyze underlying volume trends and confirm price action. By employing strategies that include divergence analysis, confirmation with other indicators, and monitoring volume dynamics, traders can effectively use OBV to enhance their trading strategies and make more informed decisions. Always remember to evaluate the context of market conditions and adapt your approach accordingly for the best results.