Submit your review | |

The Horizontal Volume Indicator (HVI) is a valuable tool for traders looking to analyze trading volume and price actions across various price levels rather than just timeframe-based volume. Here are some tips and strategies for using the HVI effectively:

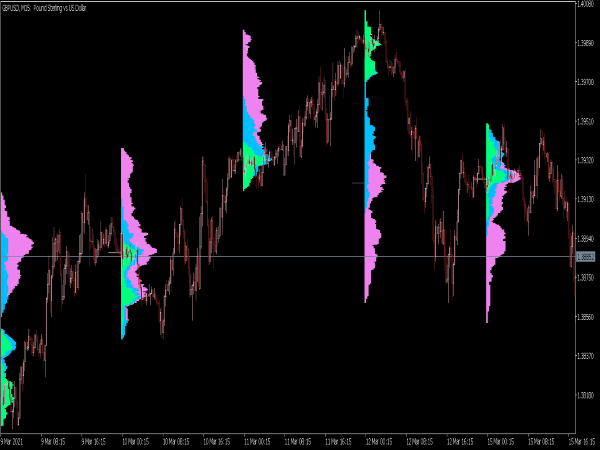

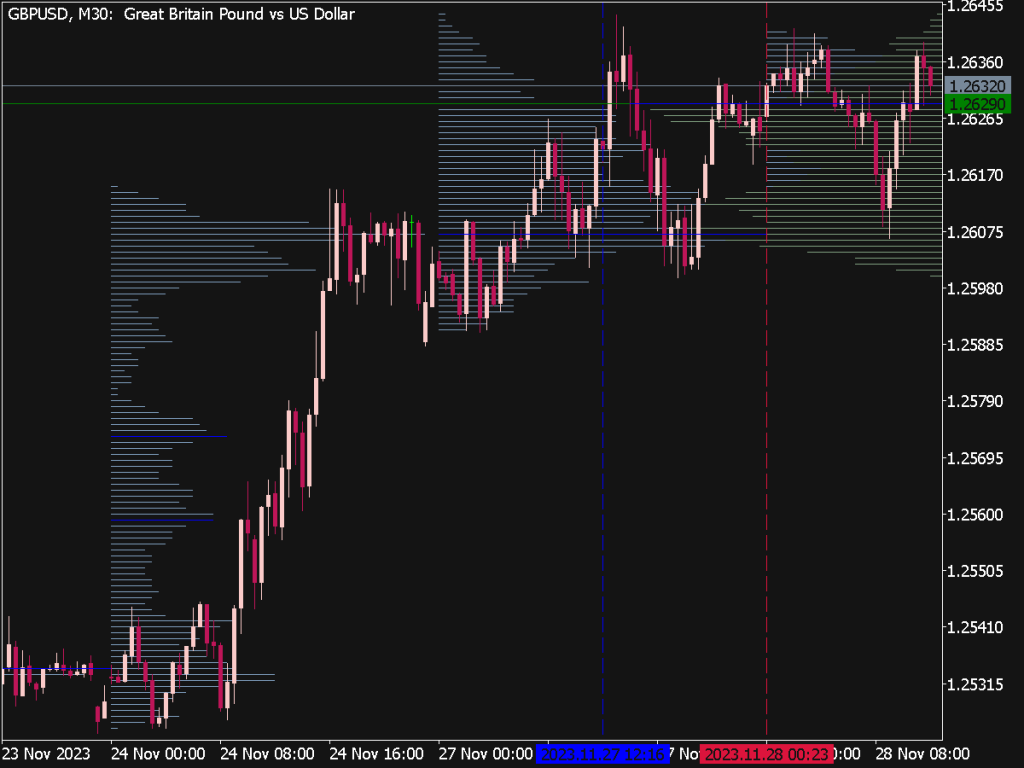

1. Identify Key Price Levels: Use HVI to spot high volume nodes, which signify areas of strong interest. These levels often act as support or resistance.

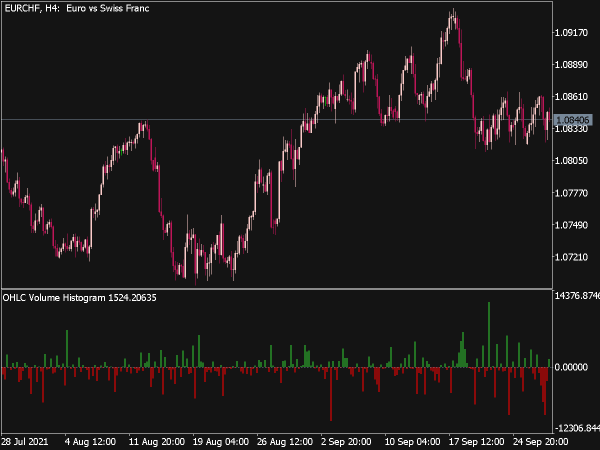

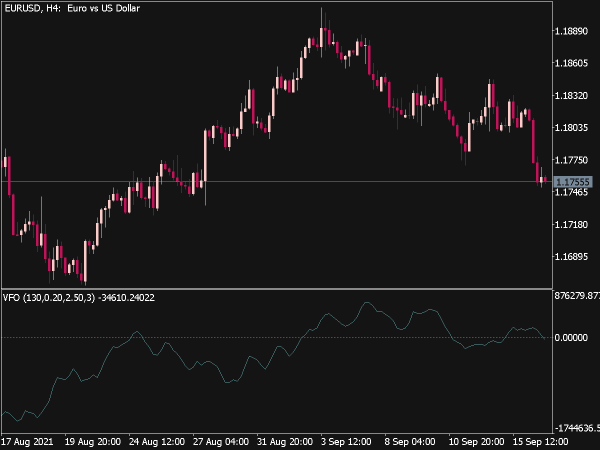

2. Volume Profile Analysis: Understanding volume distribution enables traders to visualize where significant trading activity occurs. Focus on the area where the HVI shows higher volume for potential entry or exit points.

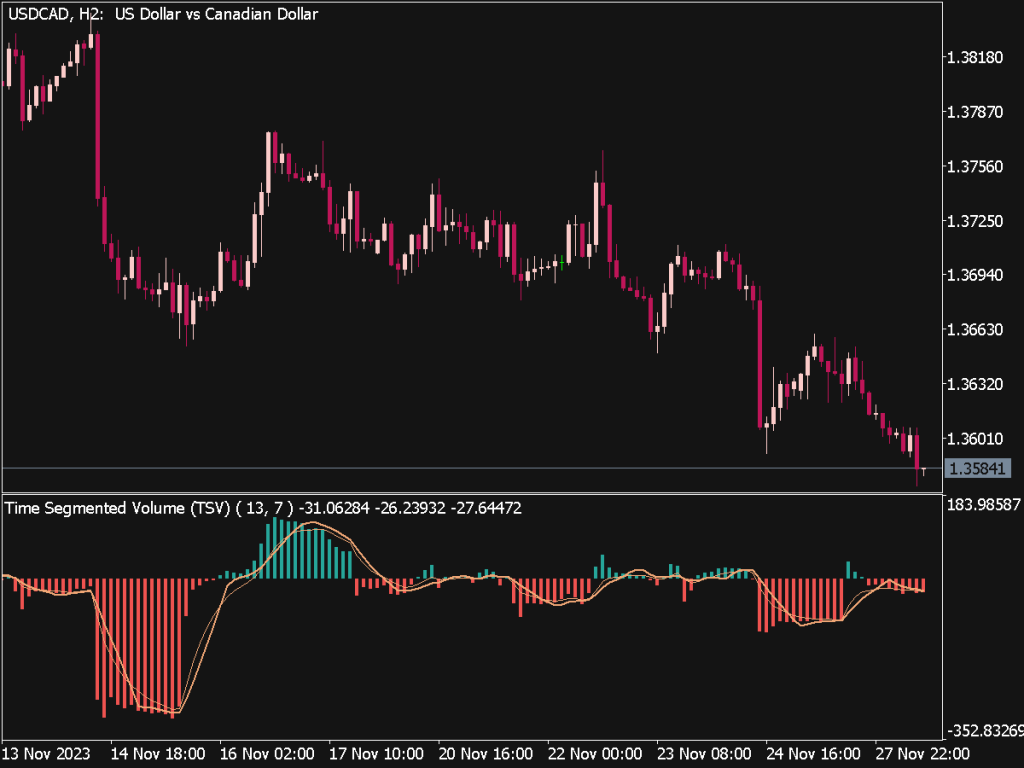

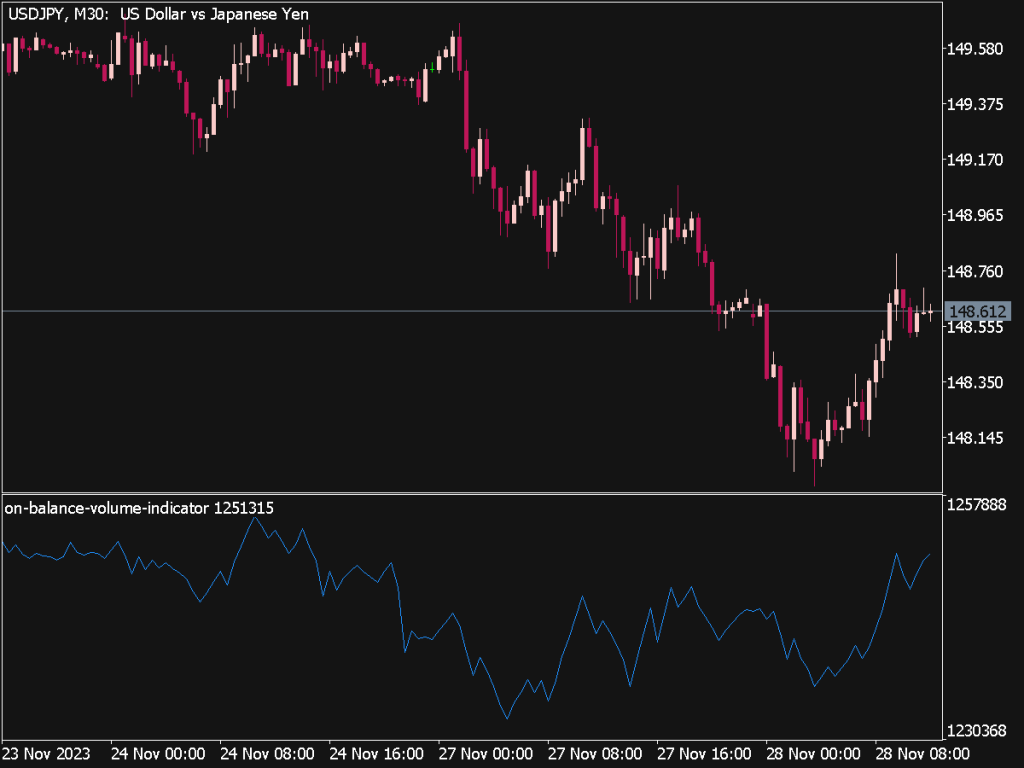

3. Combining with Other Indicators: Pair the HVI with moving averages or oscillators to confirm trend directions. For instance, if the price is above a moving average and the HVI indicates increasing volume at a high price level, consider a long position.

4. Volume Breakouts: Look for breakouts accompanied by high volume on the HVI. This often indicates strong momentum and can serve as an entry signal.

5. Divergence Analysis: Watch for divergence between price and volume indicators. If prices are rising but the HVI isn’t, it could suggest weakness in the trend.

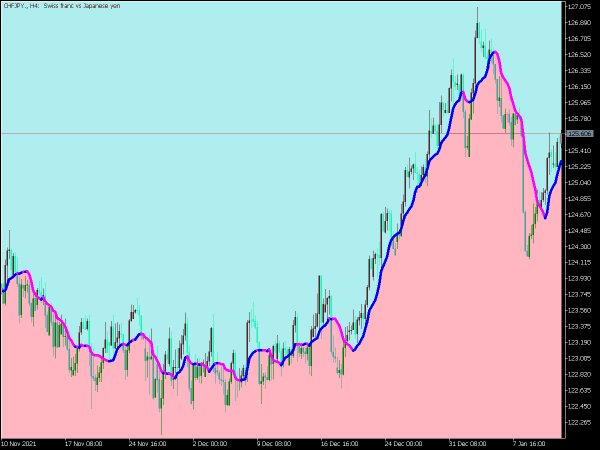

6. Adjusting Timeframes: Experiment with different timeframes to understand long-term trends versus short-term volatility. HVI can be applied in day trading, swing trading, and longer-term investments.

7. Risk Management: Set stop-loss orders based on HVI levels. If entering a trade where the HVI shows a significant volume level, position your stop just below that level to minimize potential losses.

8. Volume Exit Signs: Use the HVI to identify where to exit positions. A significant decline in volume after a price move may indicate a weakening trend.

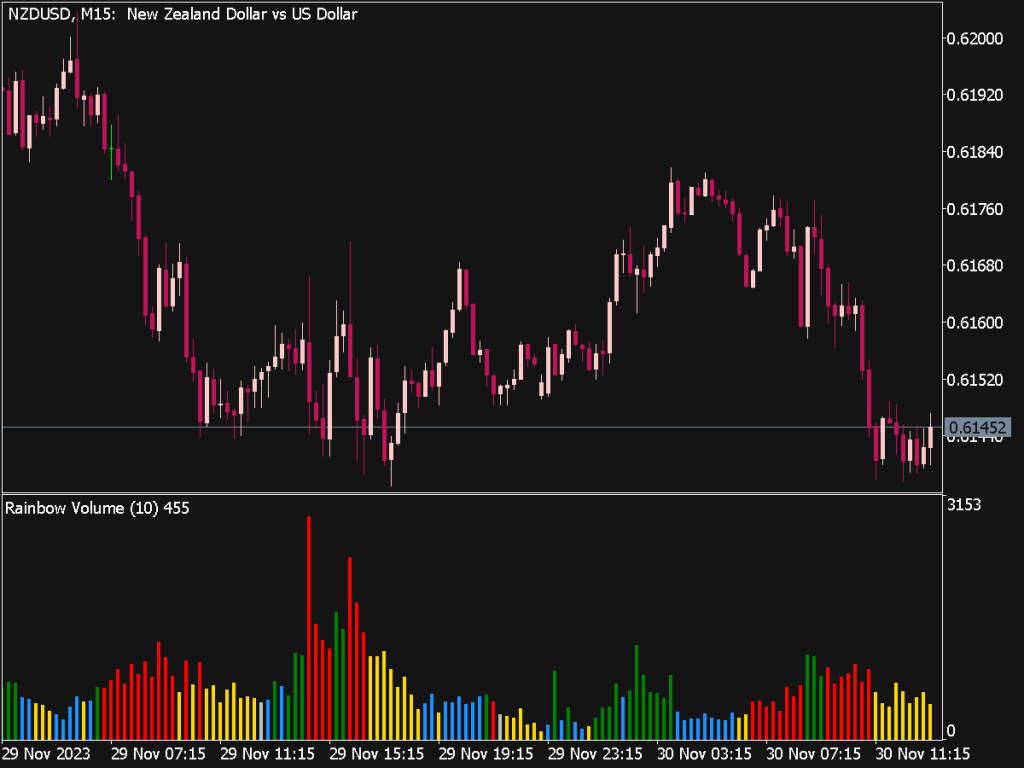

9. Scalping Techniques: In shorter timeframes, look for rapid changes in HVI to capitalize on quick price movements. React swiftly to shifts in volume.

10. Market Sentiment: Analyze HVI as part of a broader market sentiment assessment. High volume can indicate market interest and participation, giving insight into potential price direction based on trader psychology.

11. Combine with News Events: Be aware of earnings reports, economic data releases, or geopolitical events. High volume in these contexts may provide clues about market reactions to news.

12. Historical Data Review: Review historical HVI data to identify patterns or anomalies in volume at specific price levels, which can inform future trading strategies.

13. Trade with the Trend: Use HVI to determine the overall market trend. Trading in the direction of the prevailing volume trends can enhance the probability of success.

14. Watch for Exhaustion: High volume can indicate price exhaustion signals. When volume spikes amid price consolidation, it may indicate an upcoming reversal.

15. Psychological Price Levels: Pay attention to psychological levels (e.g., round numbers) and how HVI responds to them. These levels can be critical decision points for many traders and lead to high volume activity.

16. Volume Gaps: On the HVI chart, gaps in volume can denote low liquidity zones. Avoid trading in these areas unless intending to exploit volatility.

17. Use Alerts: Set alerts for when the HVI crosses certain thresholds to stay informed about significant volume changes.

18. Market Type Awareness: Recognize whether the market is trending or ranging and adjust your strategy accordingly. HVI can provide insights into the most effective strategy for either market condition.

19. Post-Trade Analysis: After executing trades based on HVI signals, conduct a post-mortem to evaluate your performance and refine your strategies.

20. Continuous Learning: Regularly update your knowledge on HVI and other volume indicators, as markets evolve and new trading technologies emerge.

Incorporating the Horizontal Volume Indicator into your trading strategy requires practice and patience. By understanding volume dynamics and combining them with other analysis tools, traders can better navigate market conditions and make informed decisions. This systematic approach not only enhances trading accuracy but also builds confidence in executing trades.