Submit your review | |

The Weis Wave Volume Indicator is a sophisticated tool used by traders to analyze price movements in conjunction with volume, aiming to identify potential trading opportunities. Here are some trading tips and strategies you might find useful:

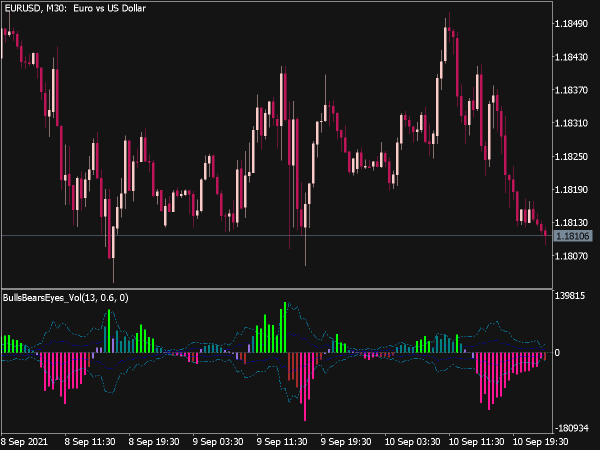

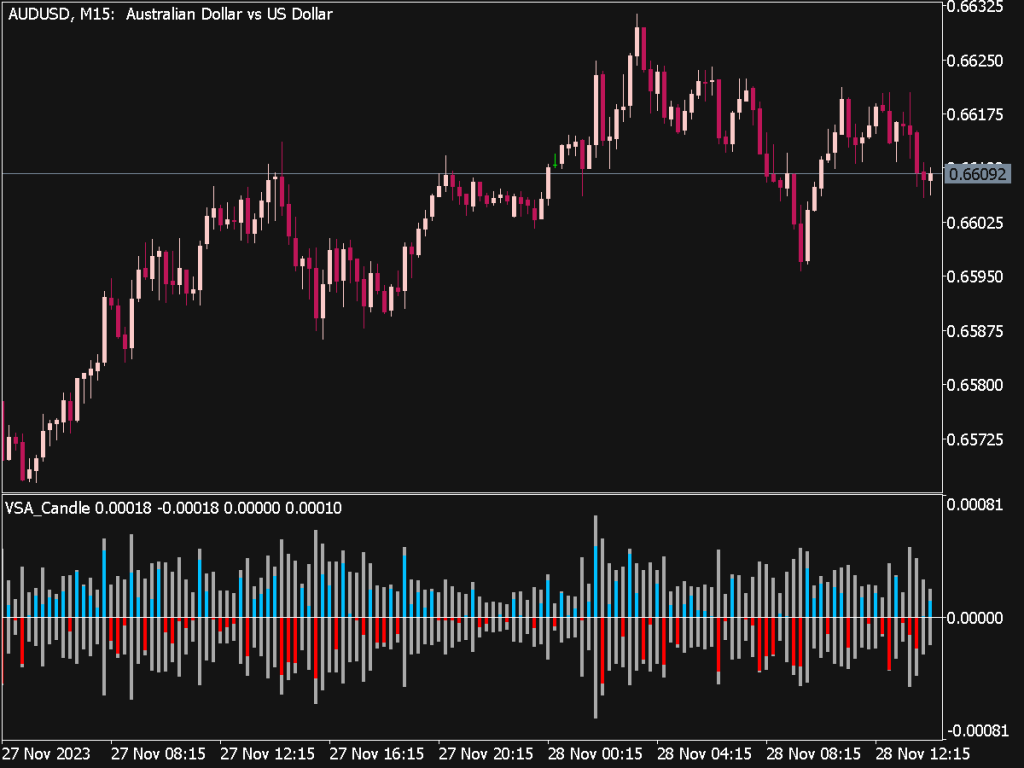

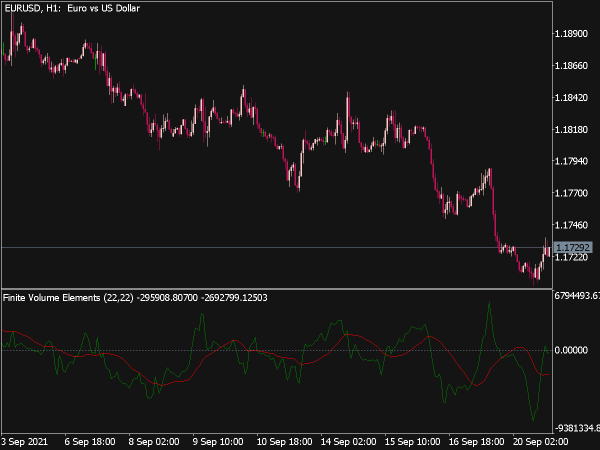

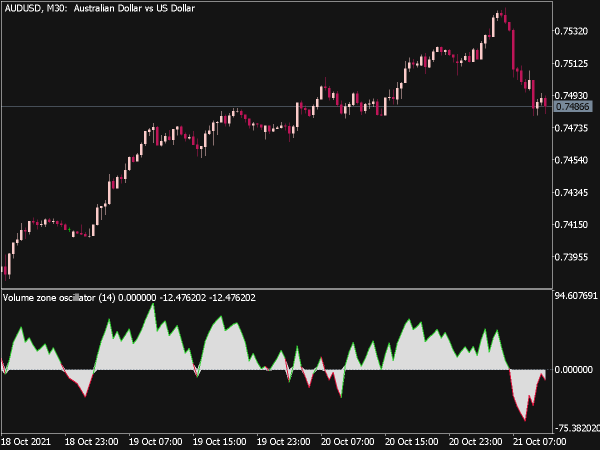

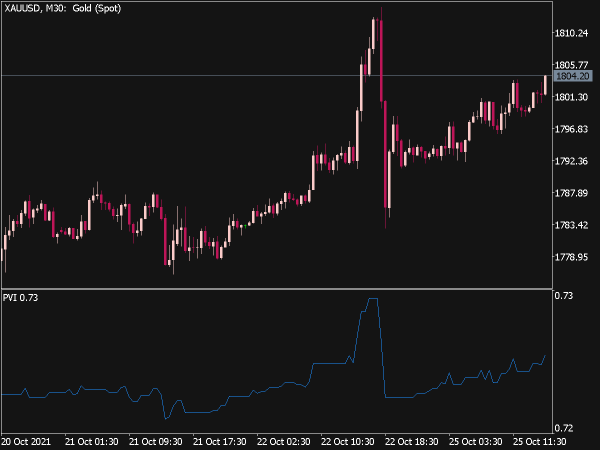

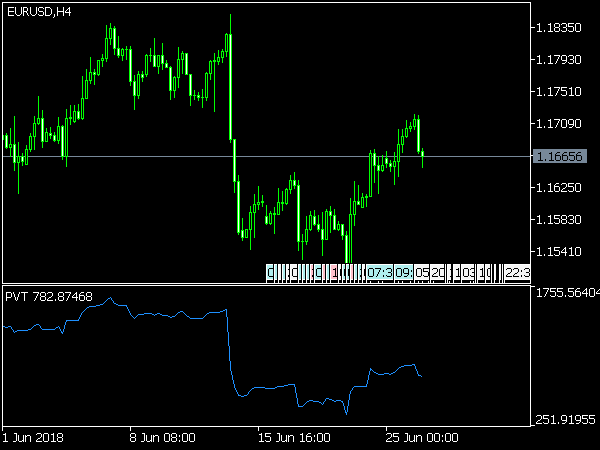

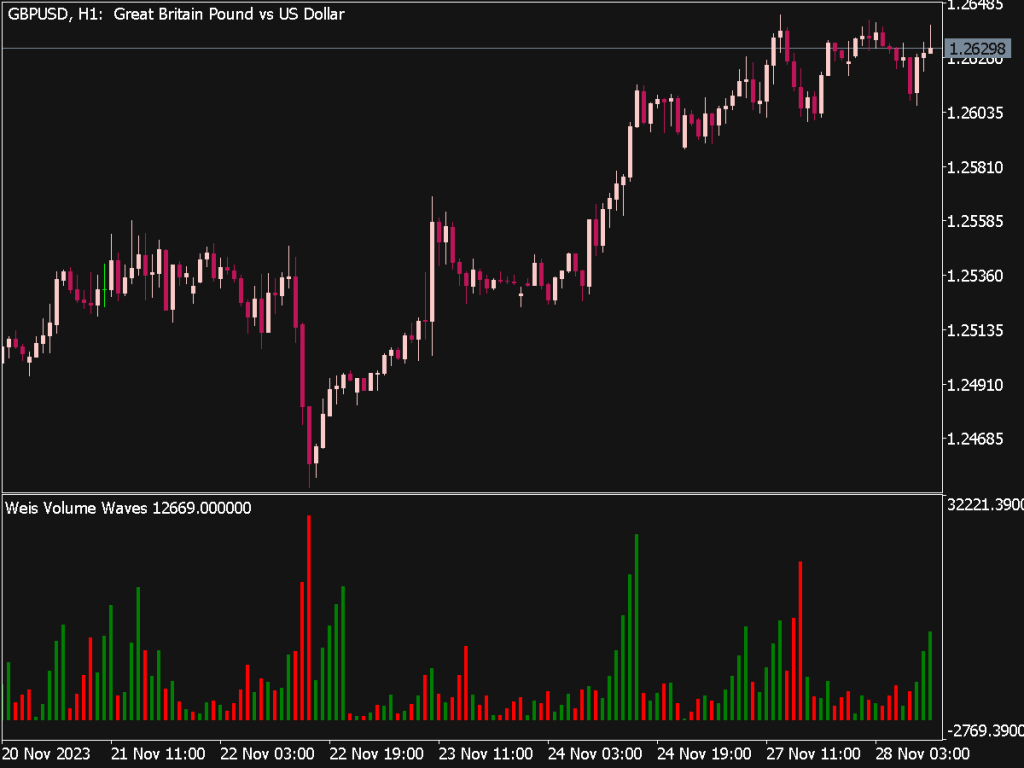

1. Understanding the Indicator: The Weis Wave Volume Indicator helps traders visualize price action relative to volume. It creates waves that signify buying or selling pressure, allowing easy identification of trends and reversals. It's crucial to familiarize yourself with how the waves are formed, ensuring you can interpret the data accurately.

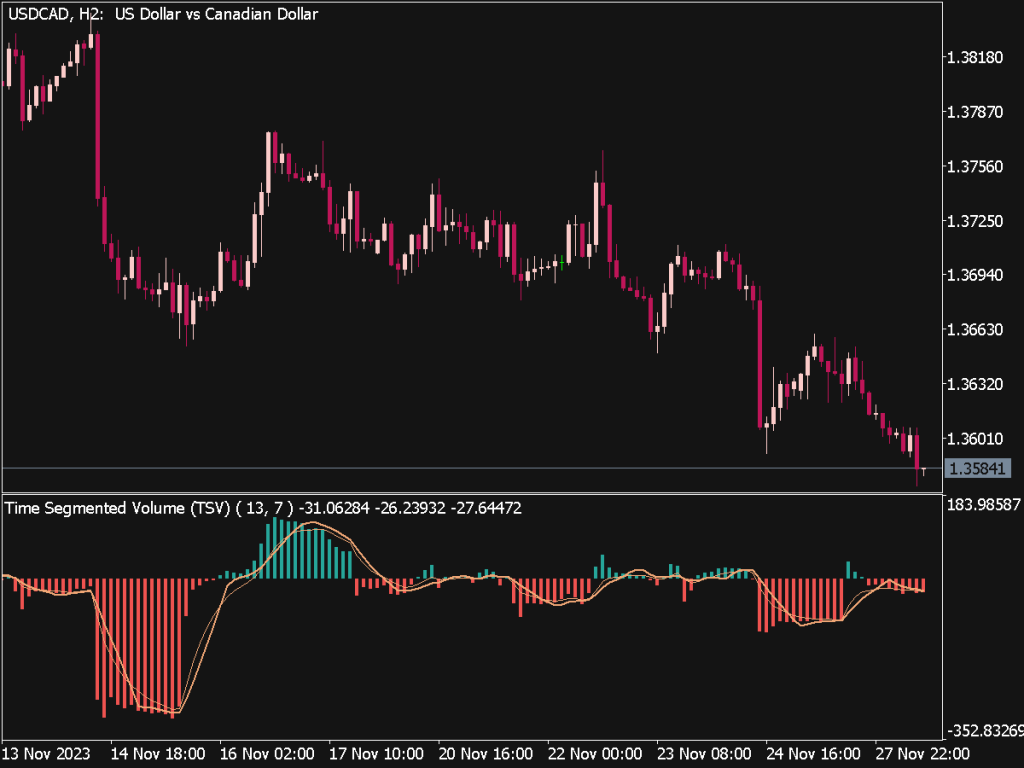

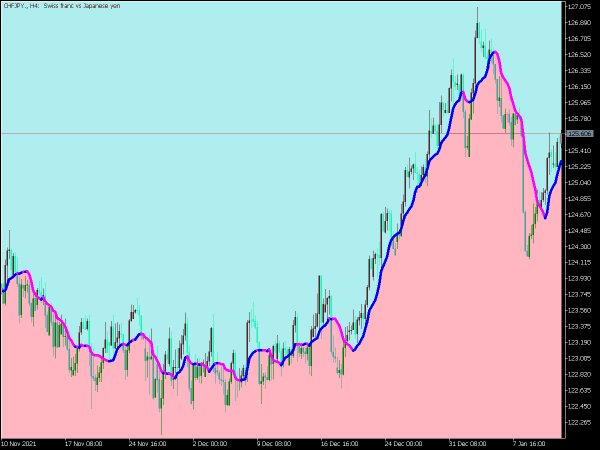

2. Trend Analysis: Use the Weis Wave to determine the overall trend. Bullish waves often indicate uptrends with increasing volume, while bearish waves show downtrends. Confirm the trend by analyzing multiple time frames—if the daily chart shows a bullish trend, and the hourly chart aligns, consider entering long positions.

3. Volume Confirmation: Look for strong volume spikes accompanying price movements. High volume on bullish waves confirms buying strength, while high volume on bearish waves indicates strong selling pressure. Enter long positions during robust bullish waves, but wait for confirmation during corrections or pullbacks.

4. Divergence Trading: Pay attention to divergences between price and the Weis Wave indicator. If price makes new highs while the wave volume declines, it may signal weakness and a potential reversal. Similarly, if price hits lower lows but the indicator reflects higher waves, it could indicate buying opportunities.

5. Support and Resistance Levels: Combine the Weis Wave with key support and resistance levels. When price approaches significant support while forming a bullish wave, it can trigger entry points. Conversely, a bearish wave at resistance might suggest a shorting opportunity.

6. Setting Stop Losses: Use the Weis Wave Indicator to define your stop loss levels. For long positions, place stops below recent swing lows; for shorts, position stops above swing highs. This approach minimizes risk exposure and supports effective risk management.

7. Risk-to-Reward Ratio: Before entering a trade, determine your risk-to-reward ratio. Aim for at least 1:2 or higher, meaning you stand to gain twice what you risk. The Weis Wave can aid in identifying potential target zones by observing previous high or low volume waves.

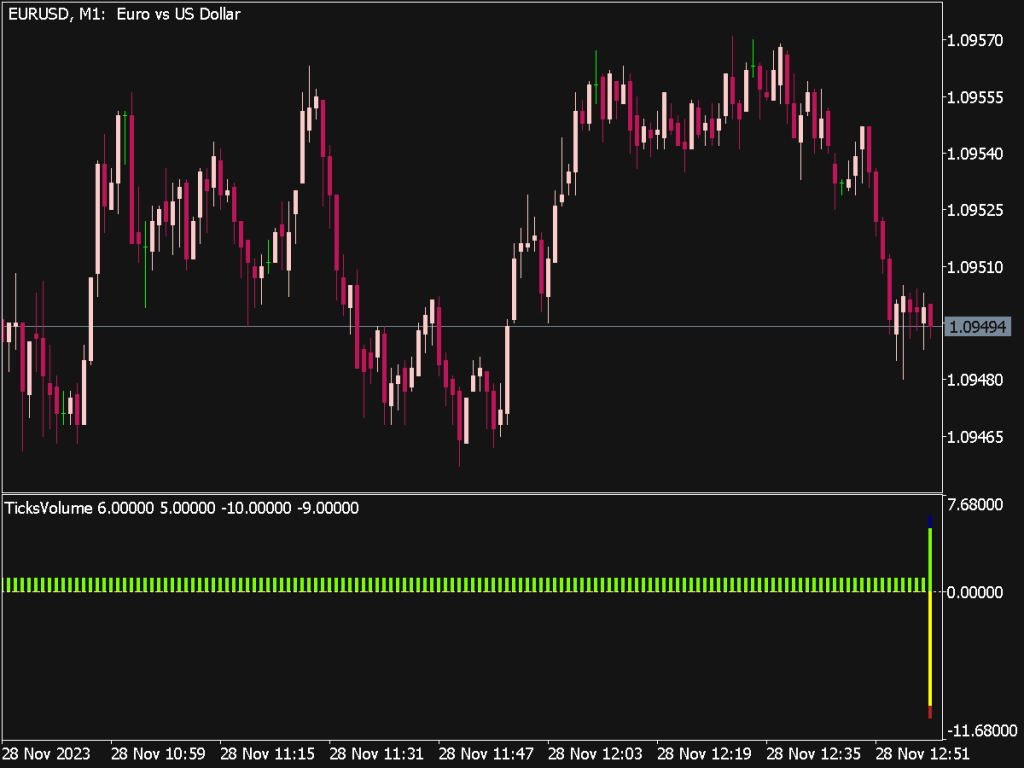

8. Time Frame Selection: Adjust your trading strategy based on the time frame. Day traders might focus on 5-15 minute charts, while swing traders may prefer hourly or daily frames. Ensure the Weis Wave patterns align with your chosen time frame for consistency.

9. Combining Indicators: Enhance the effectiveness of the Weis Wave by incorporating other technical indicators like Moving Averages, Relative Strength Index (RSI), or MACD. This combination can provide more robust trading signals and improve decision-making.

10. Backtesting Strategies: Before implementing trading strategies with real capital, backtest them using historical data. Analyze how the Weis Wave would have performed under various market conditions. This practice helps refine your strategies and improve your confidence.

11. Mind Your Emotions: Maintain discipline in your trading. The Weis Wave Indicator can be a powerful tool, but it’s crucial not to let emotions dictate your trading decisions. Stick to your plan and avoid impulsive trades based on fleeting market movements.

12. Market Conditions Awareness: Always be aware of current market conditions. The Weis Wave’s effectiveness can fluctuate during different market environments (trending vs. ranging). Adapt your strategy accordingly — for instance, employ tighter stop losses in choppy markets.

13. Use Candlestick Patterns: Incorporate candlestick patterns with the Weis Wave for added confirmation. Patterns like engulfing candles, dojis, or hammers can provide additional context on potential direction and reversal points.

14. Monitor Economic News: Economic calendars can significantly impact trade outcomes. Awareness of major economic announcements or events helps in assessing potential volatility and adjusting your strategy accordingly. Be cautious with trades during high-impact news events.

15. Community and Mentorship: Engaging with trading communities or finding a mentor can accelerate your learning process. Discussing strategies revolving around the Weis Wave with experienced traders allows you to gain insights and alternative perspectives.

16. Continuous Learning: The markets are ever-evolving, meaning that successful traders should commit to continuous learning. Stay updated with new strategies, attend webinars, read books, and review your trades regularly to identify areas for improvement.

17. Journaling: Maintain a trading journal detailing your trades, strategies, outcomes, and emotions. Review your entries periodically to learn from both successes and failures, identifying patterns that may help refine your approach over time.

By applying these tips and strategies thoughtfully, traders can leverage the Weis Wave Volume Indicator to boost their chances of success in navigating the complex world of trading. Always prioritize risk management and develop a comprehensive trading plan to guide your decisions.