Submit your review | |

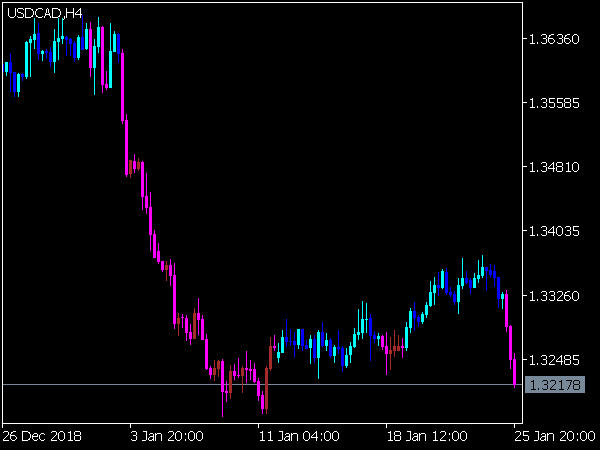

The Better Volume Candle Indicator is a valuable tool for traders looking to enhance their analysis of market movements. Here’s a concise list of trading tips and rules for utilizing this indicator effectively:

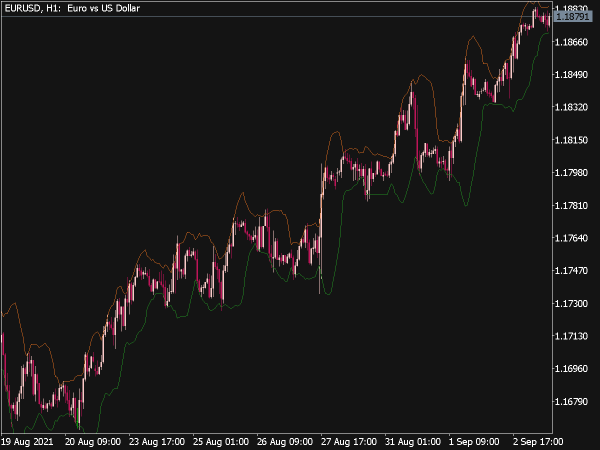

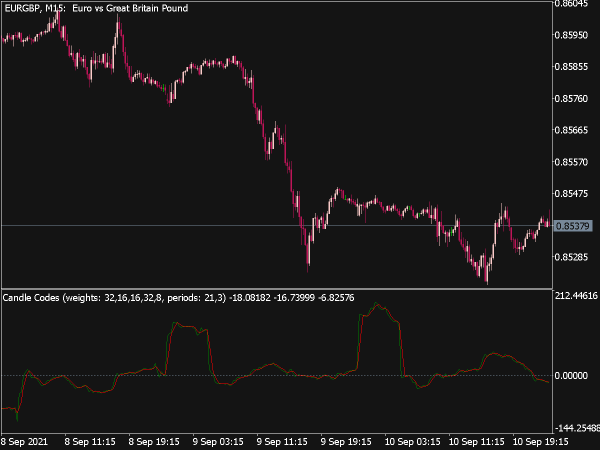

1. Understanding Volume: Recognize that volume indicates the strength of a price move. High volume can validate trends, while low volume might suggest weakness.

2. Combine with Price Action: Use the Better Volume Candle Indicator in conjunction with price patterns to confirm signals.

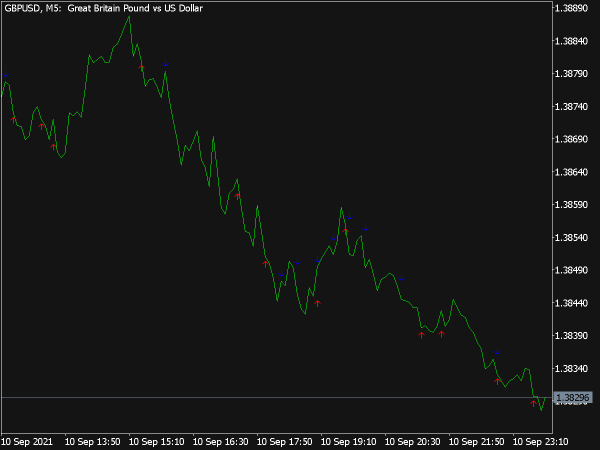

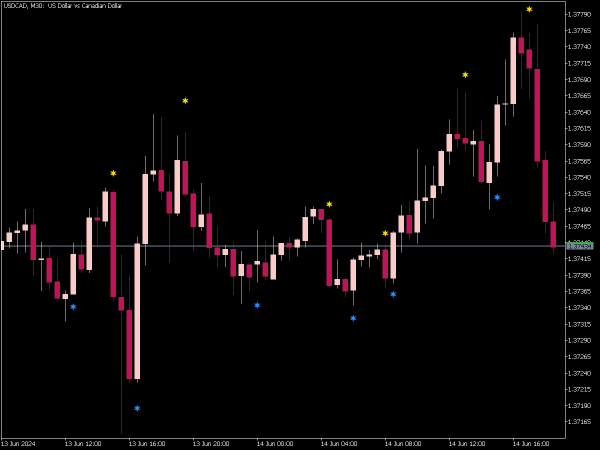

3. Identifying Trends: Yellow candles often signify trend continuation, while red candles can indicate reversals. Look for confirmation before acting.

4. Volume Spike Alerts: Watch for sudden spikes in volume; these can precede significant price movements. Set alerts to catch these opportunities.

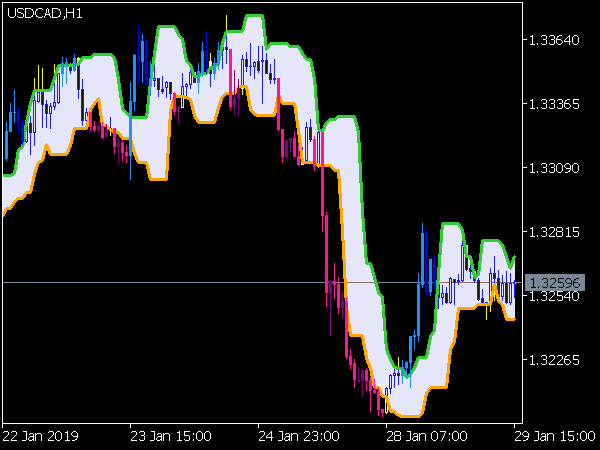

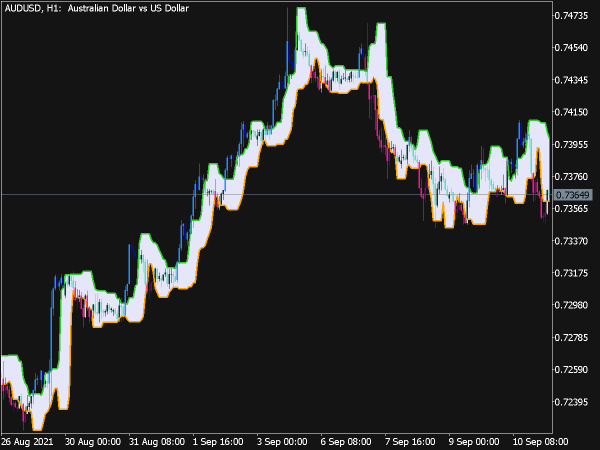

5. Support and Resistance: Pay attention to volume at key support and resistance levels; high volume at these points can either confirm a breakout or signal a reversal.

6. Trading Breakouts: Focus on breakouts accompanied by increased volume, as this often indicates a strong continuation in the breakout direction.

7. Volume Divergence: Be cautious if price makes new highs or lows without a corresponding increase in volume, as this may signal a weakening trend.

8. Risk Management: Always set stop-loss orders based on your risk tolerance to protect against unexpected market movements.

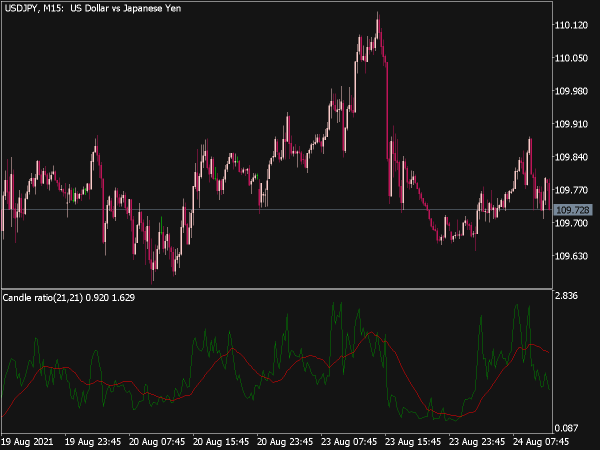

9. Time Frames: Experiment with different time frames to find the one that suits your trading style — shorter time frames may provide more signals but also more noise.

10. Market Context: Consider overall market conditions; using the indicator during volatile periods requires additional scrutiny.

11. Use with Other Indicators: Pair it with other indicators like RSI or MACD for a more rounded analysis and to confirm buy/sell signals.

12. Regularly Review Trades: Assess past trades to understand how effective the Better Volume Candle Indicator was in your decision-making process.

13. Stay Updated: Keep an eye on news and economic indicators that could impact volume and price, adjusting your strategy accordingly.

14. Emotional Discipline: Stick to your strategy and avoid emotional trading, especially if faced with unexpected outcomes.

15. Practice with Paper Trading: Before committing real capital, practice using the Better Volume Candle Indicator in a simulated environment to build confidence.

16. Continual Learning: Engage with trading communities or educational resources to enhance your understanding of volume analysis.

17. Patience is Key: Wait for clear signals and avoid overtrading; quality is better than quantity when it comes to trades.

18. Document Your Strategy: Write down your strategies, rules, and the reasoning behind your trades to help refine your approach over time.

19. Utilize Alerts: Set price and volume alerts to stay informed without needing to constantly monitor charts.

20. Stay Flexible: Be willing to adapt your strategy as market conditions change, ensuring you stay relevant and profitable.

By following these tips and rules, traders can effectively leverage the Better Volume Candle Indicator to make more informed trading decisions and enhance their overall market strategies.