Submit your review | |

Excellent indicator for order block detection 😉

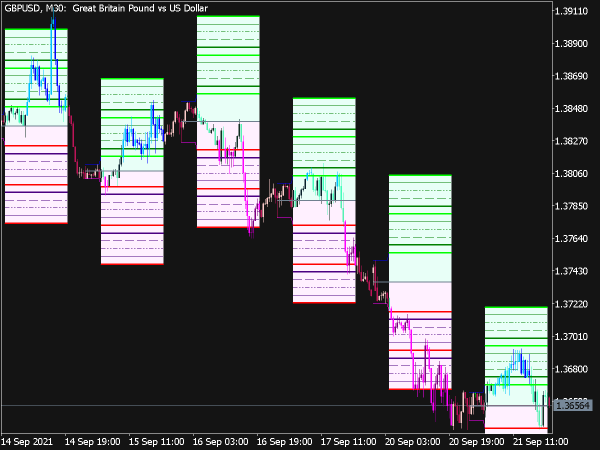

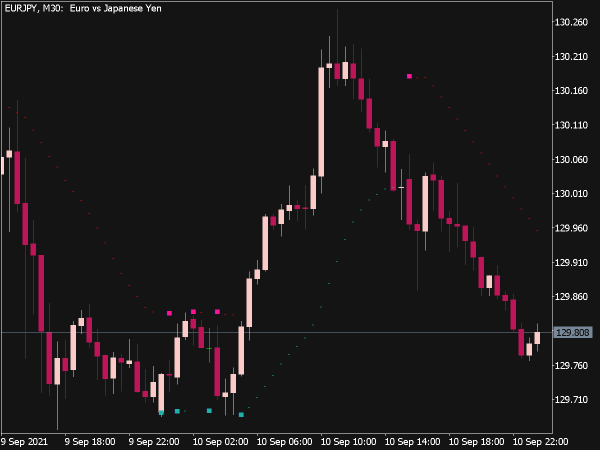

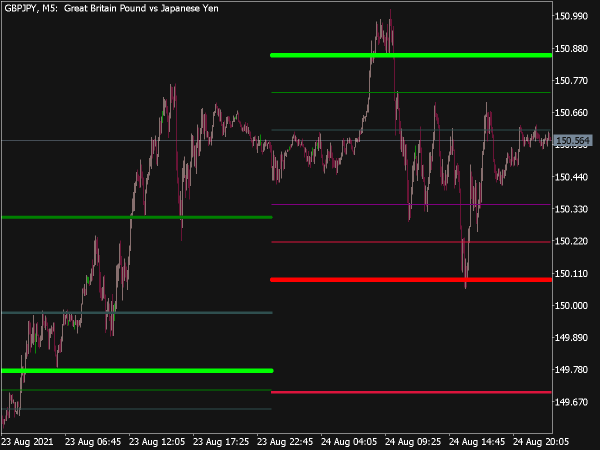

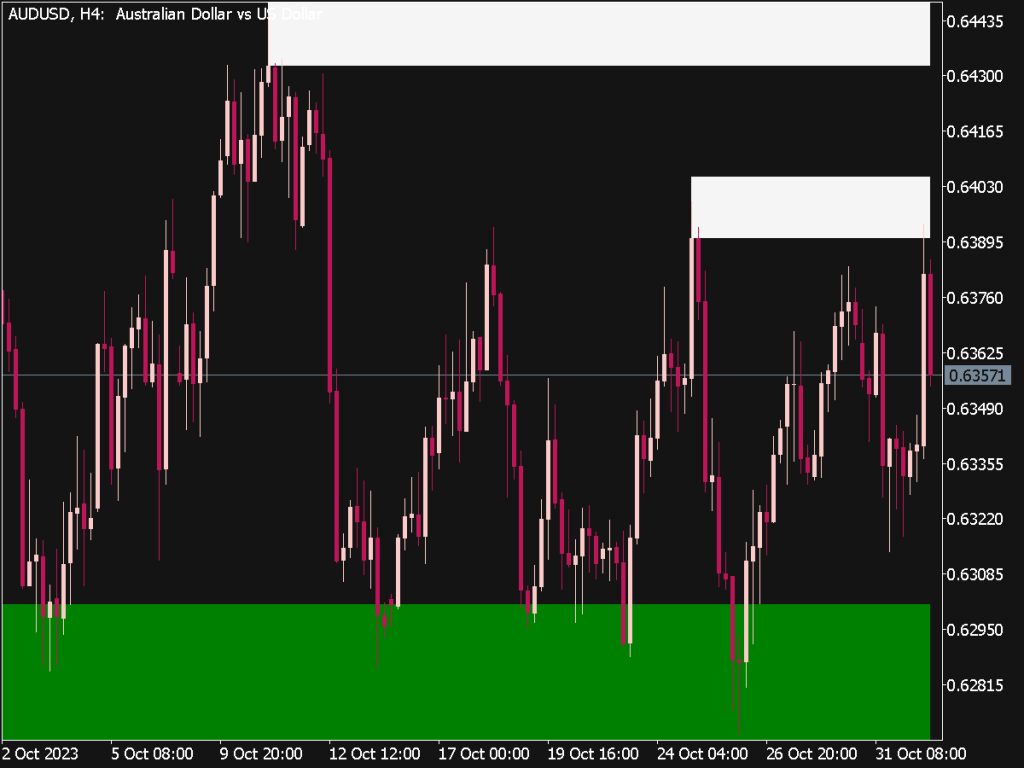

The Order Block Indicator is a powerful tool for traders looking to identify significant price levels where large institutional buy or sell orders are likely to play a critical role in price movements. Typically, an order block is defined as a zone on the chart where there was substantial buying or selling activity, leading to notable price reversals. When using the Order Block Indicator, traders look for these zones, as they can signal potential areas of support or resistance. This indicator is often utilized in conjunction with other technical analysis tools to maximize effectiveness.

Understanding Order Blocks

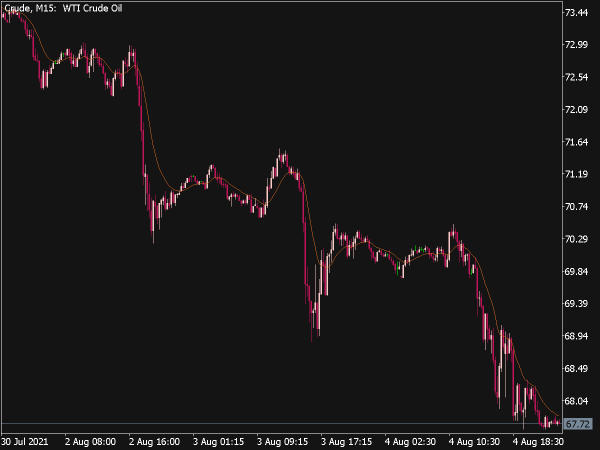

Order blocks are typically formed when institutions accumulate positions without substantially moving the market, indicating the potential for future price moves. These blocks can be identified by analyzing price action and volume, where a consolidation area is often visible before a sharp price movement. Traders should focus on identifying bullish order blocks (where an uptrend follows) and bearish order blocks (where a downtrend follows), as these can provide insights into market sentiment and potential trading opportunities.

Trading Tips and Strategies

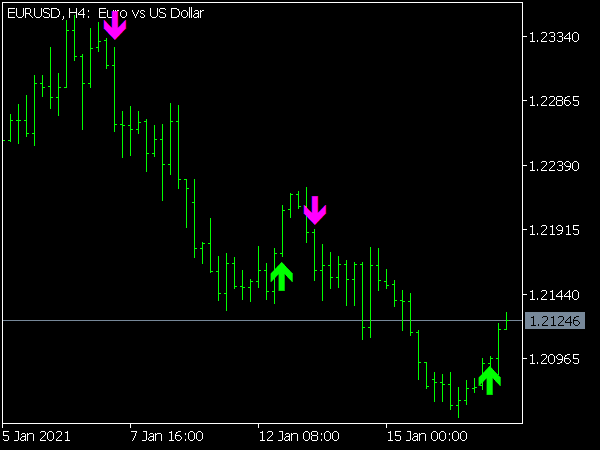

1. Identifying Order Blocks: Use the Order Block Indicator to scan for areas where price has previously consolidated before experiencing a significant breakout. Look for clusters of candles — typically, the last bullish candle before a downtrend or the last bearish candle before an uptrend acts as a visual cue.

2. Timeframe Consideration: Different traders may prefer different timeframes based on their trading style. Scalpers may look for order blocks on the minute charts, whereas swing traders might analyze daily or weekly charts. It’s essential to use a timeframe that aligns with your trading strategy.

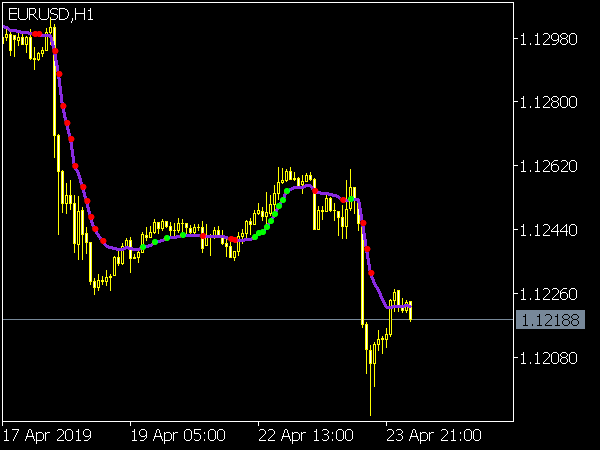

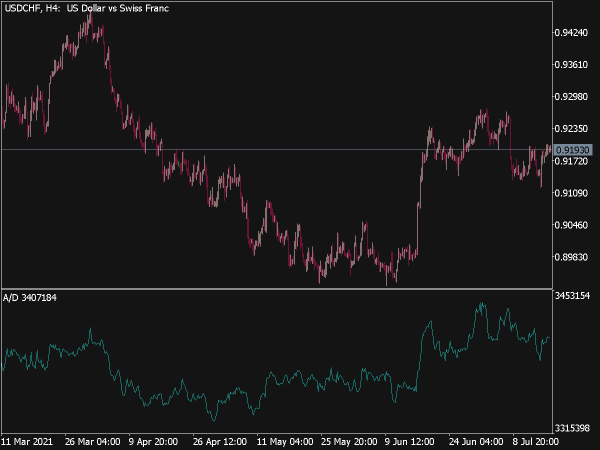

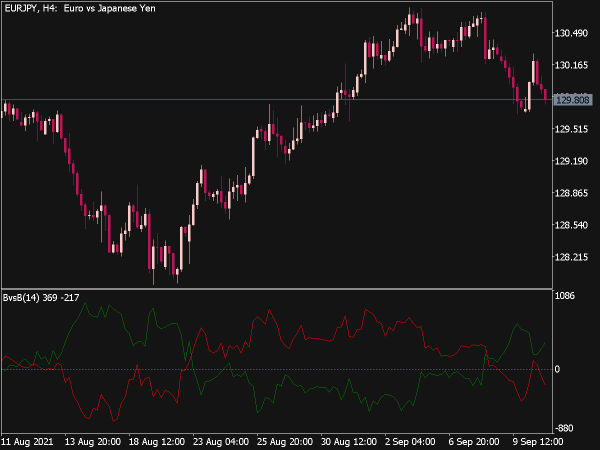

3. Confirmation: Always seek confirmation before entering a trade based on an identified order block. This can include looking for price action (like pin bars or engulfing candles), volume spikes, or other technical indicators (like RSI or MACD) that support the likelihood of a rebound or reversal at the order block level.

4. Risk Management: Establish a clear risk management strategy. Consider setting stop losses slightly below (for buy orders) or above (for sell orders) the order block to account for potential market fluctuations. Maintaining a favorable risk-to-reward ratio, aiming for a minimum of 1:2 or 1:3, is key to long-term profitability.

5. Multiple Timeframe Analysis: Use multiple timeframes to increase the reliability of your trades. A confluence of signals across different timeframes can enhance the strength of your trading setups. For instance, if an order block is identified on the H1 chart and aligns with a key support level on the D1 chart, the likelihood of a successful trade increases.

6. Market Context: It’s crucial to understand the broader market context. Economic news releases, market sentiment, or geopolitical events can dramatically affect price movements. Make sure to consult economic calendars or relevant news sources before entering trades based on order blocks.

Trading Rules

1. Entry Rule: Enter a trade when price reaches an identified order block and shows signs of reversal through candlestick formations or other indicators.

2. Stop Loss Rule: Set a stop loss above the order block for sell trades and below the order block for buy trades, ensuring it accounts for volatility in the market.

3. Take Profit Rule: Aim to take profit at predetermined levels based on previous price action or key Fibonacci retracement levels. Always adjust your target based on market conditions.

4. Reassessment: Continuously reassess your trading plan. If price fails to react at an order block as anticipated, be prepared to exit the trade early to minimize losses.

5. Journaling: Keep a trading journal detailing every order block trade you make. Review and analyze your performance to identify strengths and weaknesses in your approach, which is valuable for adapting and improving your trading strategy.

Conclusion

The Order Block Indicator can be a highly effective tool in a trader's toolkit, providing insight into where significant market players are likely to enter or exit positions. By understanding how to identify these blocks and integrating them into a comprehensive trading strategy that incorporates risk management, confirmation, and market context, traders can enhance their decision-making and improve their overall trading performance. As with any trading strategy, continuous education, practice, and adaptation to changing market conditions are vital for success.