Submit your review | |

The Xmaster Formula indicator for MT5 is a technical analysis tool that can help traders identify potential entry and exit points in the market. It uses advanced algorithms and price action analysis to offer signals based on various market conditions. To effectively use the Xmaster Formula, traders should focus on several strategies:

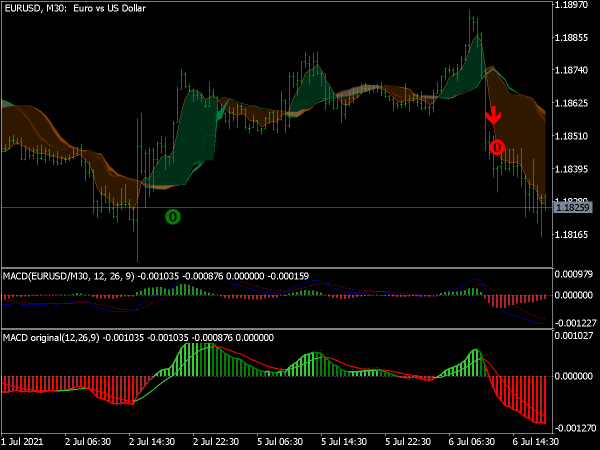

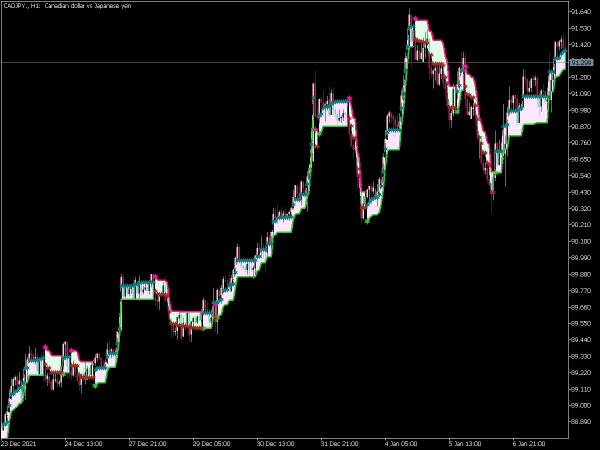

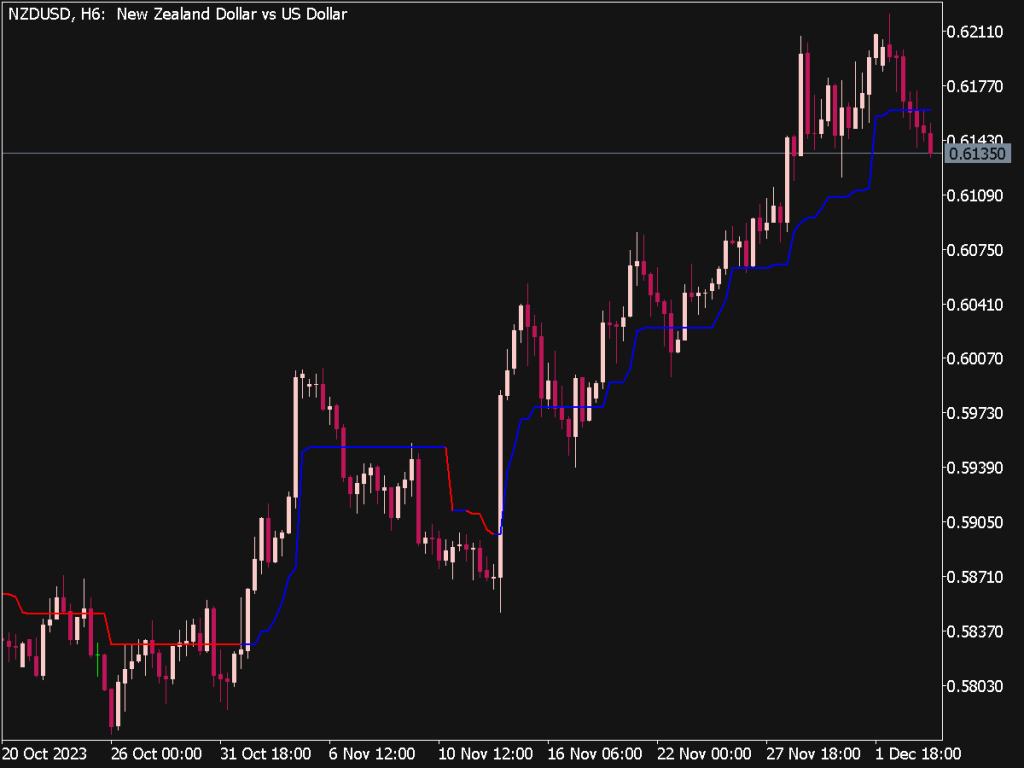

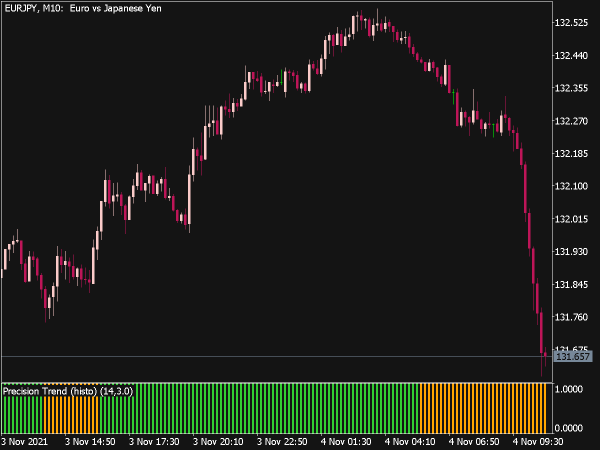

1. Trend Following: Utilize the indicator’s signals to trade in the direction of the prevailing trend. Look for buy signals when the market is trending upwards and sell signals during downtrends. Confirm trends using other indicators like moving averages or the RSI (Relative Strength Index) to avoid false signals.

2. Reversal Trading: The Xmaster Formula can also help identify possible reversal points. When the indicator signals a potential change in direction, look for additional confirmation through candlestick patterns or divergence with momentum indicators. This requires higher risk tolerance, as market reversals can be unpredictable.

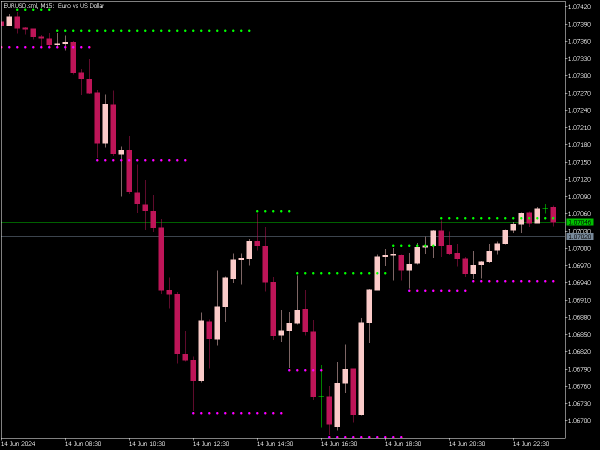

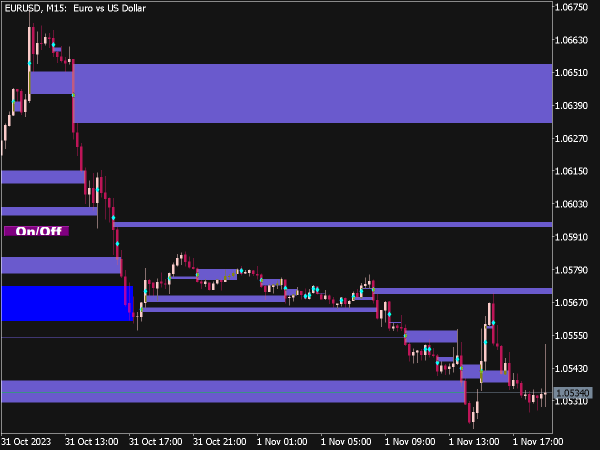

3. Support and Resistance Levels: Use the Xmaster signals in conjunction with key support and resistance levels. This approach can enhance the probability of successful trades. For example, expect a bullish reversal if the indicator suggests a buy signal near a strong support level, or a bearish signal at resistance.

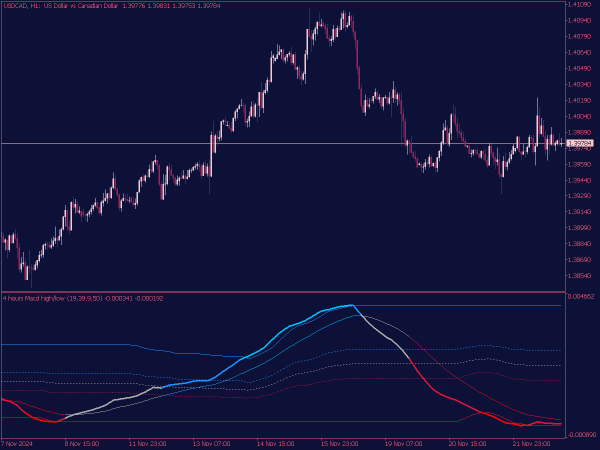

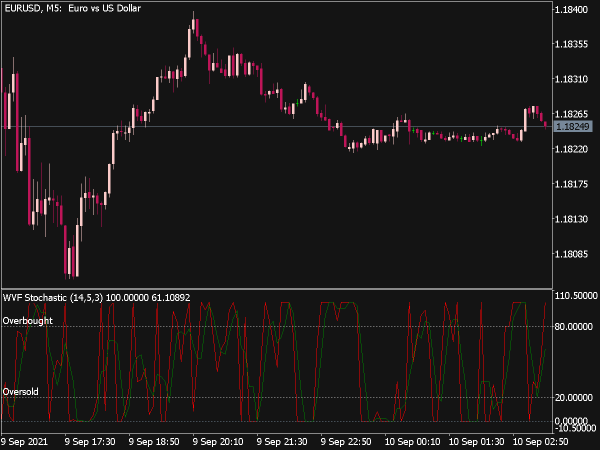

4. Time Frames: Adapt the usage of the Xmaster Formula indicator based on your trading style. Day traders might prefer shorter time frames (e.g., 5-minute or 15-minute charts), while swing traders may benefit from 1-hour or 4-hour charts. Adjust your trades accordingly, as the frequency of signals will change with different time frames.

5. Risk Management: Incorporate sound risk management practices by setting stop-loss and take-profit levels before entering trades. The Xmaster Formula can suggest entry points; however, managing exposure is crucial. A common strategy is to risk a small percentage of your trading capital on each trade.

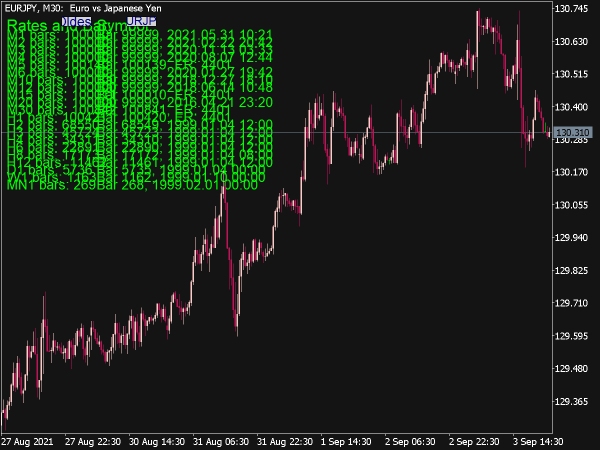

6. Backtesting and Analysis: Before implementing the indicator in live trading, it’s essential to backtest it on historical data. This provides insight into its performance across different market conditions and helps refine your strategies. Maintain a trading journal to analyze the outcomes of each trade.

7. Market Conditions: Be mindful of external factors like economic news releases or geopolitical events that can affect market volatility. The Xmaster Formula may not perform well during erratic price movements typical of high-impact news events.

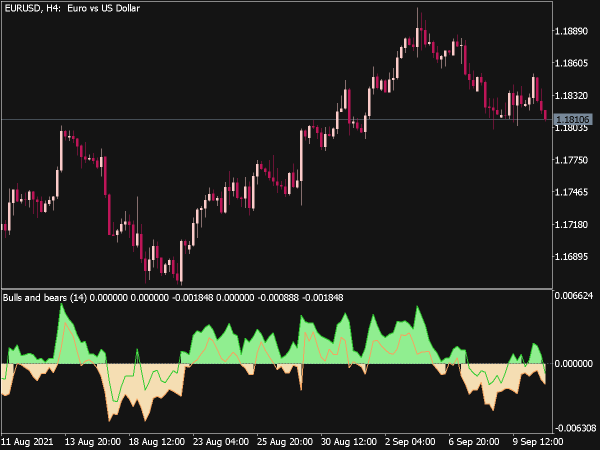

8. Combining Indicators: For improved accuracy, consider using the Xmaster Formula alongside other technical indicators, such as Fibonacci retracement levels, MACD, or Bollinger Bands. This multi-faceted approach can validate entry and exit points and increase trading success.

In conclusion, the Xmaster Formula indicator can be a powerful tool in a trader's arsenal when used with a solid strategy. Focus on identifying trends, potential reversals, and key levels, and combine it with sound risk management practices. Always backtest your strategies and remain aware of broader market conditions. By doing so, you can enhance your trading performance and make the most of the insights offered by this indicator.

If this indicator is broken,

If this indicator is broken,  Great Indicators, Trading Systems or EAs for MT4 and MT5

Great Indicators, Trading Systems or EAs for MT4 and MT5