Submit your review | |

Swing trading can be an effective strategy for traders looking to capitalize on short- to medium-term price movements in financial markets. Utilizing indicators and automatic channels can enhance your trading decision-making process. Here are some tips and strategies to effectively incorporate these tools into your swing trading approach.

Understanding Swing Trading

Swing trading involves holding positions for several days or weeks to benefit from anticipated price swings. A trader aims to identify price trends, reversals, and consolidation periods, leveraging technical indicators to inform their decisions.

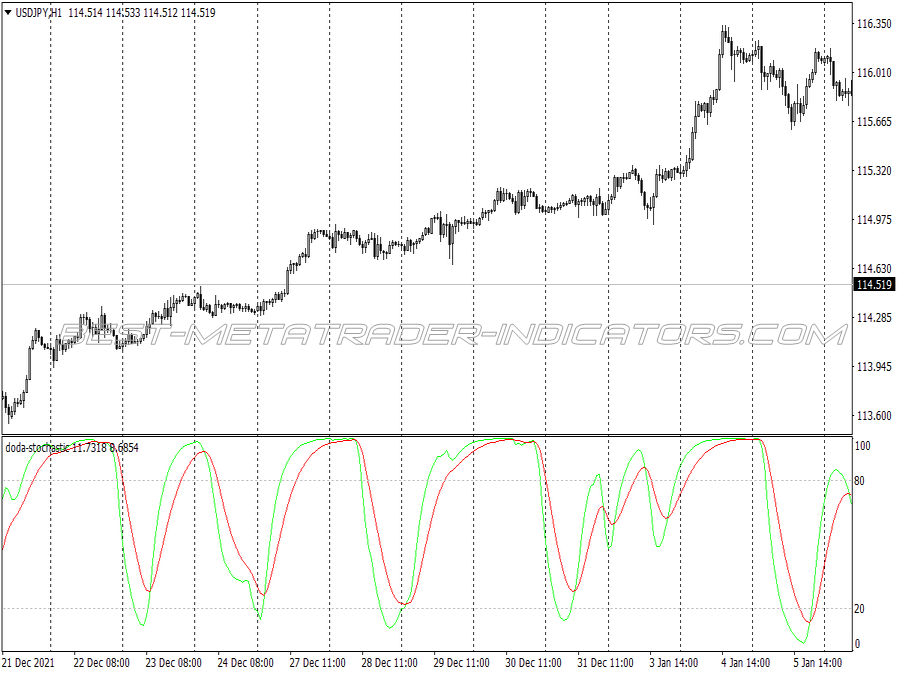

Choosing the Right Indicators

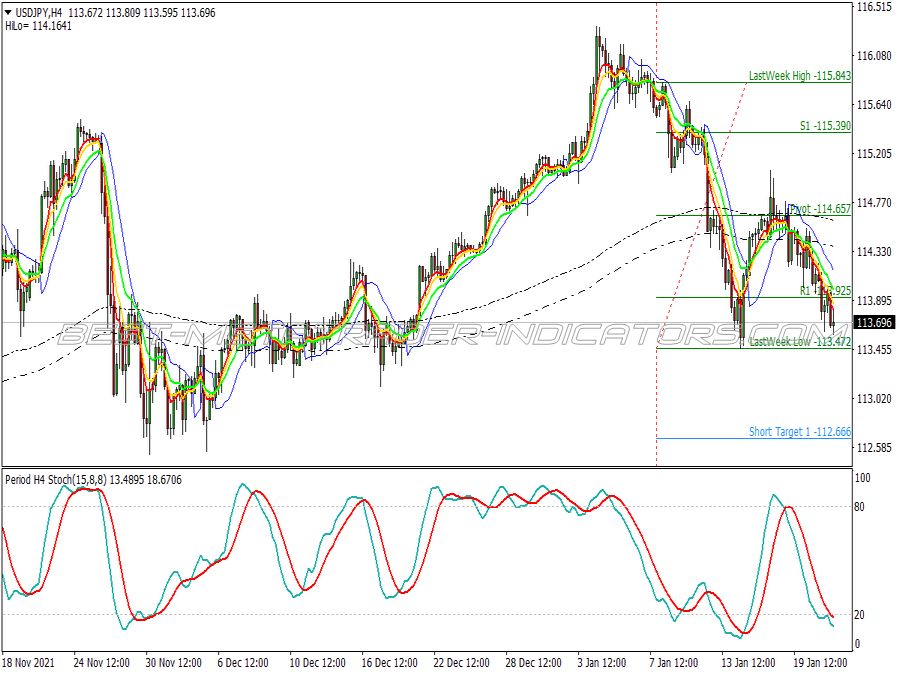

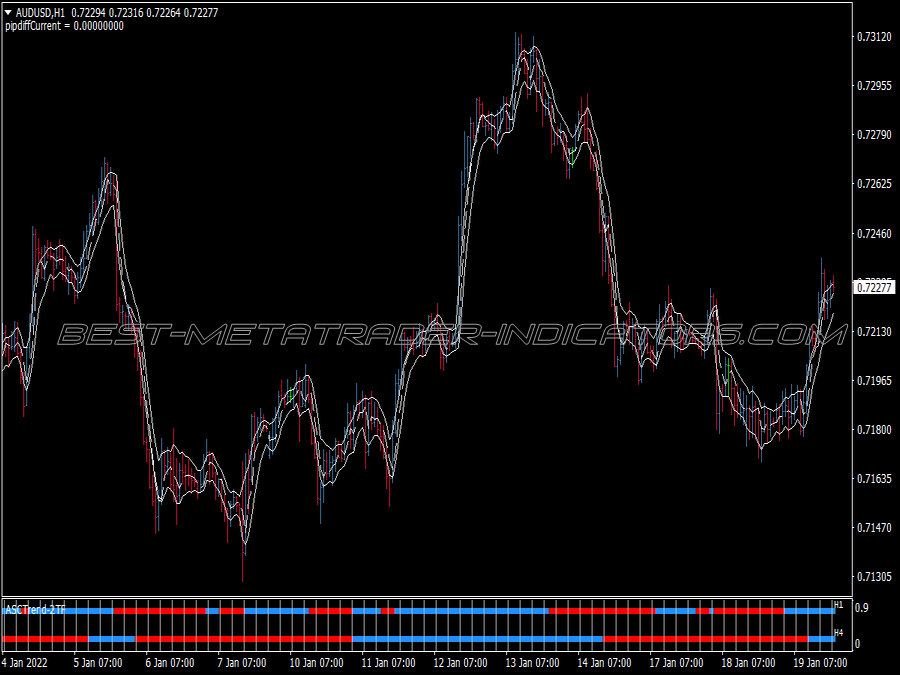

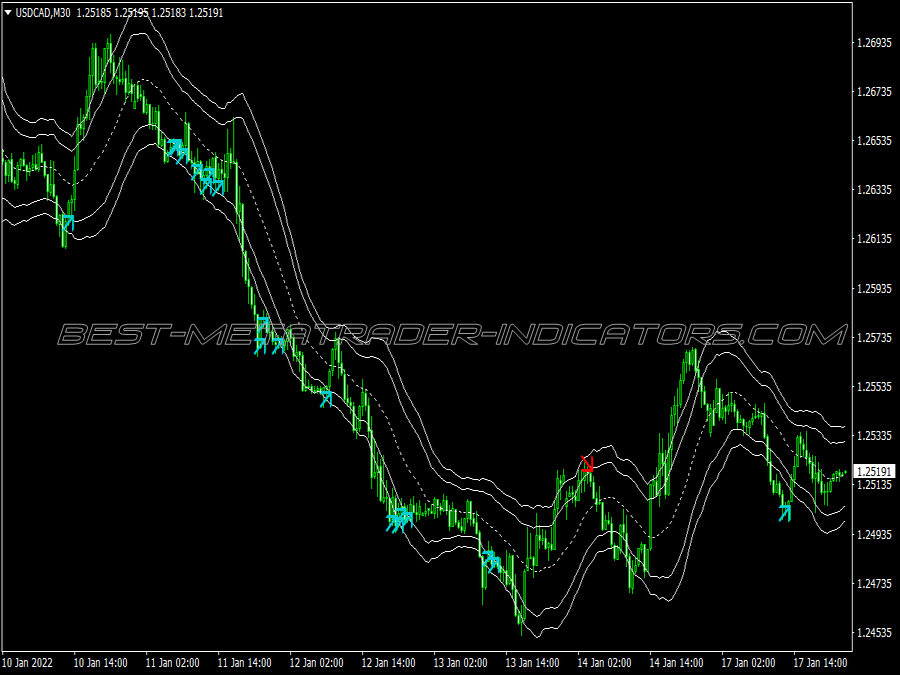

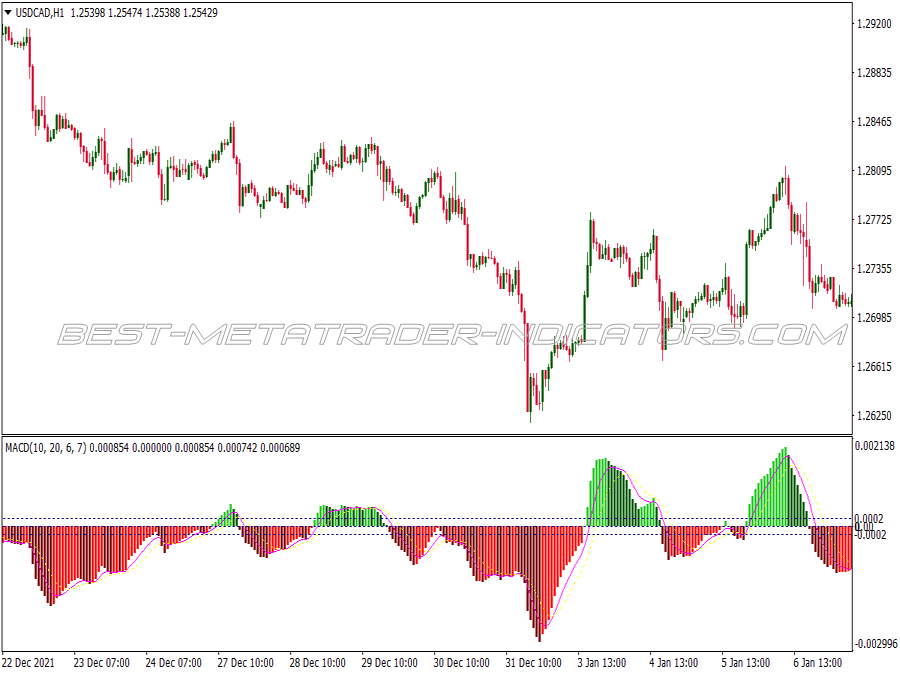

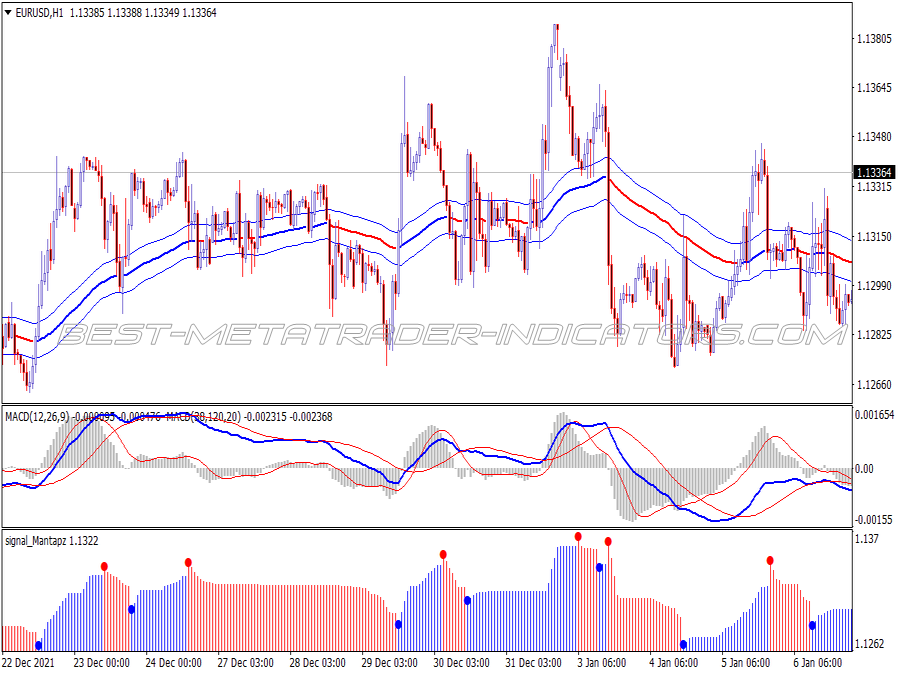

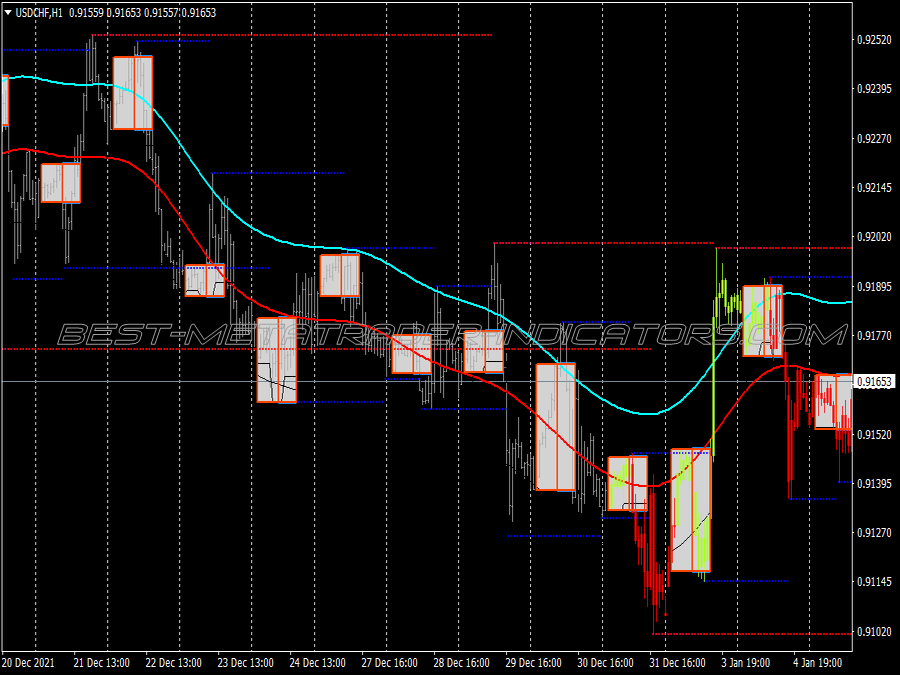

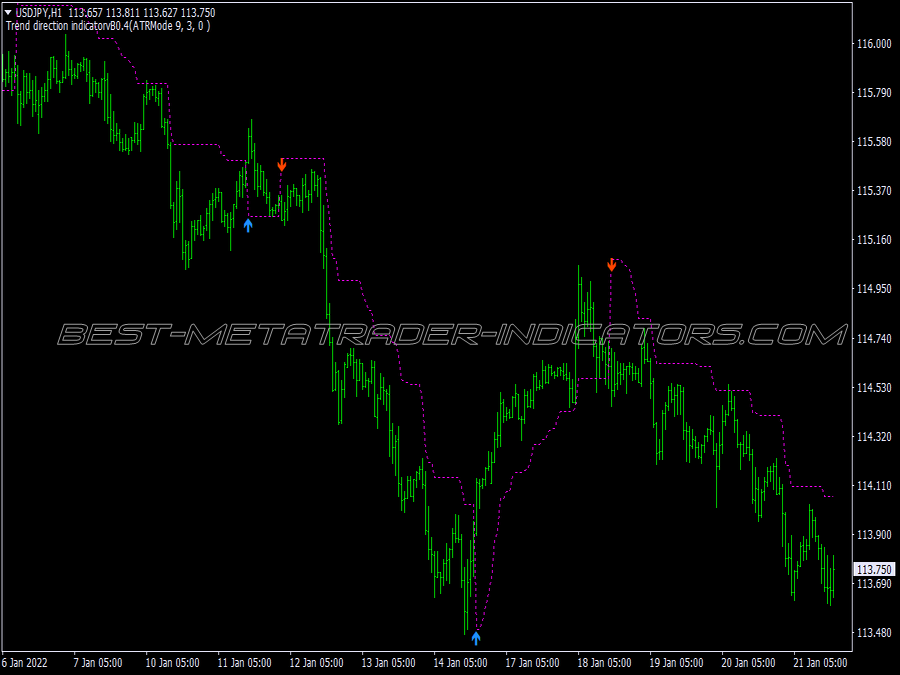

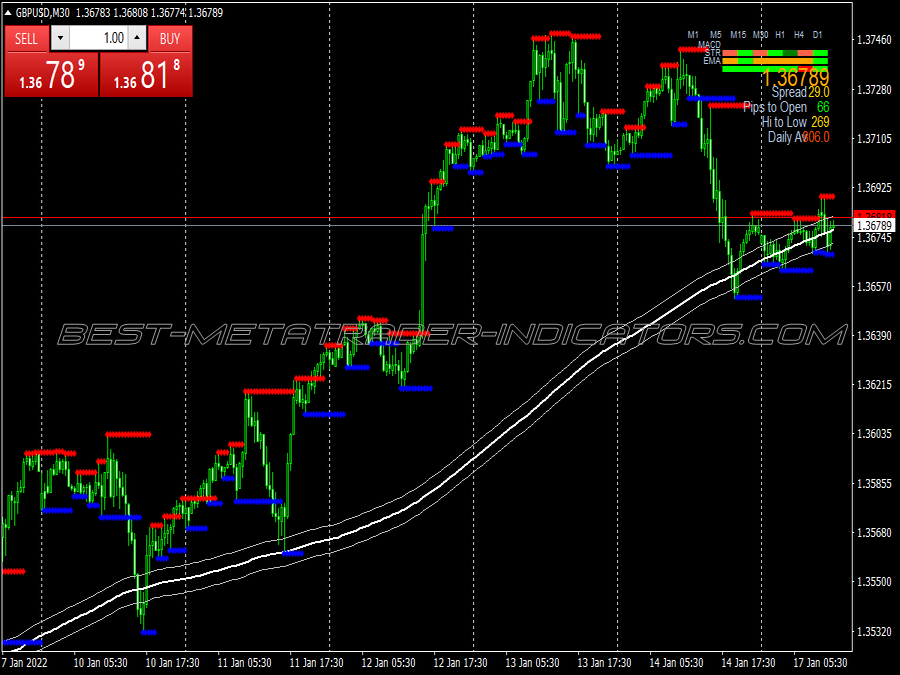

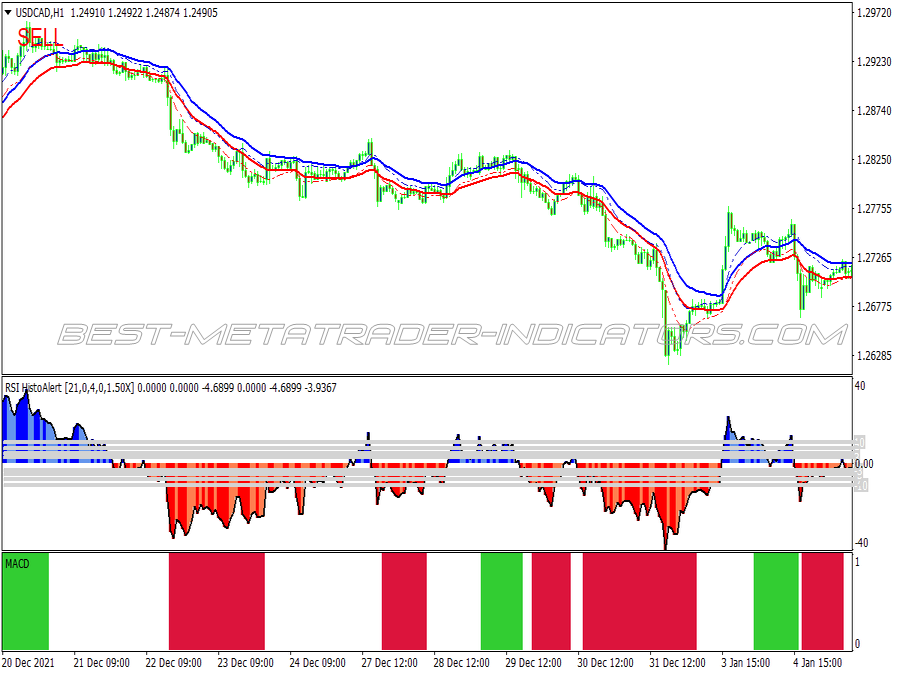

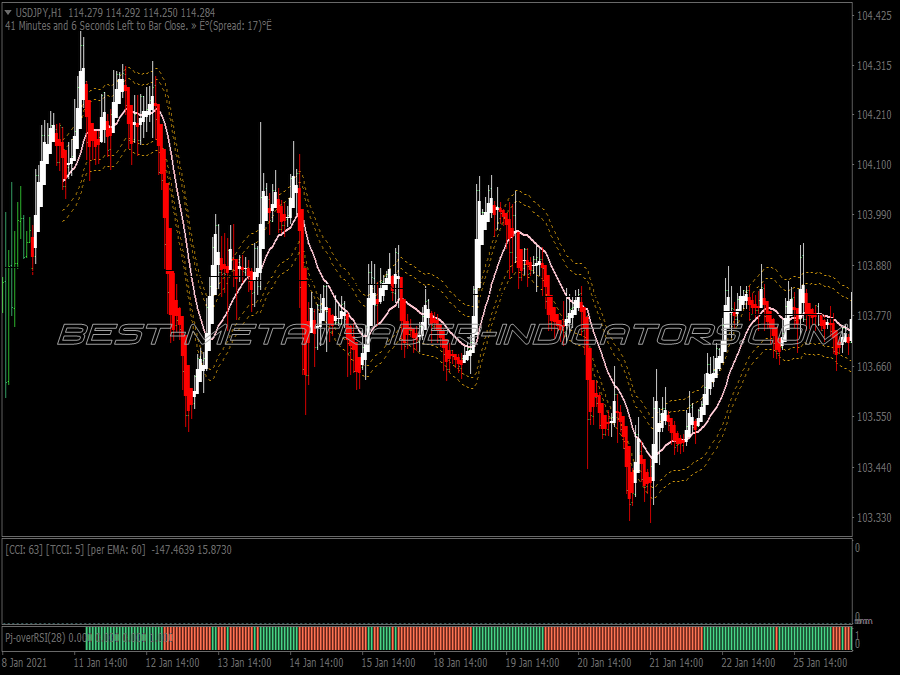

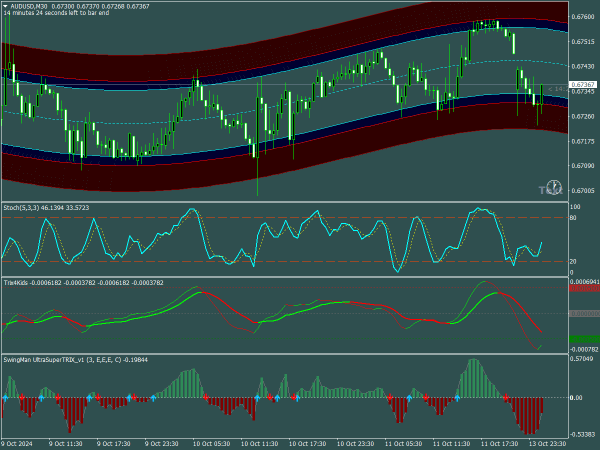

Key indicators for swing trading include moving averages (MA), Relative Strength Index (RSI), Bollinger Bands, and the Average True Range (ATR). Moving averages help smooth out price action and identify trends. The RSI indicates overbought or oversold conditions (levels above 70 suggest overbought, while levels below 30 indicate oversold conditions). Bollinger Bands provide volatility context, signaling potential price breakouts or reversals. The ATR can help assess market volatility, which is crucial for setting stop-loss orders and managing risk.

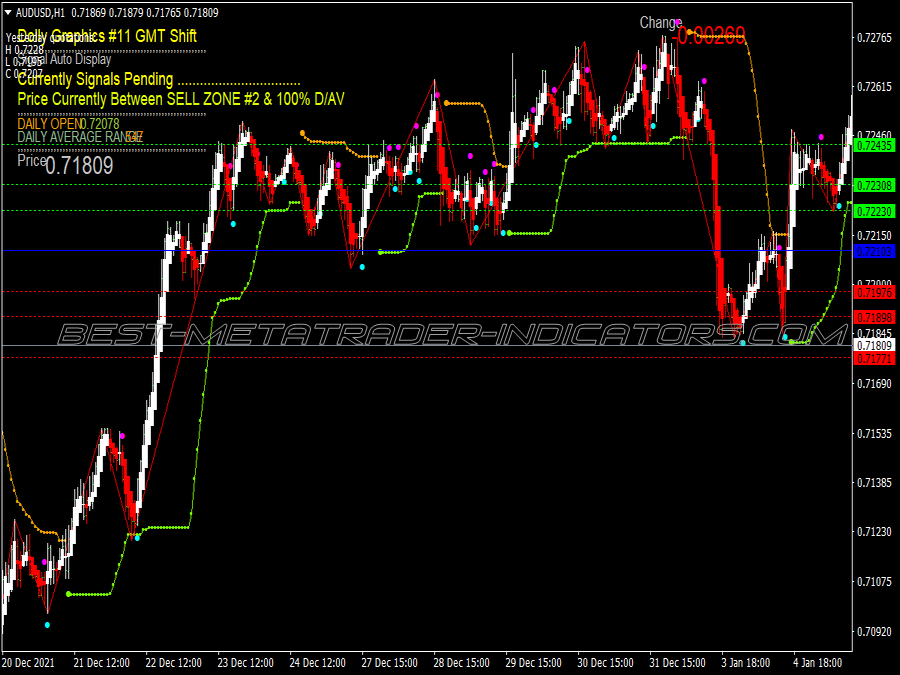

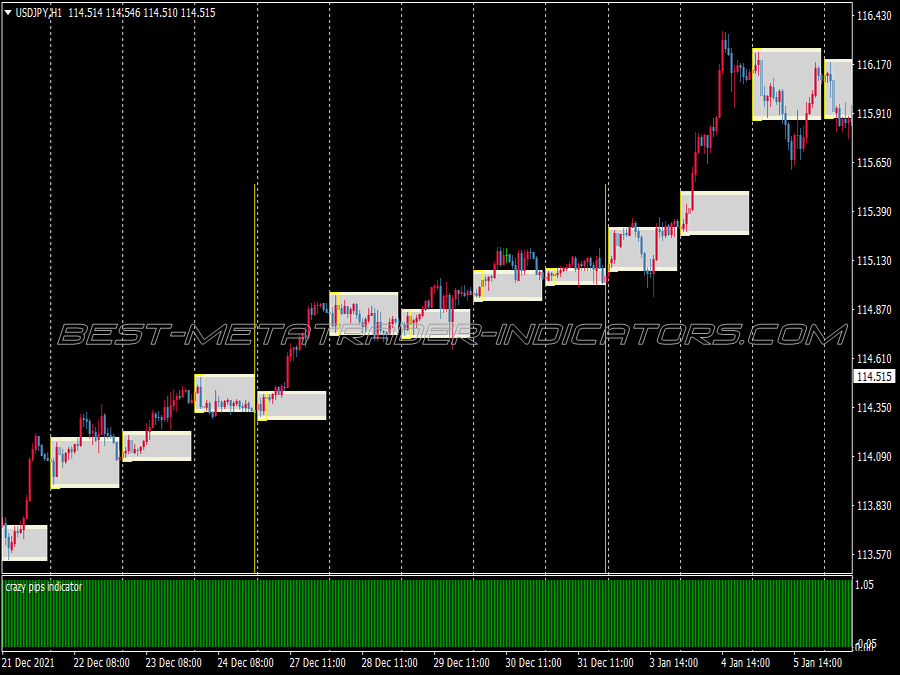

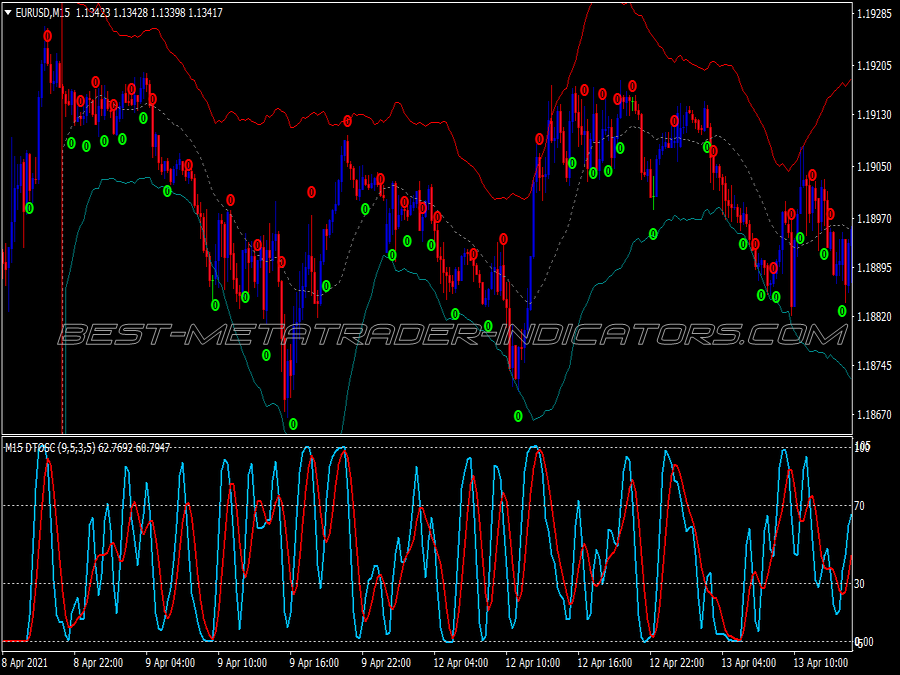

Utilizing Automatic Channels

Automatic trading channels, such as trend lines or Fibonacci retracement levels, can help identify potential price targets and support/resistance levels. These channels can be drawn using tools available on most trading platforms, allowing traders to visualize potential entry and exit points. A price trading within a channel could signal a high probability trade setup, and automated alerts can notify you when price levels of interest are reached.

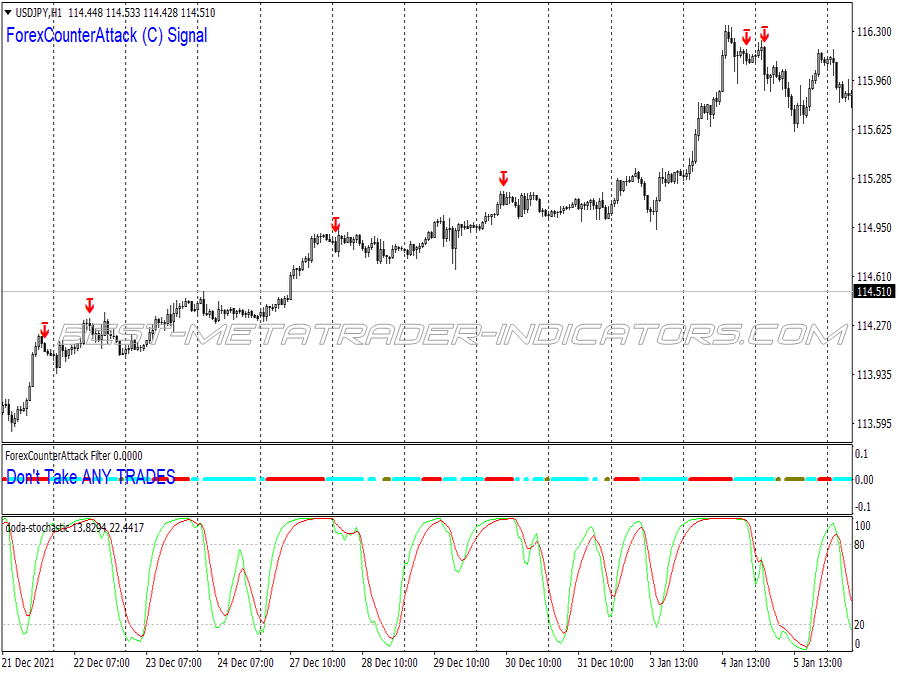

Timing Your Entries and Exits

Effective timing is crucial in swing trading. One strategy is to enter a trade during a pullback within an upward trend or a bounce in a downward trend. For example, if the price approaches a key moving average, it might offer a potential entry point. For exits, consider using fixed profit targets or trailing stops, which allow you to lock in gains while letting profits run.

Using Risk Management

Risk management is essential in swing trading. Employ a risk-to-reward ratio of at least 1:2 to maintain profitability over time. Set stop-loss orders to protect against significant losses; this is particularly important in volatile markets. Additionally, diversifying your trades across different assets can mitigate risk.

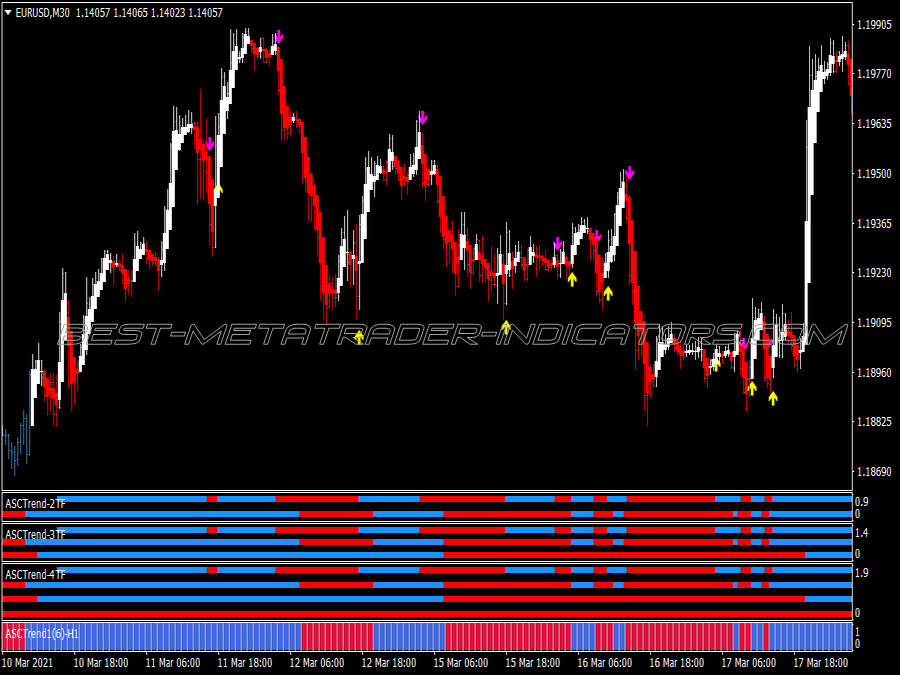

Analyzing Market Conditions

Keep an eye on broader market conditions, economic events, and news that may influence asset prices. Economic indicators, earnings reports, and geopolitical events can create volatility. Using a multi-timeframe analysis can help you understand the larger trend while fine-tuning your entry points.

Developing a Trading Plan

Creating a well-defined trading plan is paramount. Outline your strategy, including the indicators you will use, specific entry and exit criteria, and risk management rules. Following a trading plan helps eliminate emotional trading and enhances consistency.

Continuously Backtesting and Adjusting Strategies

Regularly backtest your strategies against historical data to assess their effectiveness. This helps you identify weaknesses and optimize your trading approach. Financial markets can change, and continuous learning and adaptation are necessary for success.

Maintaining Discipline and Patience

Discipline is crucial in stickhing to your chosen strategy and not deviating due to market noise. Swing trading may require patience as price movements can take time to unfold. Avoid the temptation to chase trades that do not meet your criteria.

In conclusion, integrating indicators and automatic channels into your swing trading routine can significantly enhance your trading outcomes. Focus on selecting key indicators, utilizing automatic tools for channel analysis, effectively timing trades, managing risk, and adhering to a disciplined trading plan. Through continuous analysis and the willingness to adapt, you can improve your swing trading strategy and potentially increase profitability over time.