Submit your review | |

Scalping is a trading strategy focused on making small profits from many trades throughout the day. Scalpers aim to exploit minor price movements in high liquidity markets, such as forex or stocks. A key to successful scalping is speed; traders typically hold positions for just a few seconds to minutes. Here’s a comprehensive guide to develop a scalping trading system along with some tips.

1. Choose the Right Market and Broker:

Select a liquid market with high volatility, which allows for rapid price movements. Popular choices include forex pairs like EUR/USD or GBP/USD, as well as high-volume stocks. Additionally, finding a broker that offers low spreads and fast execution is crucial; any delay can erode profits from small trades. Look for brokers with minimal commissions since fees can quickly add up on multiple transactions.

2. Develop a Trading Plan:

A well-defined trading plan is essential. Outline your profit target per trade (usually 1-3 pips in forex), maximum loss, risk-reward ratio, and overall daily profit goals. Additionally, specify which instruments to trade and the number of trades you aim for in a session. Stick to your plan to avoid emotional trading decisions under pressure.

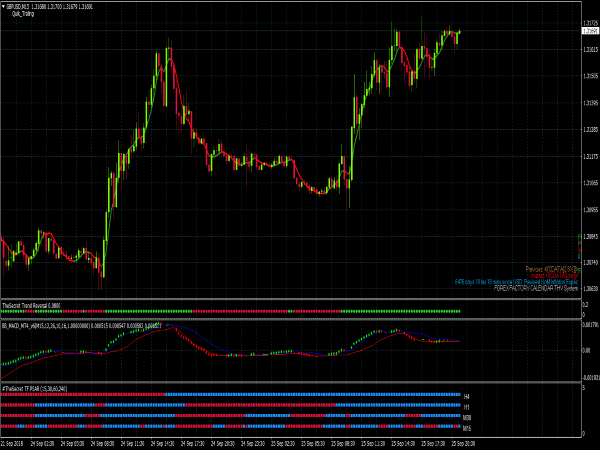

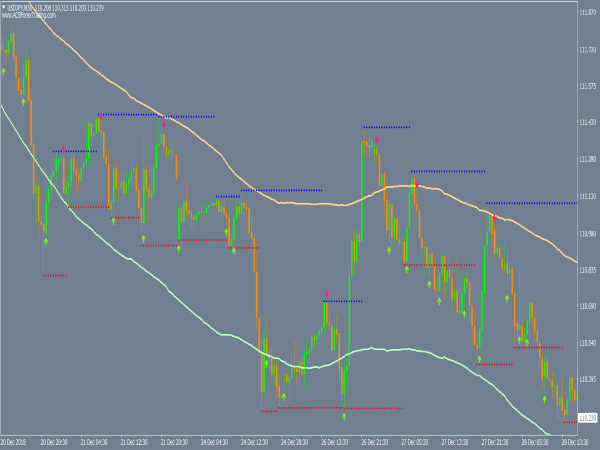

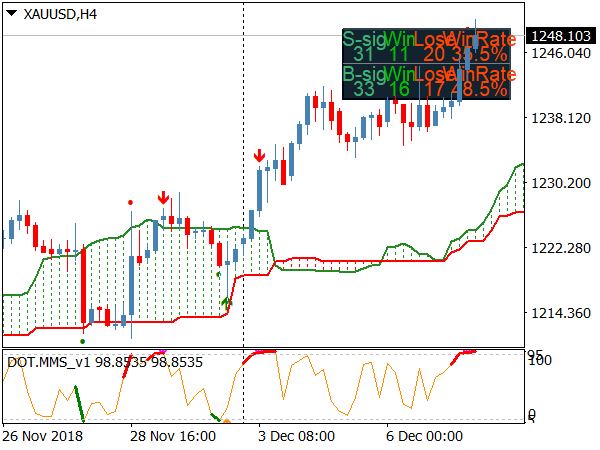

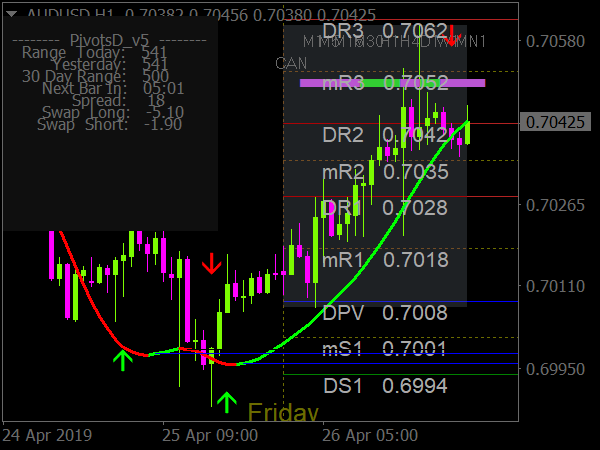

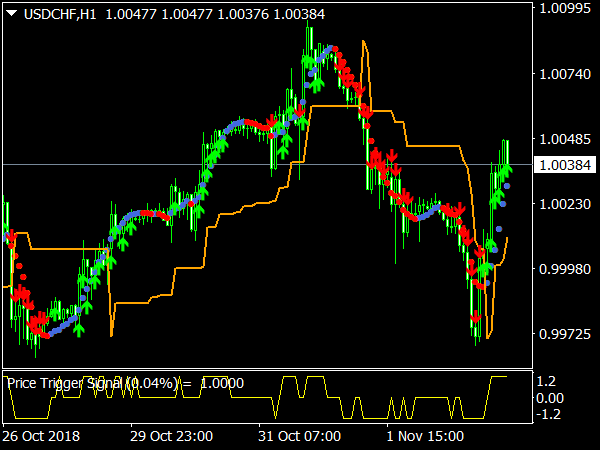

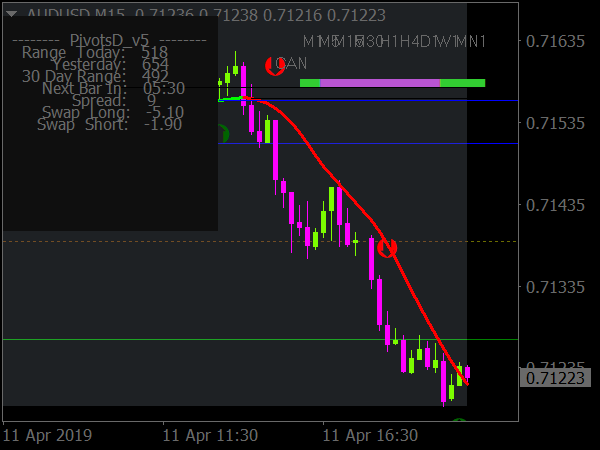

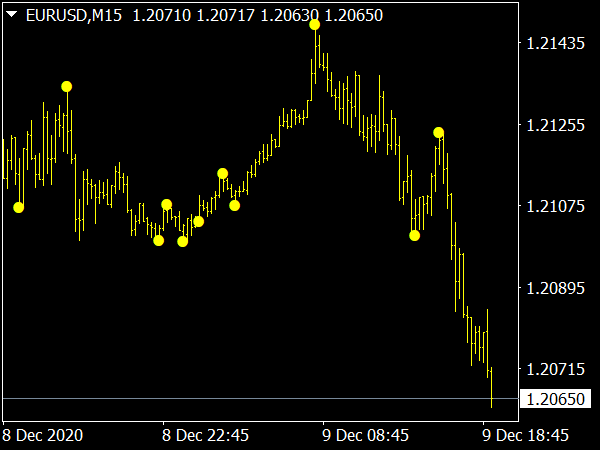

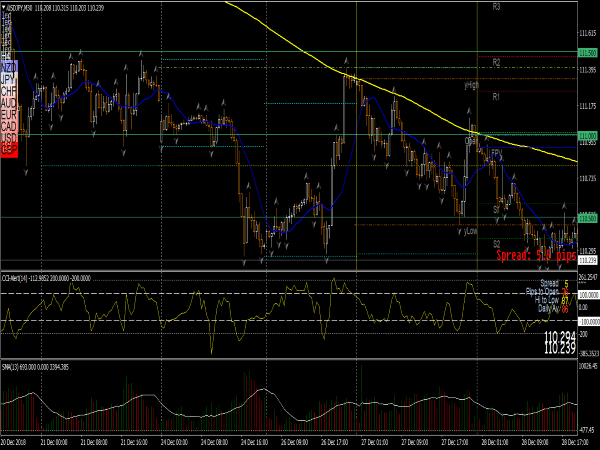

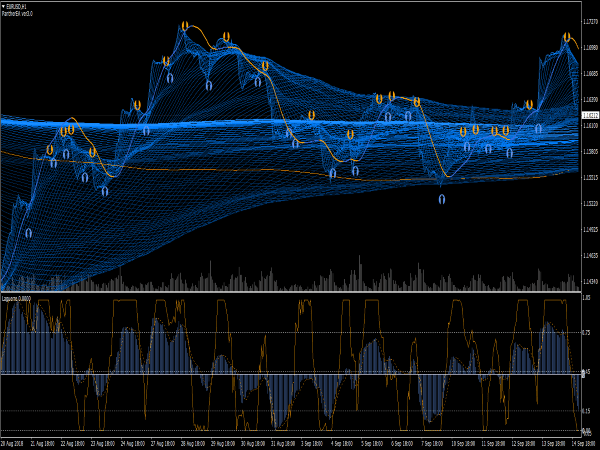

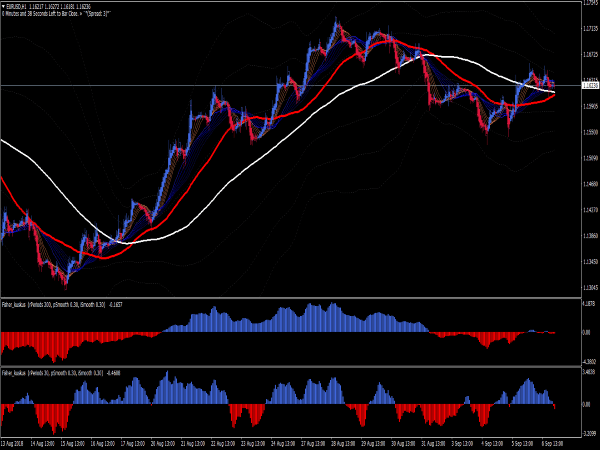

3. Use Technical Analysis:

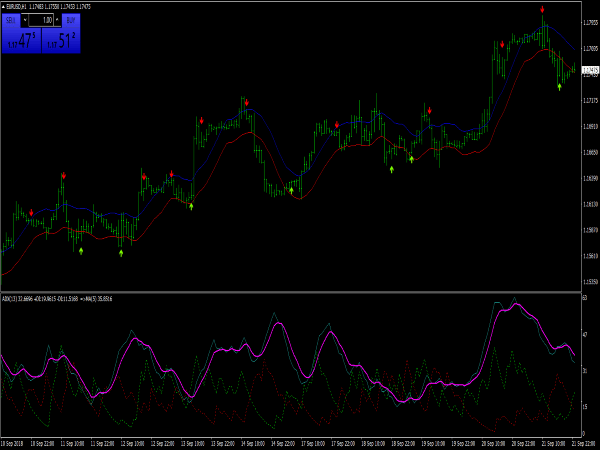

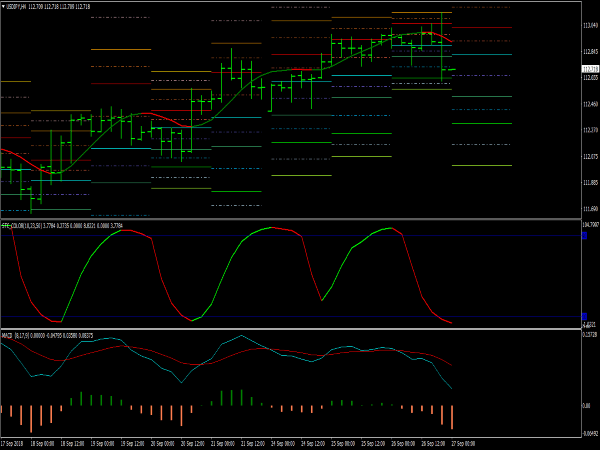

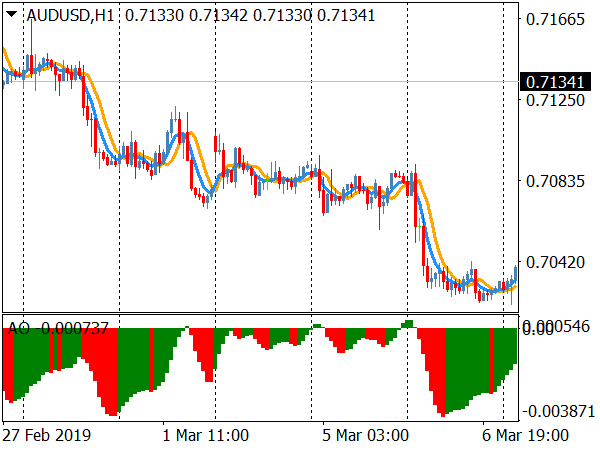

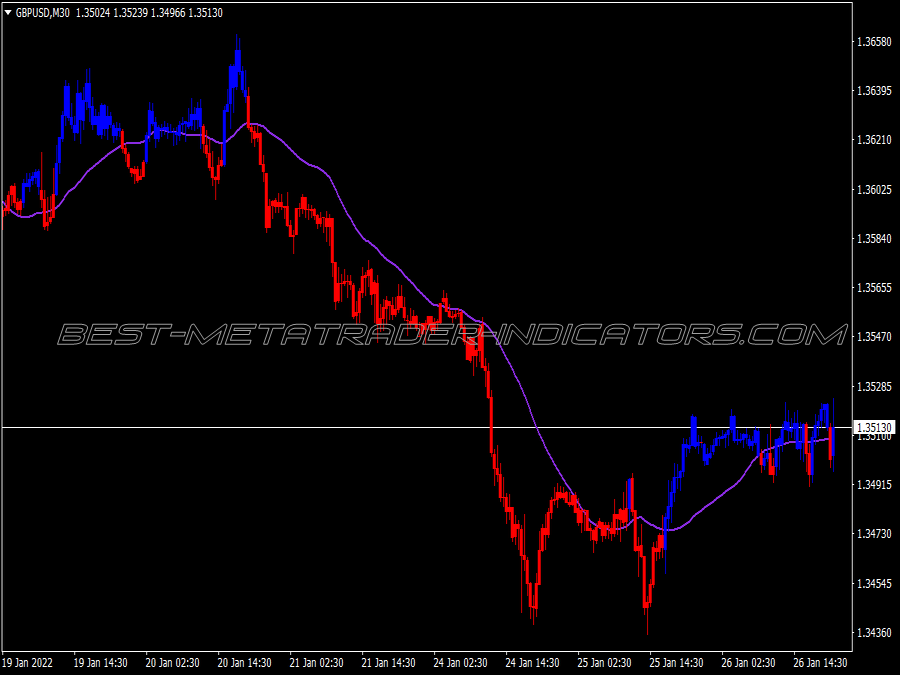

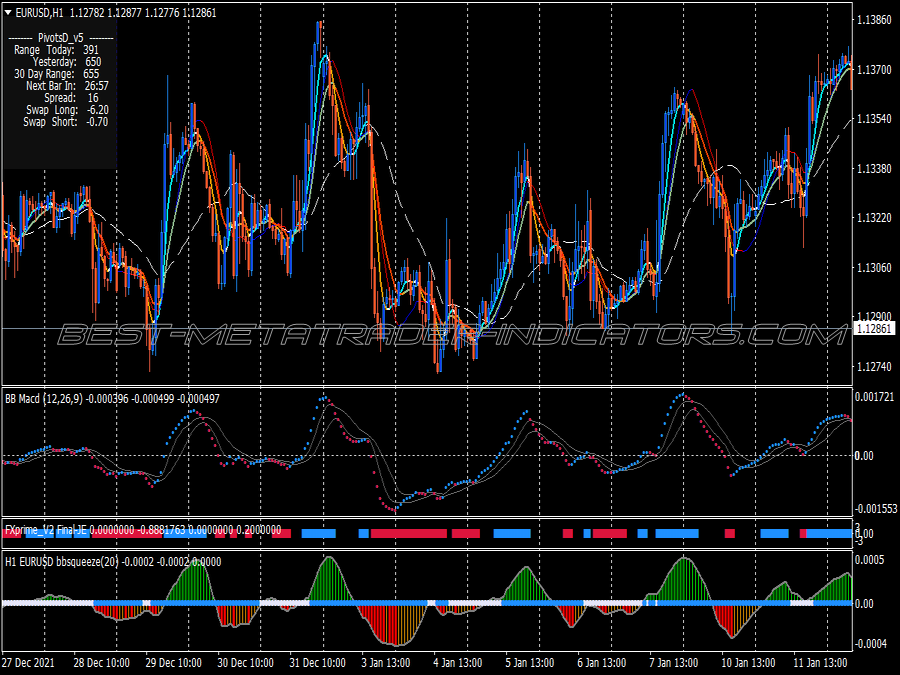

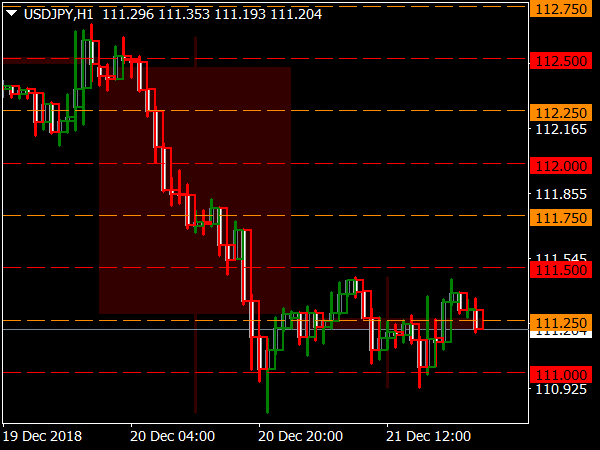

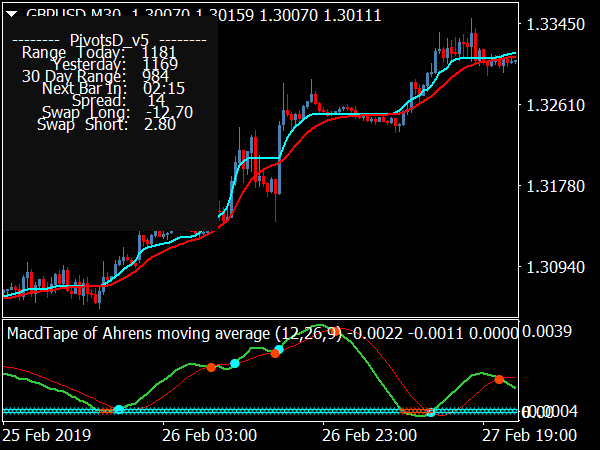

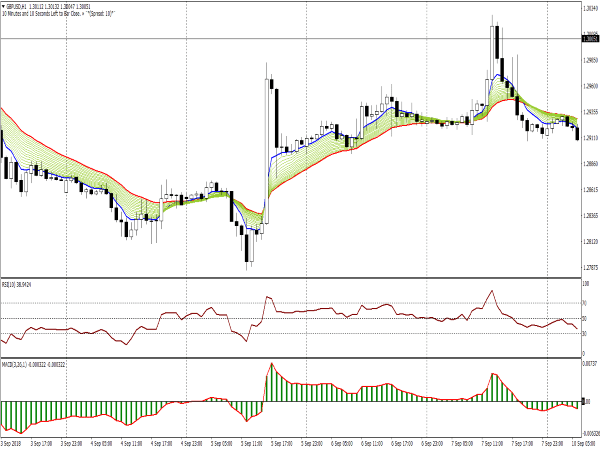

Scalp traders typically rely on technical analysis, using indicators and charts to identify entry and exit points. Commonly used tools include moving averages, Bollinger Bands, the Relative Strength Index (RSI), and volume indicators. Chart patterns can also provide clues about price movements. Consider setting up a 1-minute or 5-minute chart to identify micro-trends.

4. Set Up Entry and Exit Strategies:

Your entry strategy should be quick and systematic. For instance, you might enter trades based on specific breakout signals, indicators, or price patterns. Exit strategies are equally critical; due to the small profit margins, it is important to set tight stop-loss orders to protect your capital. A common approach is a 1:1 risk-reward ratio, ensuring that your potential reward aligns with the risk taken.

5. Optimize Position Sizing:

Effective risk management is vital in scalping. The traditional rule for position sizing suggests risking no more than 1% of your total account balance on a single trade. Given that scalping involves frequent trades, maintaining strict discipline and having a clear stop-loss for every position is essential to limit losses.

6. Keep an Eye on Economic News:

Economic events and news releases can create volatility, offering great scalping opportunities, but they can also introduce risk. Use a financial calendar to track relevant news and prepare to step back from trading during major announcements which can lead to unpredictable price movements.

7. Stay Aware of Market Conditions:

Market conditions change, and so do trading strategies. Scalping in a ranging market differs from trading in a trending one. Monitoring market trends and adjusting your strategy accordingly will improve your success rate. Be ready to switch strategies if you notice high volatility can be advantageous, while enduring periods of consolidation may require a different approach.

8. Use Technology to Your Advantage:

Many scalpers utilize automated systems or algorithms to make trades on their behalf, which helps reduce the response time and minimizes the emotional component of trading. Having access to trading platforms that support automated strategies can give you an edge in executing trades instantly.

9. Practice with a Demo Account:

Before risking real money, practice your scalping strategy on a demo account. This enables you to test your system, understand the market dynamics, and refine your methods without financial risk. Analyzing your results over time will help you understand what works and what adjustments are necessary.

10. Maintain Discipline and Emotional Control:

The fast-paced nature of scalping demands high levels of discipline. Avoid overtrading, chasing losses, or deviating from your trading plan. Keeping emotions in check is critical; consider a post-trade analysis routine to review trades, learn from mistakes, and continuously improve your strategy.

11. Staying Healthy:

Scalping can be stressful and tiring, especially if you're glued to your screen for hours. It’s vital to maintain good health through proper posture, frequent breaks, and hydration. A clear mind will help in making objective trading decisions.

In conclusion, scalping can be a profitable trading strategy for disciplined traders who understand the nuances of quick trades. Successful scalpers employ a solid plan, effective risk management, and constant self-improvement to navigate the fast-paced market efficiently. By integrating these tactics, you can enhance your chances of success and potentially achieve consistent profitability.

If this indicator is broken,

If this indicator is broken,  Great Indicators, Trading Systems or EAs for MT4 and MT5

Great Indicators, Trading Systems or EAs for MT4 and MT5