Submit your review | |

Breakout strategies are trading methods utilized to capitalize on assets' price movements when they breach established support or resistance levels. A breakout occurs when the price passes through a significant barrier, often signaling the start of a new trend. Effective breakout trading requires a blend of technical analysis, indicators, and disciplined risk management.

Description of Breakout Strategies:

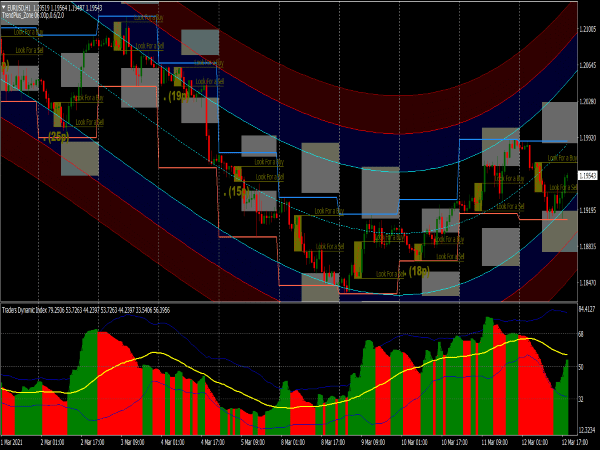

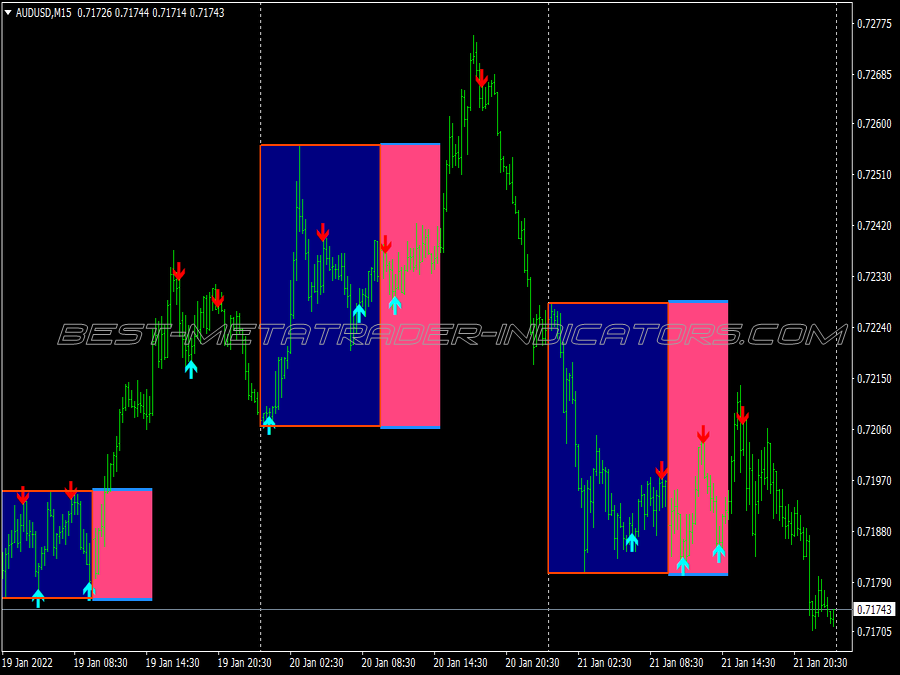

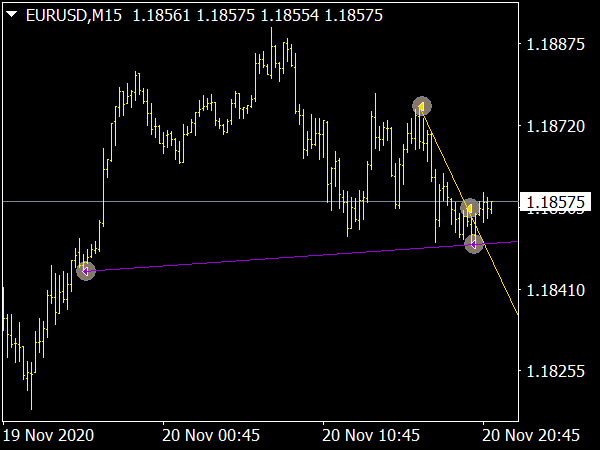

Breakout strategies focus on identifying key price levels that, once breached, indicate a potential for significant price movement. These strategies can be implemented in various markets, including stocks, currencies, and commodities. Traders look for consolidation patterns, such as triangles, flags, or rectangles, where prices trade within a narrow range, leading to a potential breakout. The objective is to enter a position just before or as the price breaks the critical level to profit from the ensuing volatility.

Key Indicators:

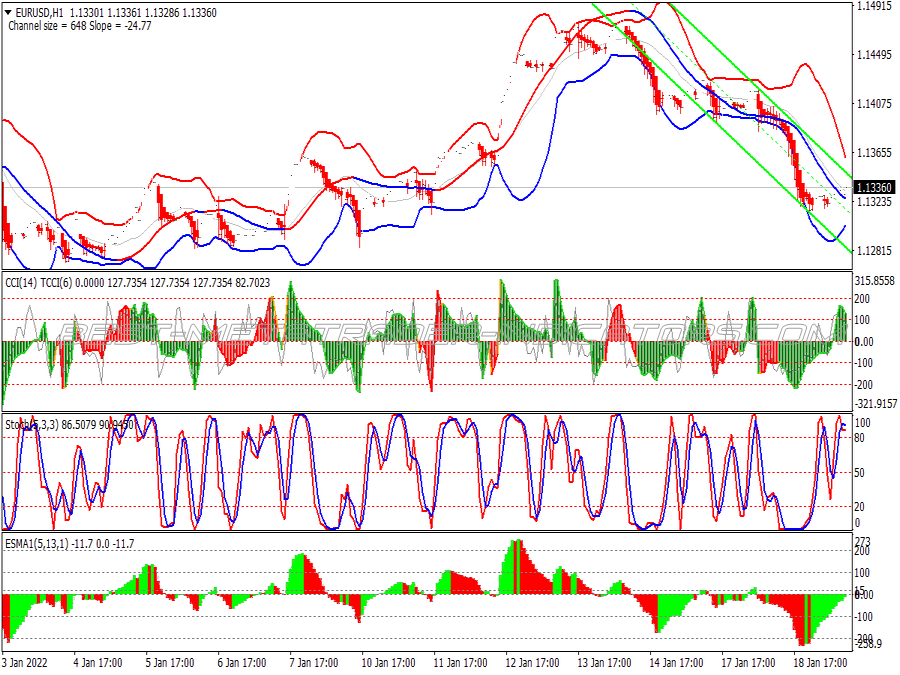

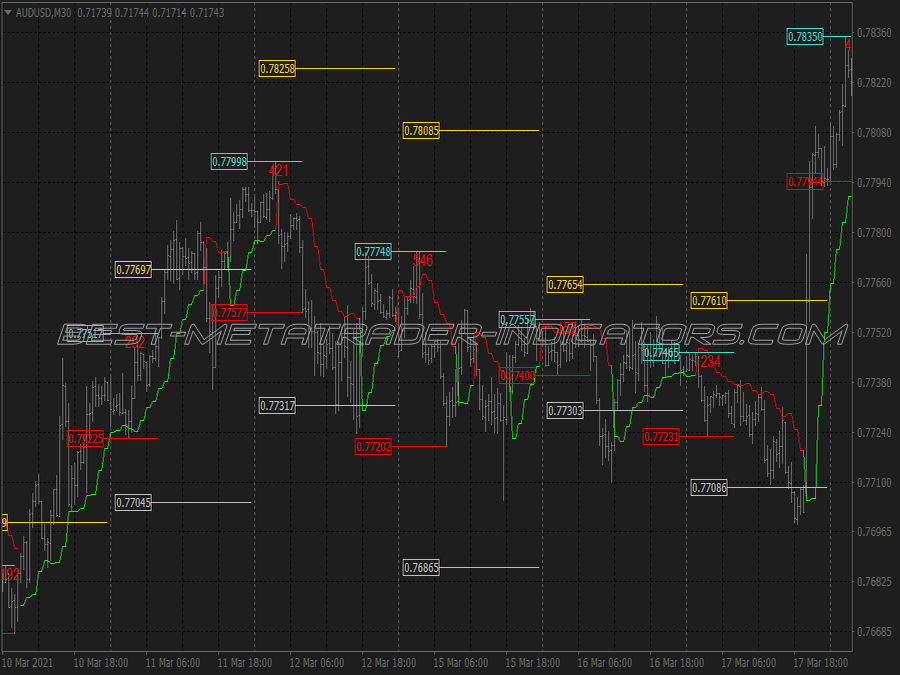

1. Volume: This is one of the most critical indicators for confirming a breakout. A significant increase in volume accompanying the breakout suggests strong interest and validates that the price movement may continue.

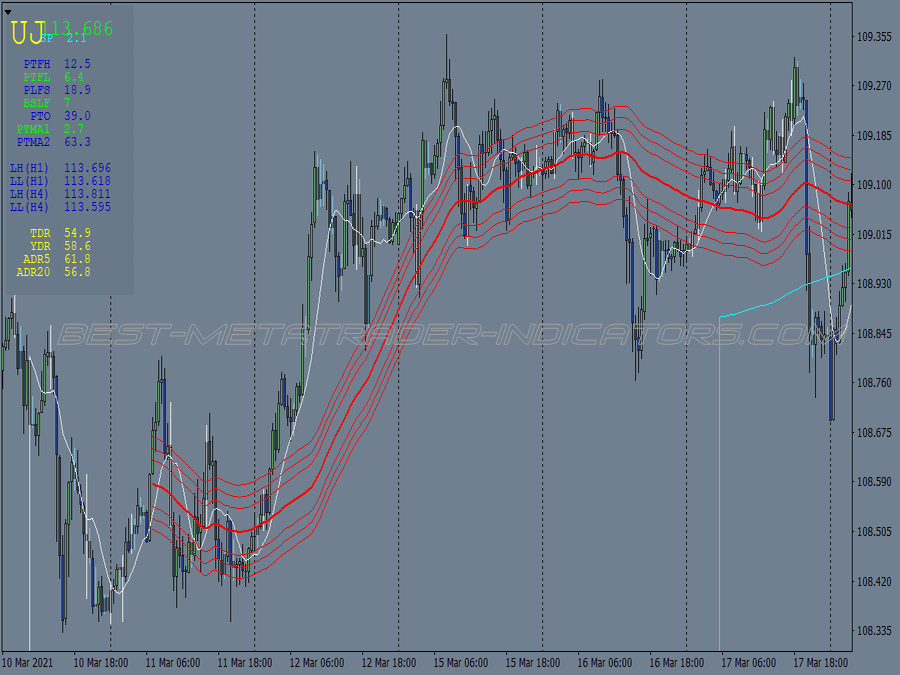

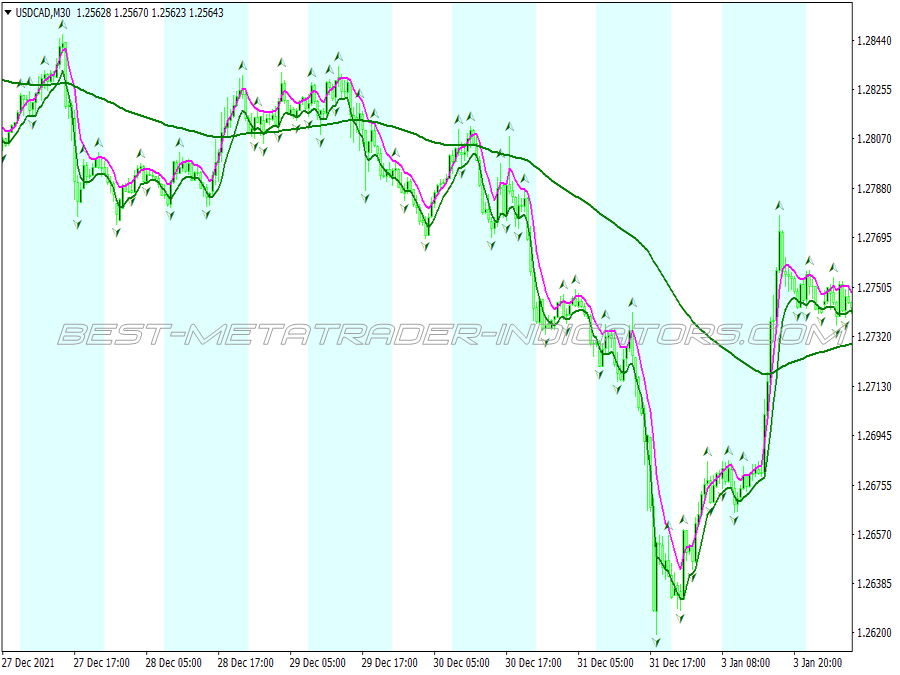

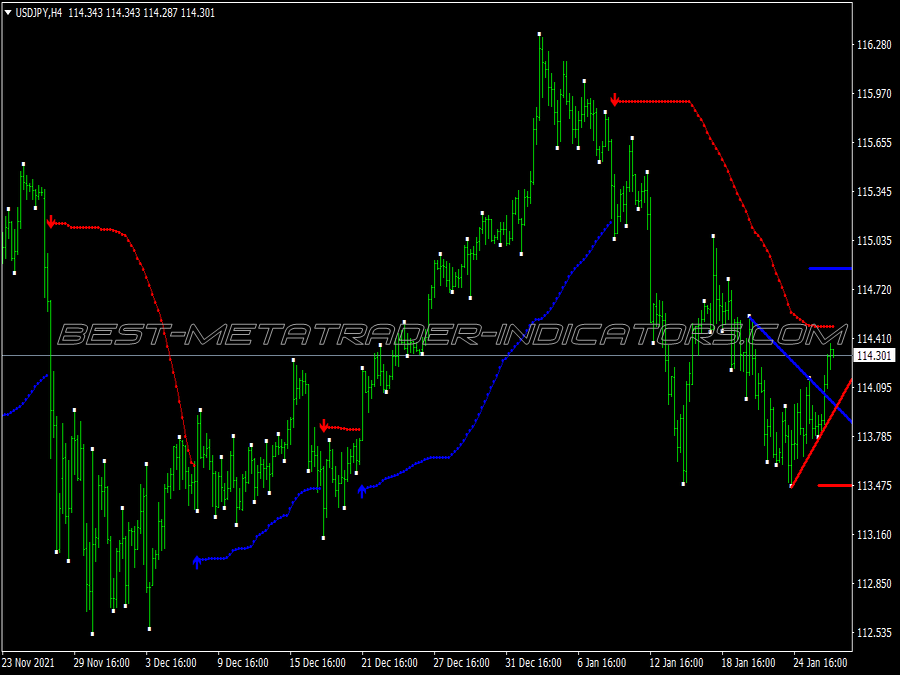

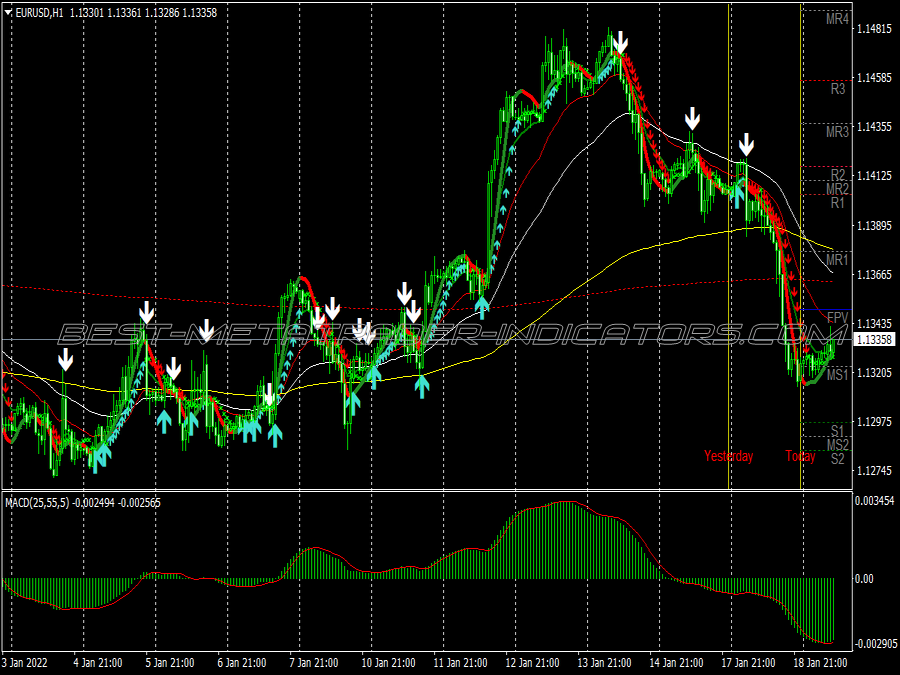

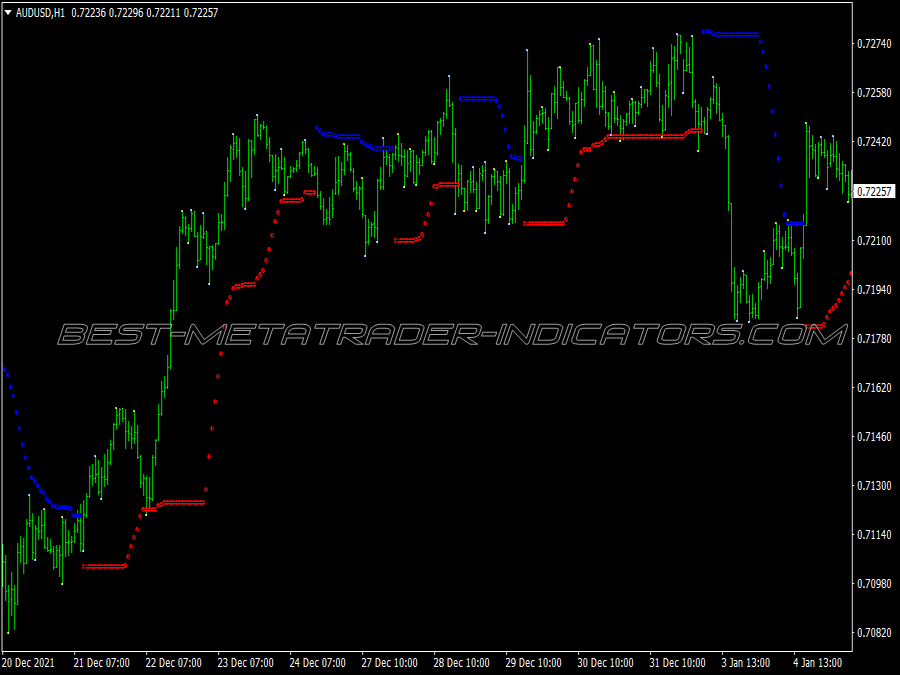

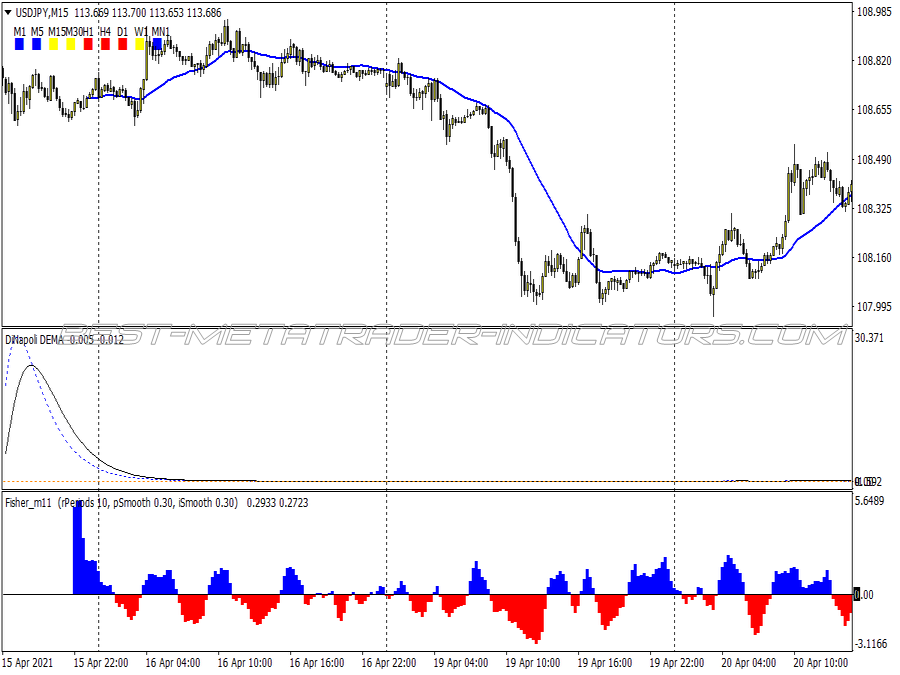

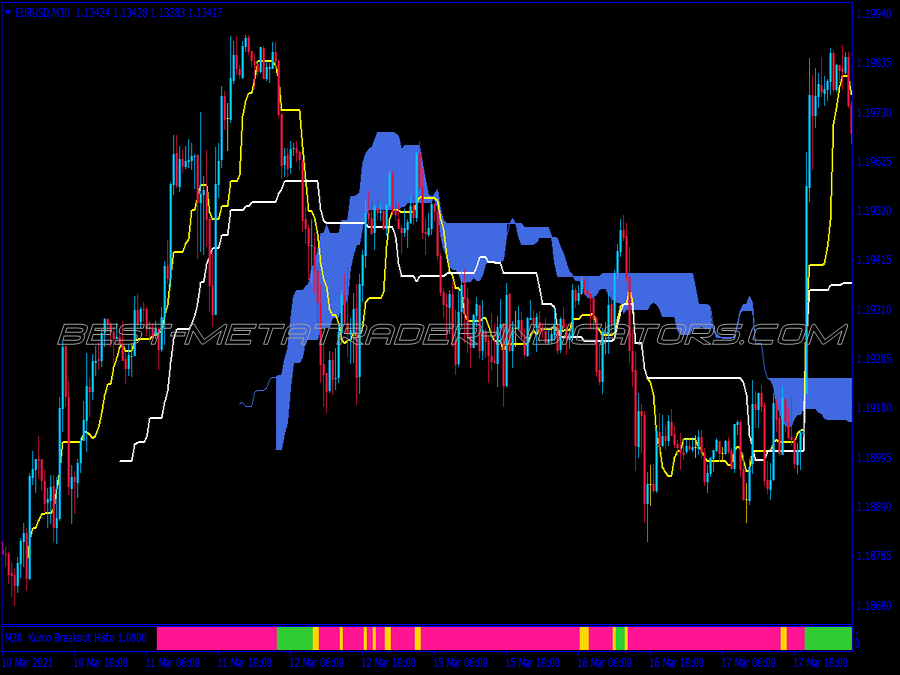

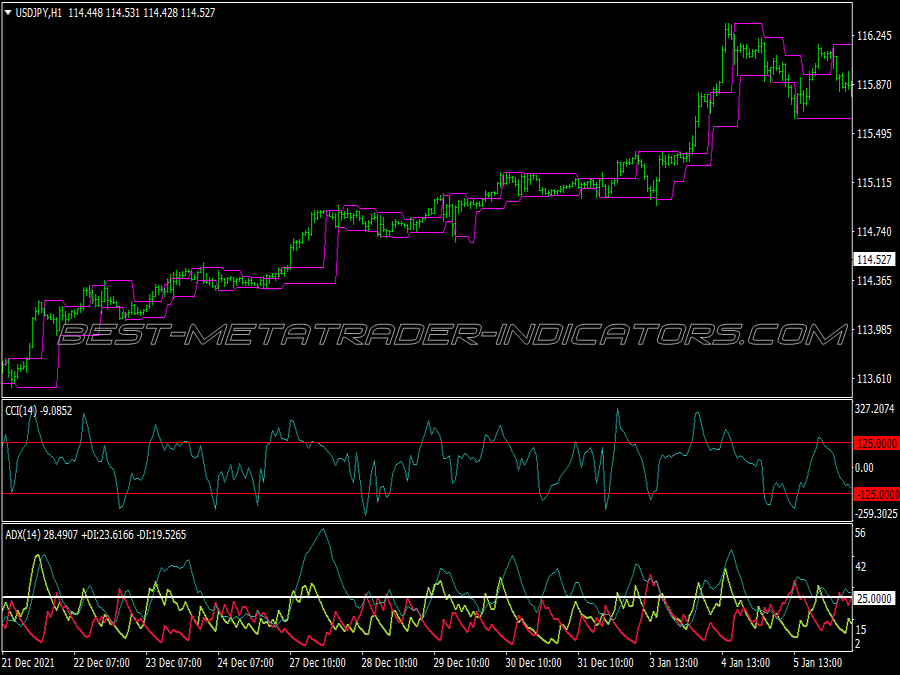

2. Moving Averages: Traders often use moving averages to identify trends. A price breakout above a moving average may signal a bullish trend, while a breakdown below can indicate a bearish trend.

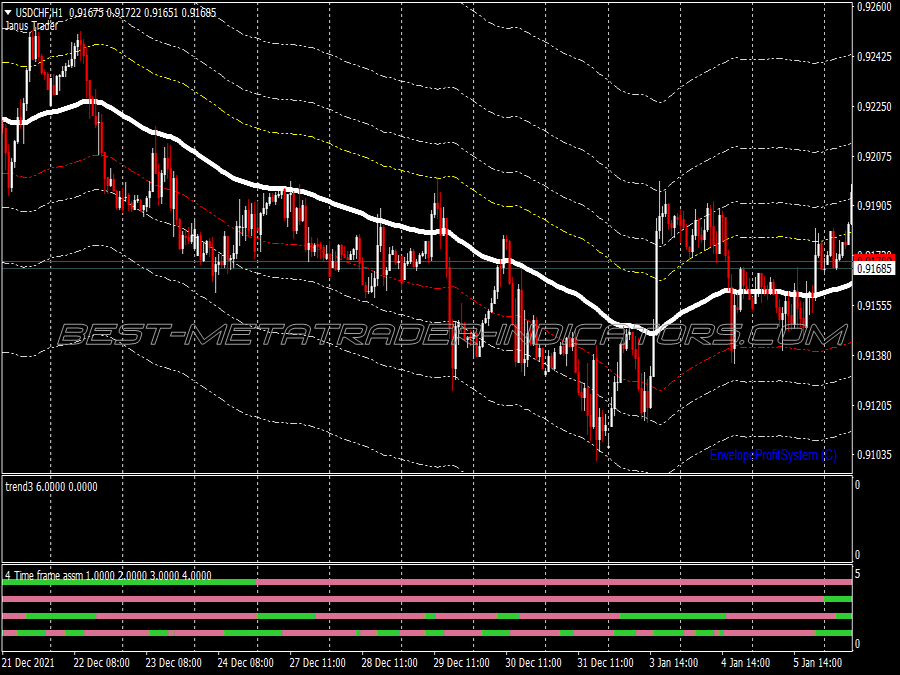

3. Bollinger Bands: These bands help assess volatility. When prices break above the upper band or below the lower band, it can indicate a strong move, signaling a breakout.

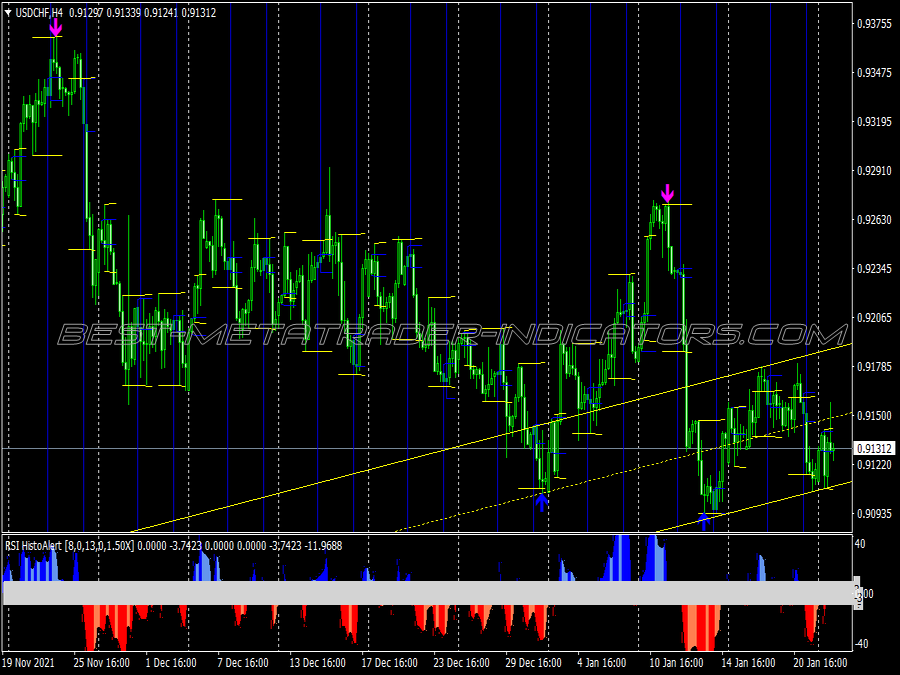

4. Relative Strength Index (RSI): Traders use this momentum oscillator to identify potential reversals. An RSI close to 70 may indicate overbought conditions during a breakout, while an RSI near 30 may suggest oversold conditions.

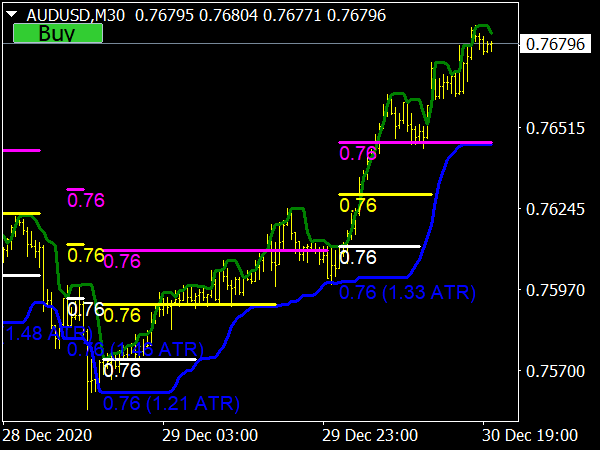

5. Average True Range (ATR): This indicator measures market volatility. A rising ATR can indicate the potential for a breakout, while a falling ATR may suggest a lack of significant movement.

Tips for Successful Breakout Trading:

1. Identify Key Levels: Prioritize significant support and resistance levels. Draw trendlines and use previous highs and lows to pinpoint potential breakout points.

2. Wait for Confirmation: Entering a trade too early can lead to false breakouts. Wait for confirmation through indicators or a sustained price movement past the breakout level.

3. Set Stop-Loss Orders: Protect your capital by placing stop-loss orders just below the breakout point for long positions and above for short positions. This minimizes potential losses in the event of a false breakout.

4. Use Proper Position Sizing: Adequate risk management is crucial. Determine the percentage of your account you’re willing to risk on a trade and adjust your position size accordingly.

5. Look for a Retest: Sometimes, prices will break out and then retrace back to the original level (the breakout point) to test its validity. This can provide traders with an additional entry point.

6. Monitor Market Conditions: Be aware of broader market trends, economic news, and events that could influence price movements. Major news can lead to significant volatility, affecting breakout opportunities.

7. Practice Patience: Not every breakout will result in a trend. Being patient and selective with trade entries can help filter out less reliable breakout opportunities.

8. Use Multiple Timeframes: Consider analyzing charts on different timeframes (daily, weekly, hourly) to gauge the strength and validity of a breakout. A breakout on a higher timeframe often has more significance.

9. Follow Your Trading Plan: Having a well-defined trading plan, inclusive of entry, exit, and risk management strategies, will help maintain discipline and reduce the emotional impact of trading decisions.

10. Learn from Each Trade: After every breakout trade, analyze the outcome. Determine what worked and what didn’t, allowing you to refine your strategy over time.

Ultimately, successful breakout trading requires a combination of technical skill, using the right indicators, and disciplined execution. By adhering to sound strategies and maintaining a focus on risk management, traders can enhance their potential for success in recognizing and capitalizing on breakout patterns in the financial markets.