Submit your review | |

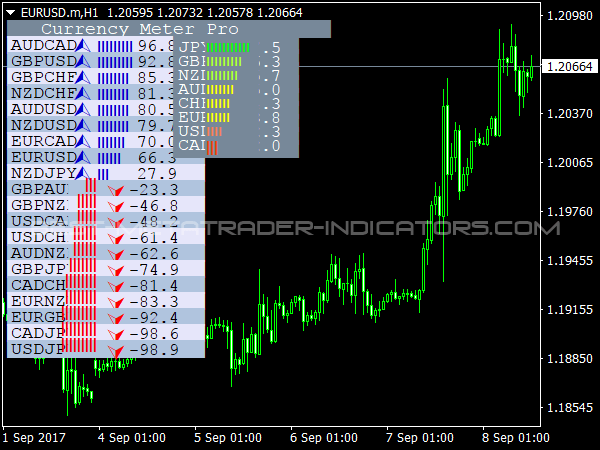

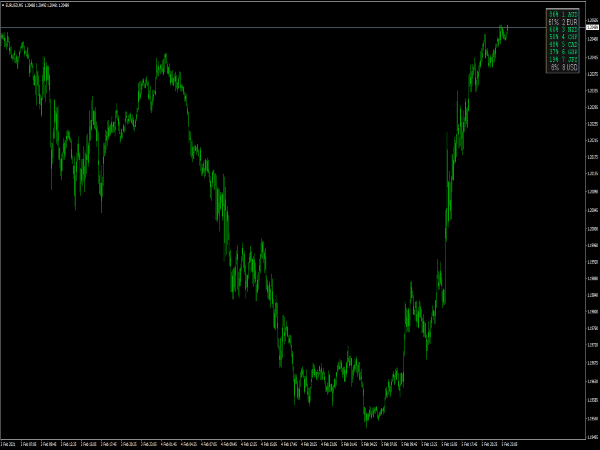

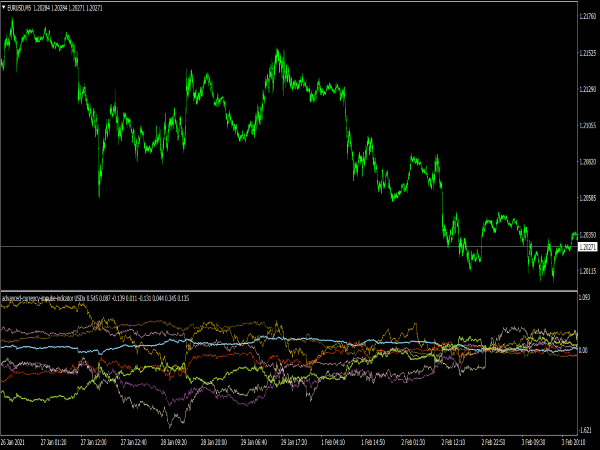

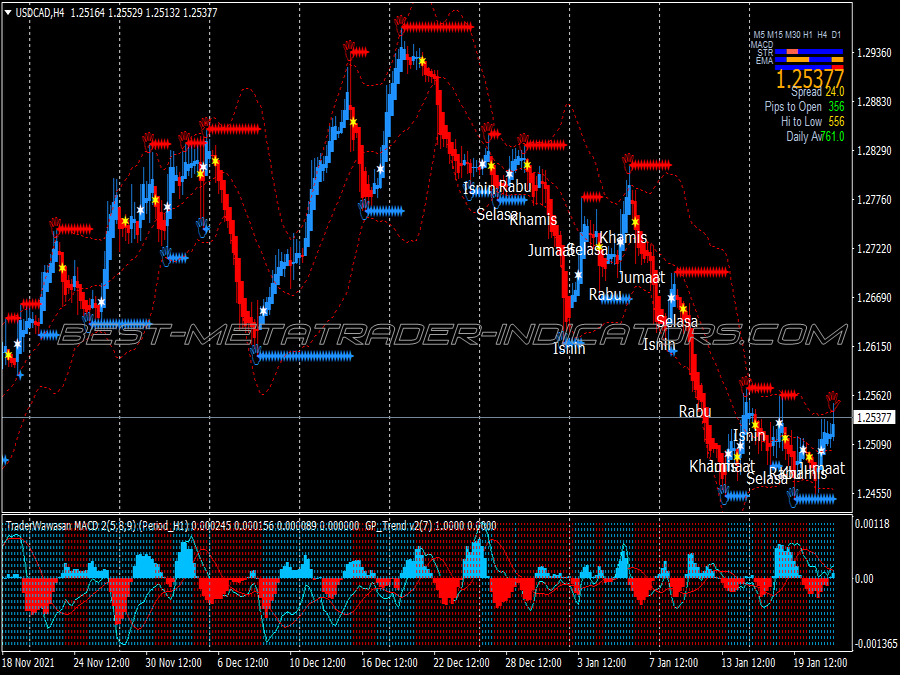

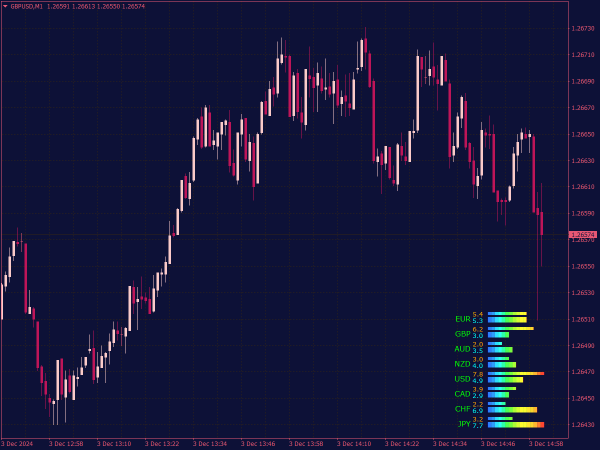

The Currency Power Meter indicator is a MT4 tool that helps traders assess the relative strength or weakness of various currencies in the forex market. It typically visualizes the strength of different currencies in real-time, allowing traders to identify trends and potential trading opportunities by comparing multiple currency pairs.

The indicator often features a user-friendly dashboard that displays strength scores, making it easy to determine which currencies are stronger or weaker at any given moment, and can be customized to suit individual trading strategies.

Here are several effective strategies that can be used with the Currency Power Meter:

1. Identification of Strong and Weak Currencies

One of the primary strategies involving the Currency Power Meter is identifying strong and weak currencies. This strategy revolves around trading currency pairs where one currency is strong, while the other is weak.

Tips and Rules

• Analyze the Meter: Identify the top-performing currency (e.g., USD, EUR) and the worst-performing currency (e.g., AUD, JPY).

• Select Pairs: Look for pairs that include the strong currency as the base and the weak currency as the quote (e.g., USD/AUD).

• Entry and Exit: Enter a long position when the strong currency shows upward momentum and exit when the power meter indicates that the strength is fading.

2. Momentum Trading

Momentum trading using the Currency Power Meter leverages the indicator's insights into market trends. Traders can capitalize on currencies that are trending in a particular direction.

Tips and Rules

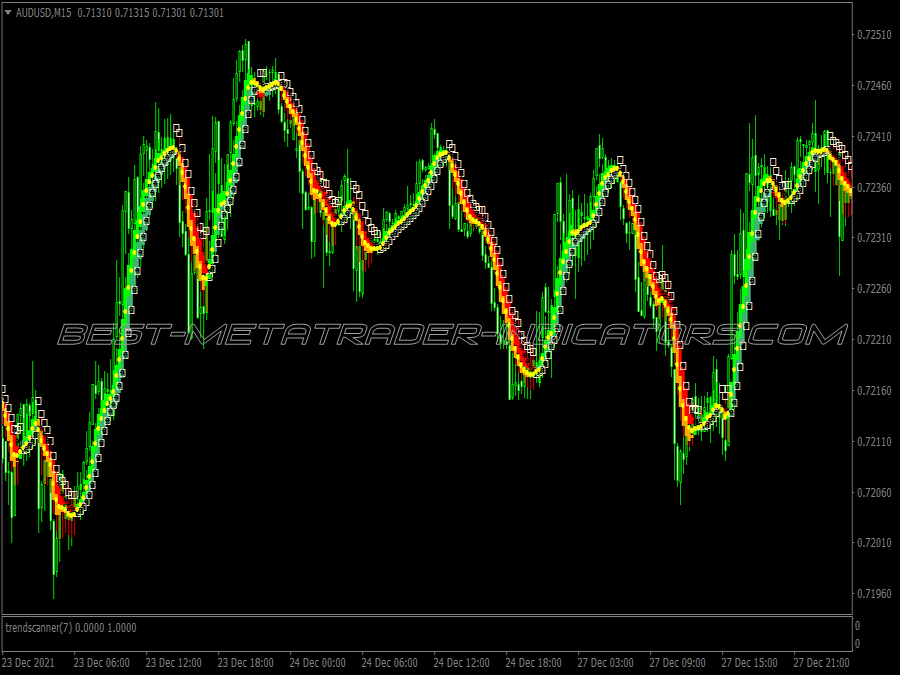

• Follow the Trends: Monitor the power meter for any significant changes. A currency that remains strong over several periods indicates strong momentum.

• Entry Points: Enter the trade early, ideally when the currency starts showing signs of strength. This could be coupled with candlestick patterns or moving averages for additional confirmation.

• Exit Strategy: Use trailing stops to secure profits, allowing for exit once the momentum appears to stall.

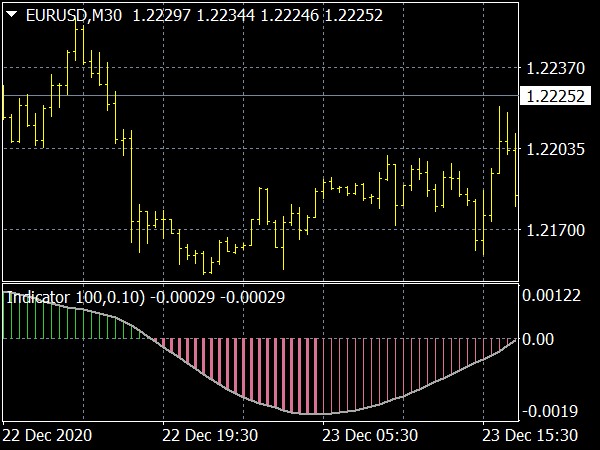

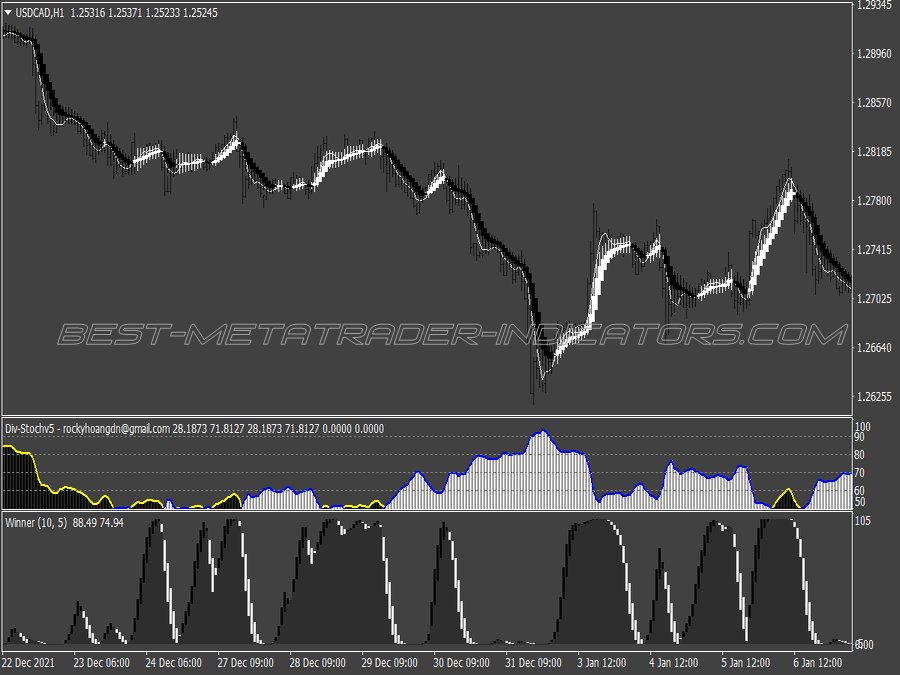

3. Divergence Strategy

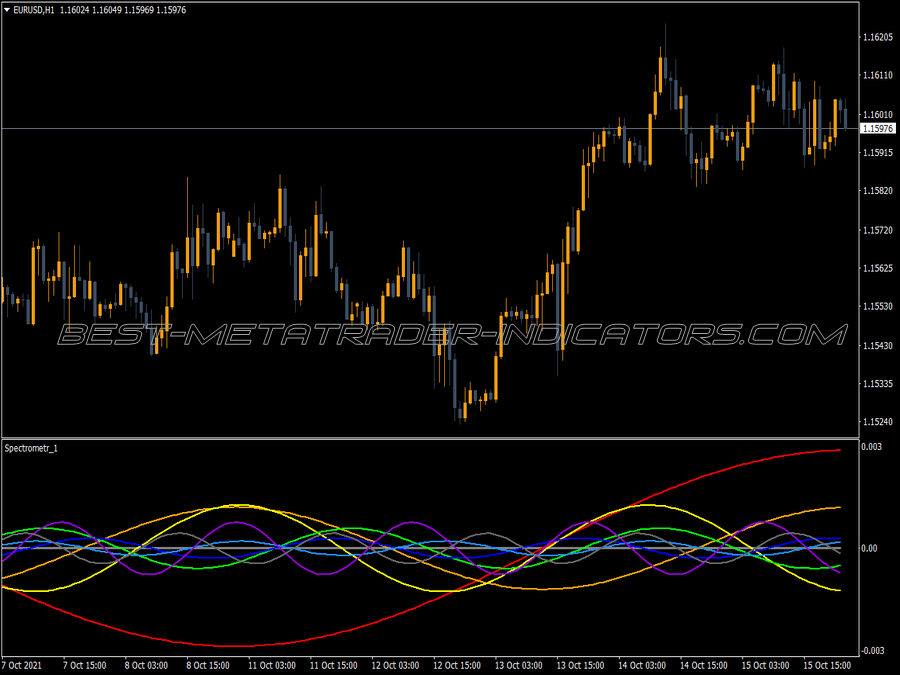

Divergence occurs when the price of a currency pair moves in the opposite direction to the Currency Power Meter. This can signal potential reversals and offers trading opportunities.

Tips and Rules

• Identify Divergence: Watch for scenarios where the market price of a currency pair continues to rise or fall, while the Power Meter indicates a regression in strength.

• Trade with Caution: Once divergence is confirmed, consider entering the opposite position (sell when strong, buy when weak).

• Manage Risk: Use stop-loss orders to manage any unexpected price movements, especially in volatile markets.

4. Confluence Trading

Confluence trading involves using multiple trading indicators alongside the Currency Power Meter to validate trade signals. This method enhances decision-making and reduces the likelihood of false signals.

Tips and Rules

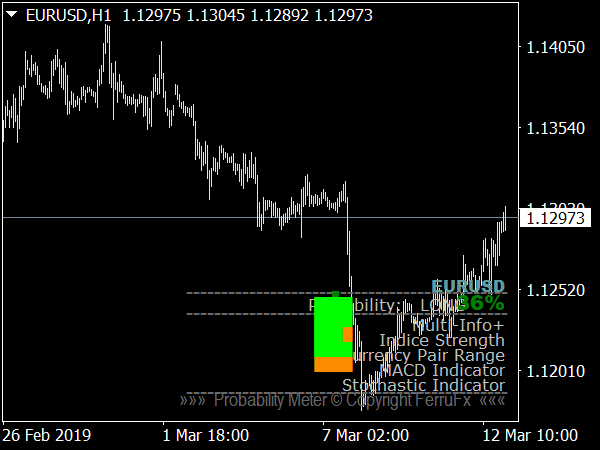

• Select Additional Indicators: Combine the Currency Power Meter with tools such as Relative Strength Index (RSI), Moving Averages, or Fibonacci retracement levels.

• Confirm Entry: Look for confirmation between the Currency Power Meter and other indicators. For example, if the meter shows a strong currency, check if the RSI indicates an oversold condition to confirm a bullish entry.

• Diverse Exit Strategies: Use multiple indicators to determine exit points, ensuring that you’re capitalizing on the most profitable price movements.

5. Forex News Events Strategy

Events like economic reports, policy changes, and geopolitical developments can significantly impact currency strength. By utilizing the Currency Power Meter, traders can make informed decisions around news releases.

Tips and Rules

• Before News Releases: Check the Currency Power Meter and identify which currencies are slated to move in response to the news (e.g., a positive employment report for the USD).

• Pre-emptive Positioning: Enter positions ahead of the news, capitalizing on expected volatility.

• Reacting to News: Use the meter post-release to reassess positions and exit or adjust trades based on how currencies react to new information.

6. Scalping with the Currency Power Meter

Scalping is a strategy that involves making quick trades to capitalize on small price movements. The Currency Power Meter can assist in identifying quick entry and exit points.

Tips and Rules

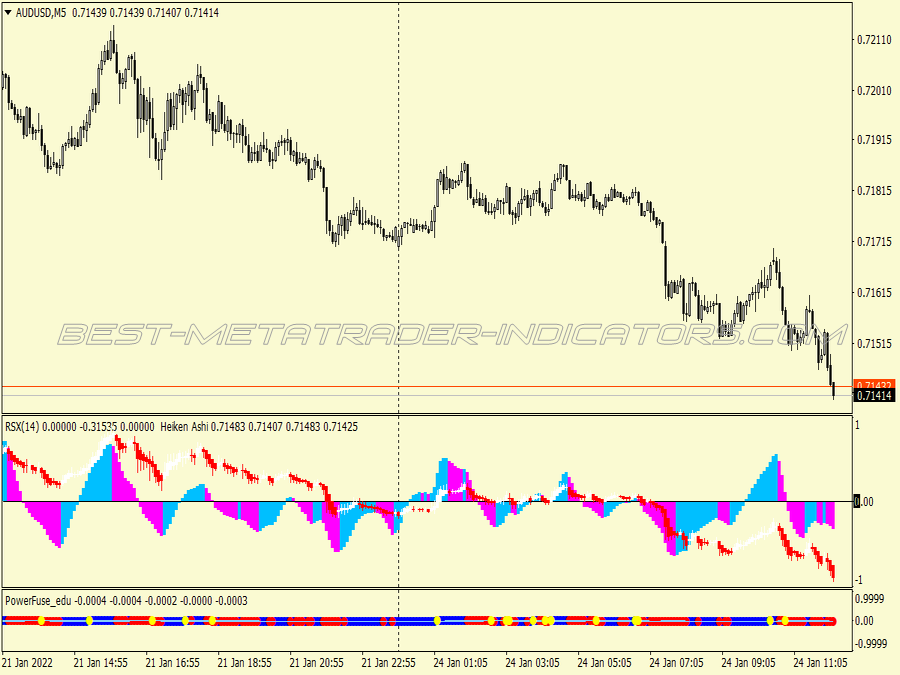

• Identify Short-Term Trends: Use the Currency Power Meter for quick evaluations of currency strength in shorter time frames (e.g., 1-minute or 5-minute charts).

• Quick Trades: Execute trades based on minute-to-minute changes, targeting quick profits as the strength of currencies fluctuates.

• Tight Stop Losses: Due to the rapid nature of scalping, ensure that stop losses are tight to mitigate risks.

Conclusion

The Currency Power Meter is a versatile tool that, when used judiciously, can significantly enhance trading strategies in the forex market. By leveraging its insights into currency strength and weakness, traders can identify profitable opportunities and make well-informed decisions.

Each strategy discussed here requires practice and understanding of risk management to maximize success. As with all trading methods, continuous market analysis and adapting to changing conditions are vital for long-term profitability. Traders should combine these strategies with a comprehensive trading plan and disciplined approach for the best chances of success in forex trading.

If this indicator is broken,

If this indicator is broken,  More Great Indicators and Trading Systems for MT4 or MT5

More Great Indicators and Trading Systems for MT4 or MT5