Submit your review | |

The Xmaster Formula Indicator is a popular trading tool designed to assist traders in making informed decisions in the Forex market. The indicator primarily employs a combination of price action, trend analysis, and support/resistance levels to provide buy and sell signals. Here are some trading tips and rules for effectively using the Xmaster Formula Indicator:

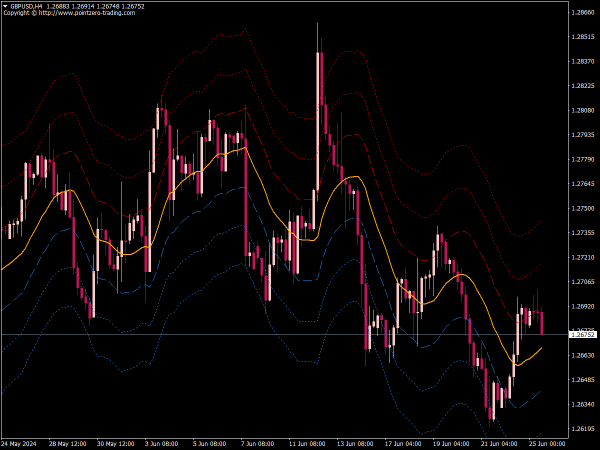

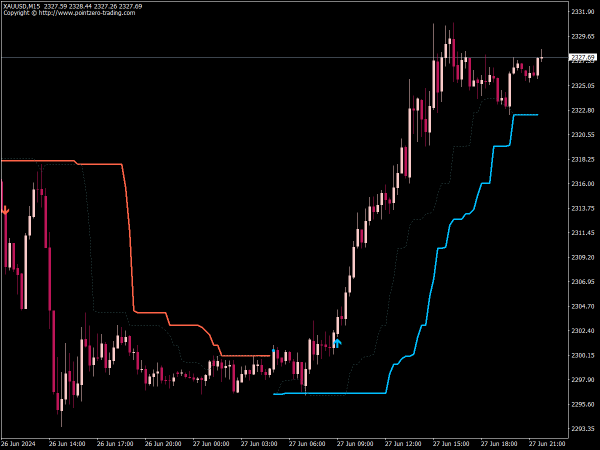

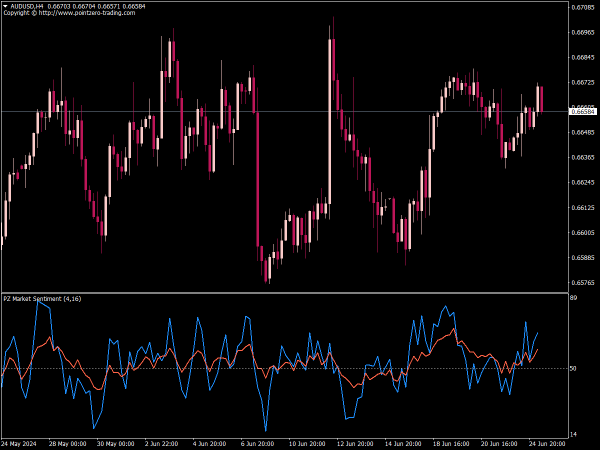

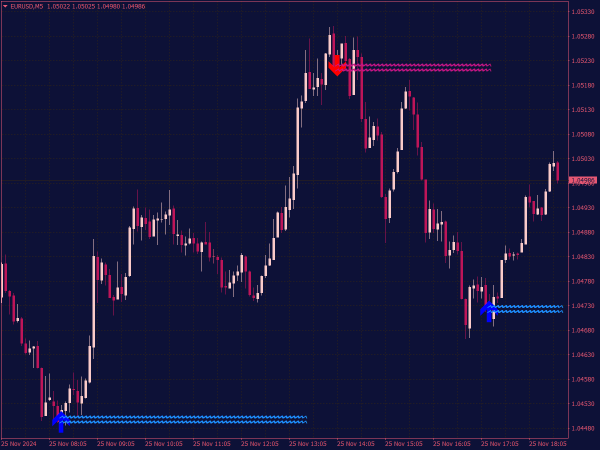

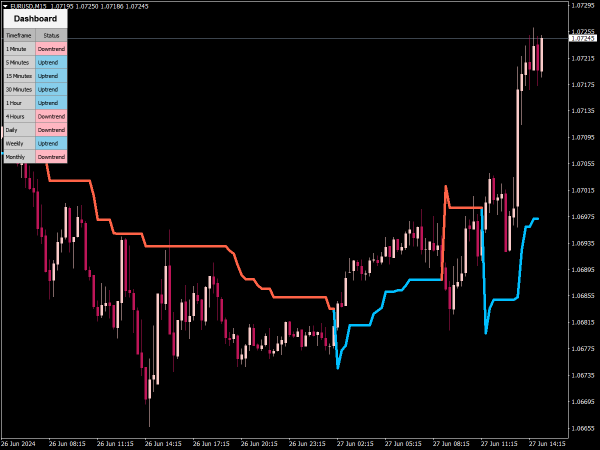

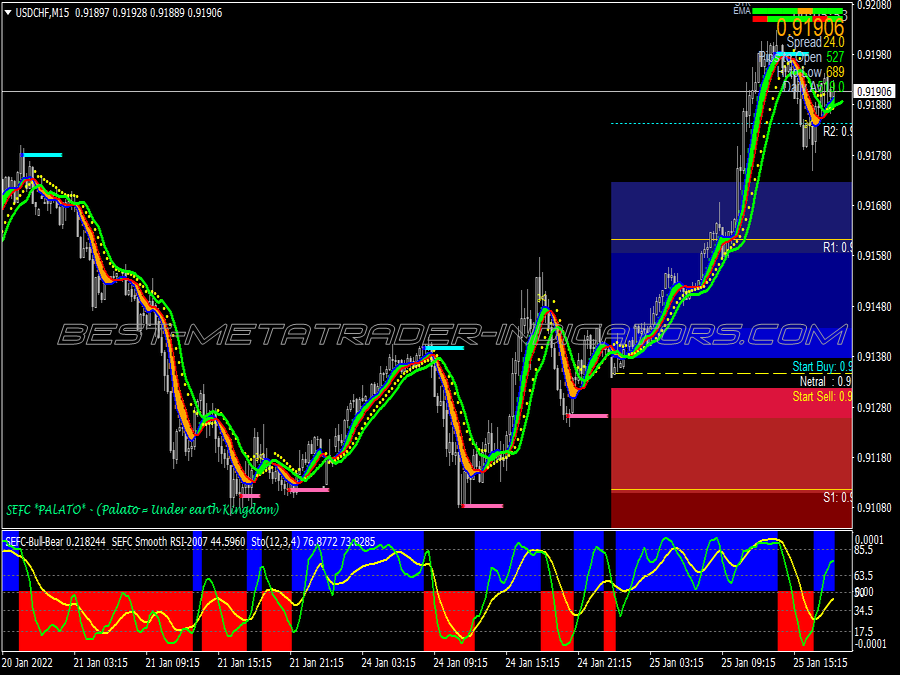

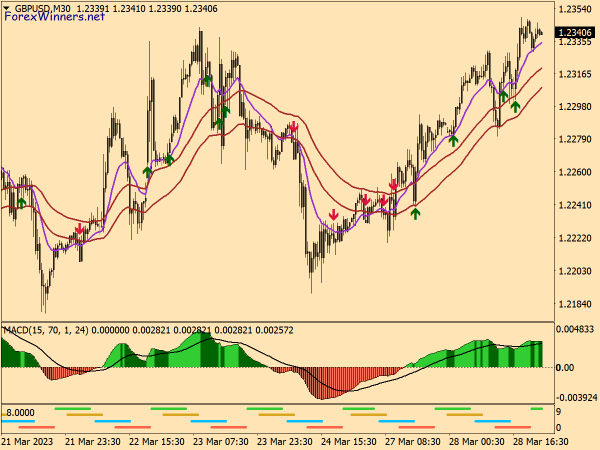

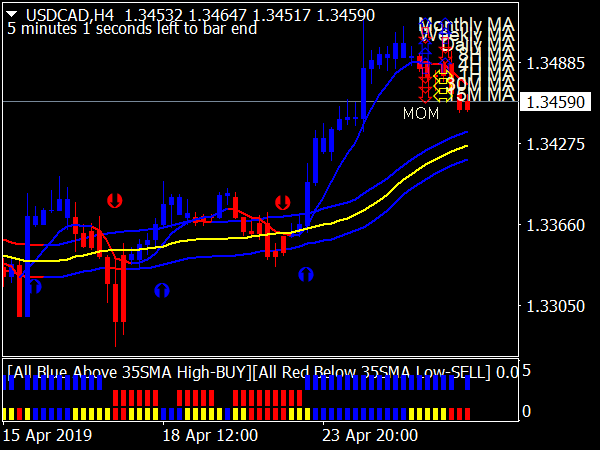

1. Understand the Indicator: Familiarize yourself with how the Xmaster Formula Indicator operates. It typically generates signals through color coding and arrow indicators on the price chart. Green may indicate a buy signal, while red might indicate a sell signal.

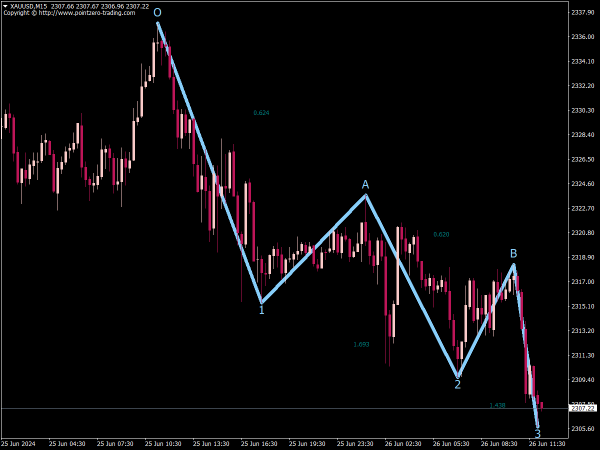

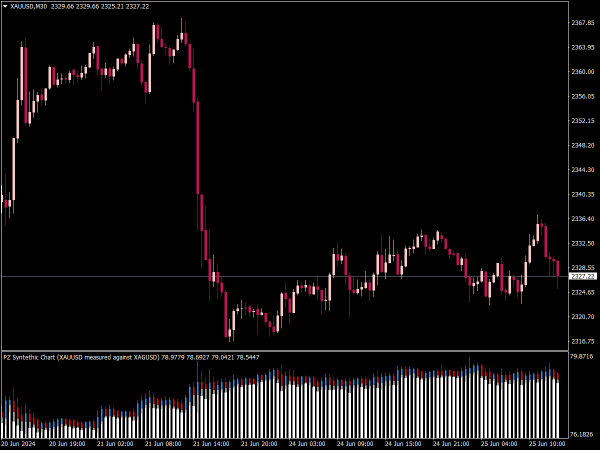

2. Confirm with Other Indicators: While the Xmaster Formula can provide valuable signals, it’s wise to cross-reference its indications with other technical indicators, such as Moving Averages or RSI (Relative Strength Index). This helps confirm the validity of the signal and reduces false entries.

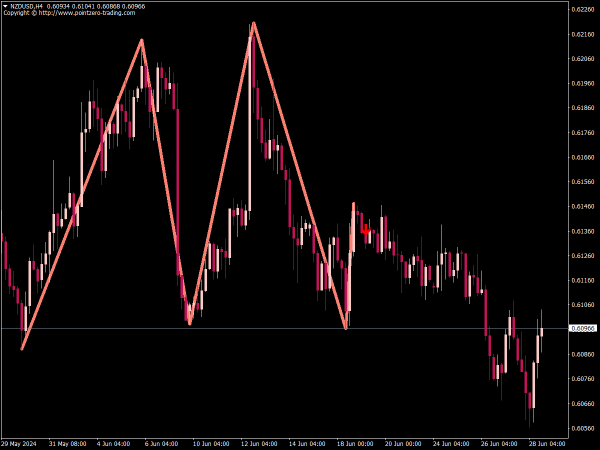

3. Select the Right Timeframe: The effectiveness of the indicator can vary by timeframe. For day trading, shorter timeframes like 15 to 30 minutes may be preferable, while swing traders may benefit more from daily or weekly charts. Experiment to find which timeframe aligns best with your trading strategy.

4. Risk Management: Always implement strict risk management rules. Set stop-loss orders to limit potential losses and only risk a small percentage (typically 1-2%) of your trading capital on any single trade. This ensures that no single trade can significantly damage your account.

5. Practice Patience: Wait for confirmed signals. This means using the Xmaster Formula Indicator in conjunction with other analytical tools to ensure that a trade aligns with your criteria. Patience can help avoid impulsive decisions that often lead to losses.

6. Avoid Overtrading: One of the common pitfalls in trading is overtrading due to overconfidence in an indicator. Stick to your trading plan and only take trades that meet your predetermined criteria. Quality over quantity is essential for long-term success.

7. Utilize Support and Resistance Levels: The Xmaster Formula Indicator can help identify potential support and resistance levels. Pay attention to these levels when entering or exiting trades, as they can indicate reversal points or confirm the strength of a trend.

8. Adapt to Market Conditions: The Forex market often changes conditions due to factors like economic news and events. Be prepared to adjust your trading strategy based on market volatility and trends. Keep an economic calendar on hand to stay informed.

9. Keep a Trading Journal: Document your trades to analyze performance over time. Review which strategies worked well and which didn’t, allowing you to refine your approach continuously. This practice can also help in identifying emotional and behavioral patterns in your trading.

10. Stay Educated: The Forex market is dynamic and ever-evolving. Stay updated on market trends, news, and new trading strategies. Consider joining trading communities or forums where you can share insights, tips, and experiences with other traders.

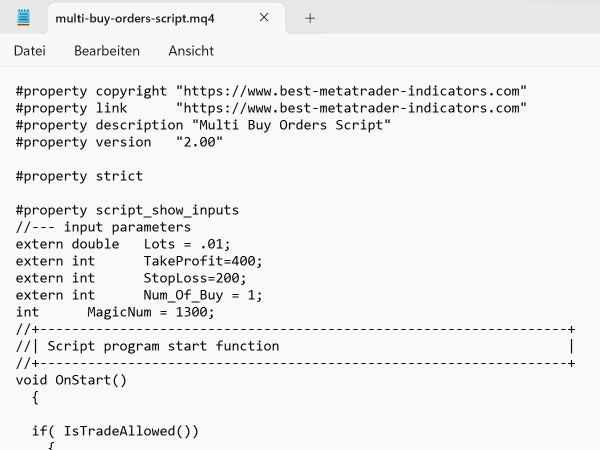

11. Backtesting: Before live trading with the Xmaster Formula Indicator, backtest it on historical data. This can give you an understanding of how the indicator performs under various market conditions and help build confidence in your strategy.

12. Use Proper Lot Sizes: Ensure that you are using appropriate lot sizes based on your account balance and risk management criteria. This practice is crucial in maintaining a sustainable trading strategy over the long term.

By following these tips and rules, traders can maximize the effectiveness of the Xmaster Formula Indicator and enhance their overall trading experience. Always maintain a disciplined approach and avoid emotional trading decisions based on short-term fluctuations in the market.