Submit your review | |

ℹ️ How to Identify Price Trend with Moving Average

In the previous tip, we've discussed about the basic building blocks of a trend i.e. peak and trough. Now let's take one more way to identify price trend with the help of moving average. A moving average, for a simple understanding, is merely a price average of certain asset or market instrument, within a certain period of time. The most common way, to calculate a moving average is using closing price. So, an X moving average is the average of closing price within X period.

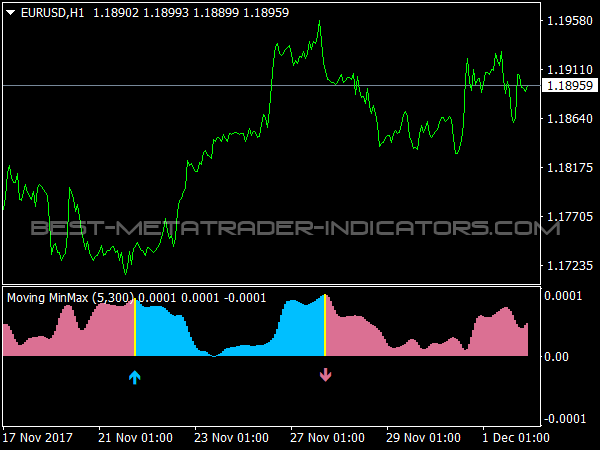

Let's say you want to calculate 5-day moving average, what you need is the last five-day closing prices then sum them. The result then divided by five. Voila! You get the figure of your desired 5-day moving average. However, we won't discuss about moving average in-depth in this tip. But for you who just got into the world of technical analysis, you should know that we have several kinds of moving average, they are simple moving average (SMA), exponential moving average (EMA) and weighted moving average (WMA). As technical analysis scope grows all the time, there are also some other modified moving averages.

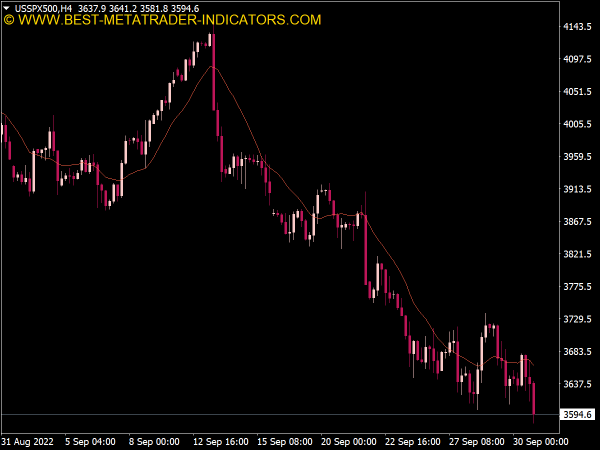

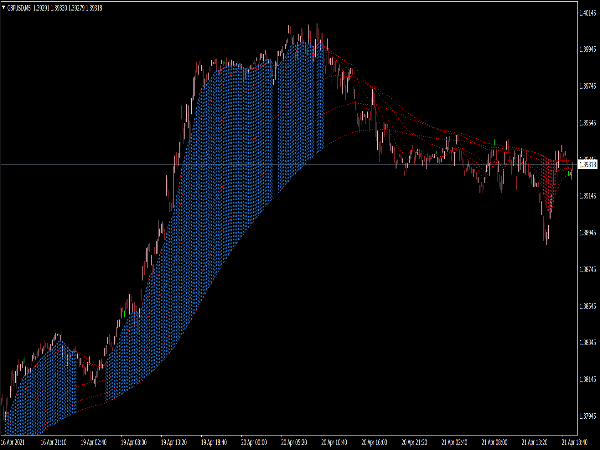

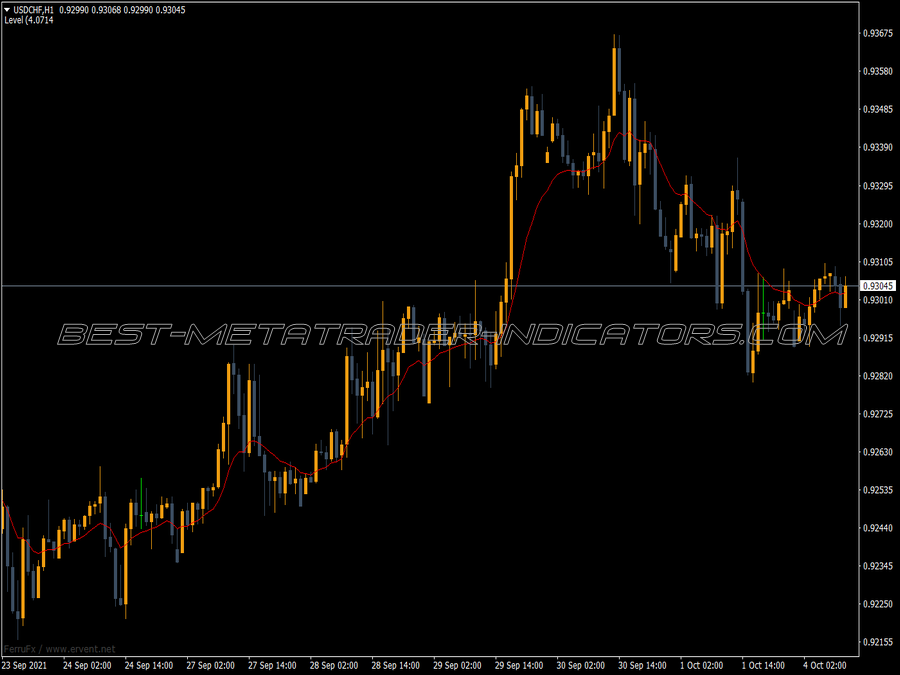

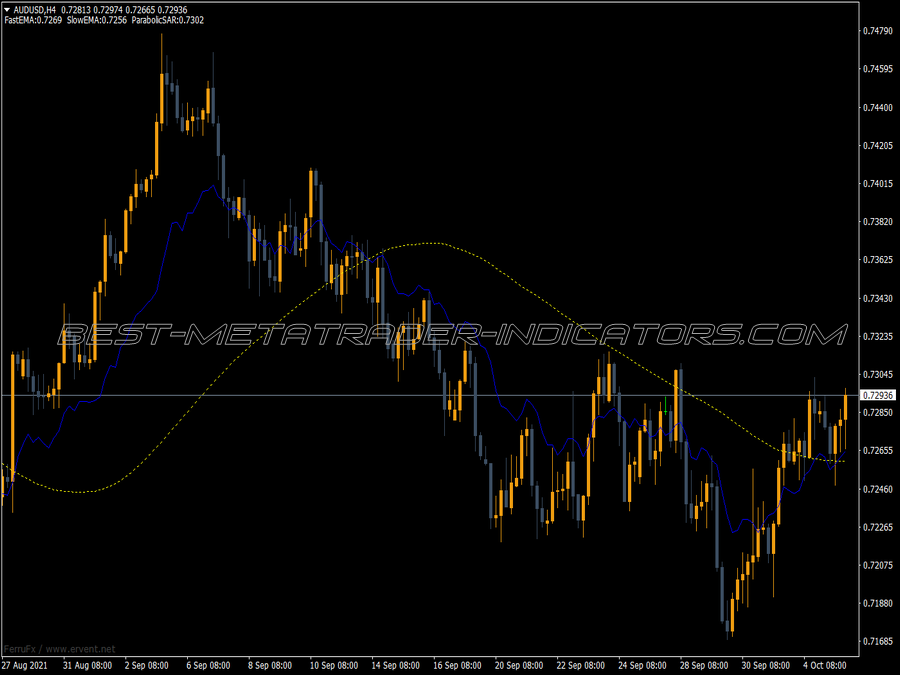

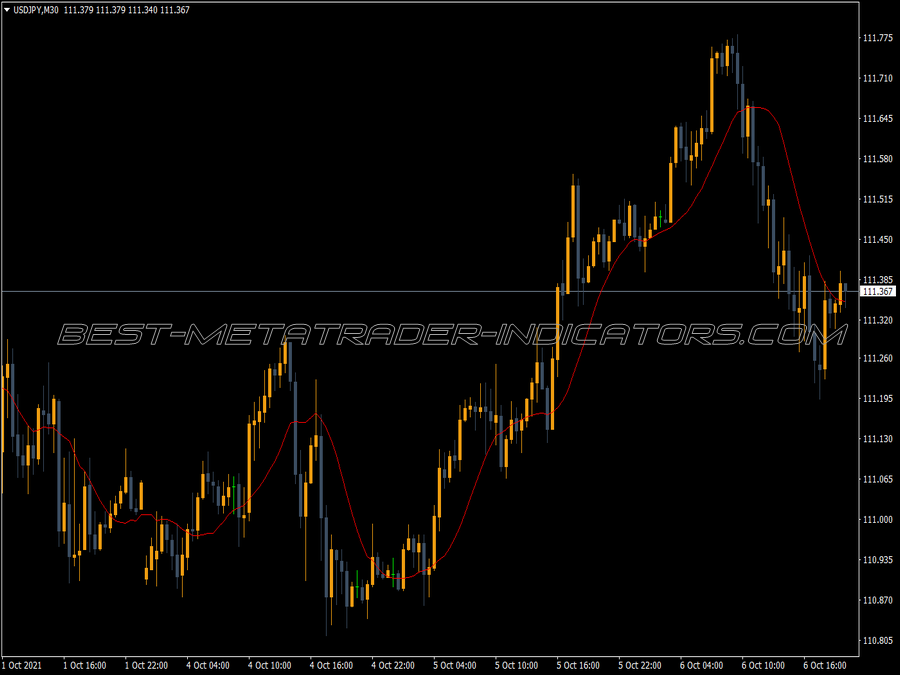

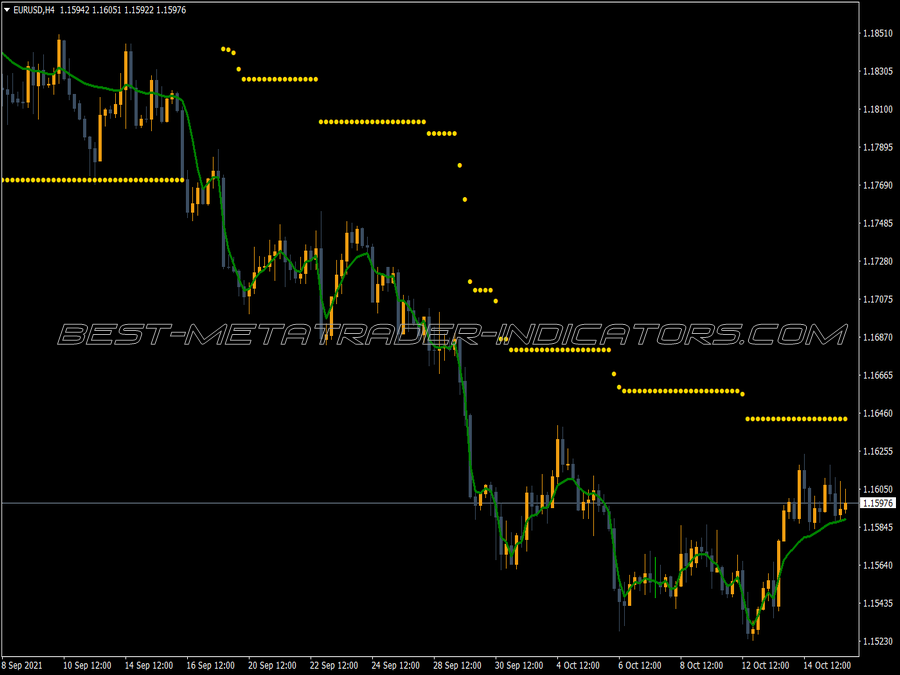

Now let's get back into our main focus. How to identify a price trend with moving average? Simple. Please a careful look at picture 1. When you see price moves above a moving average then the trend is rising and when you find price falls and moves below a moving average then it is a downtrend.

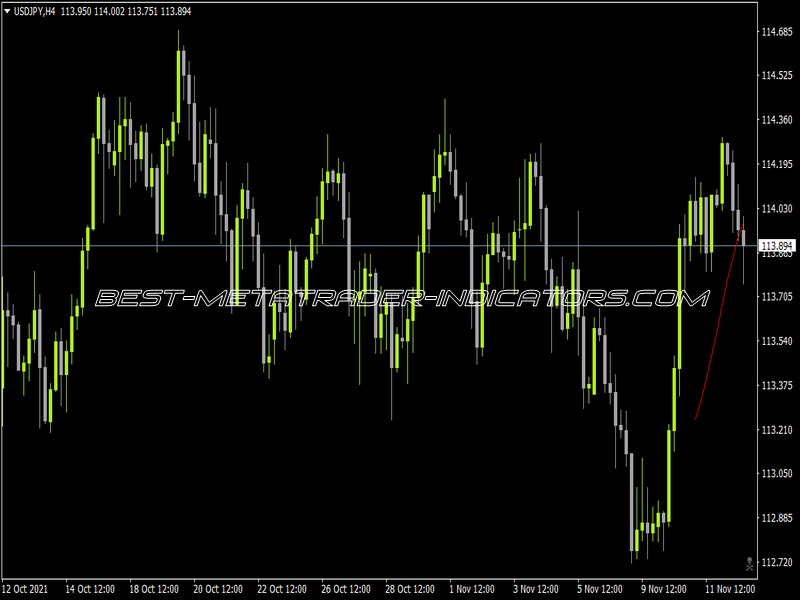

However, please be careful that the rule is not always right. We mean, it depends on market condition. When a market is lack of power, you will see price will do some noises or whipsawing at a moving average. Along with your growing experience, you'll get more tricks to identify when a market is sideways and when a market is trending. And a moving average, as it is a trend-following indicator, will work best during trending market.

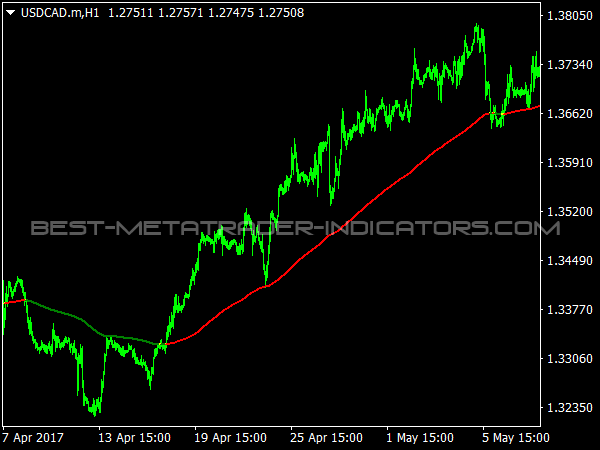

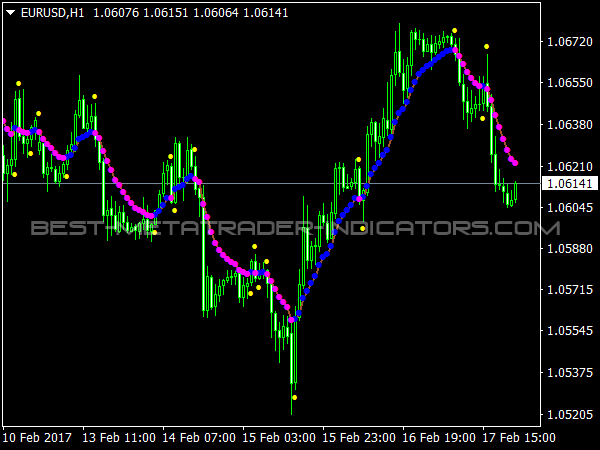

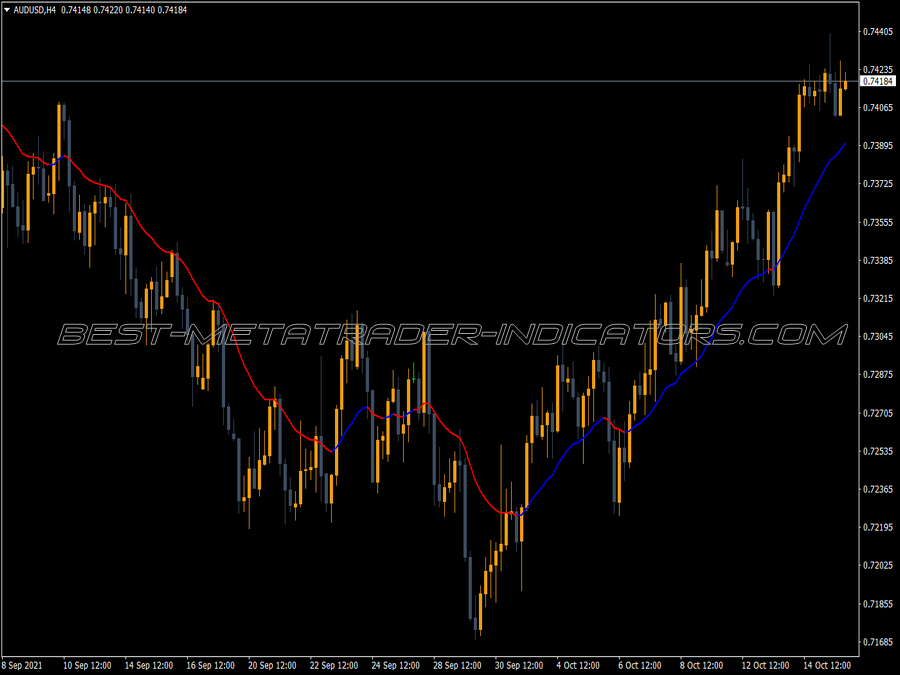

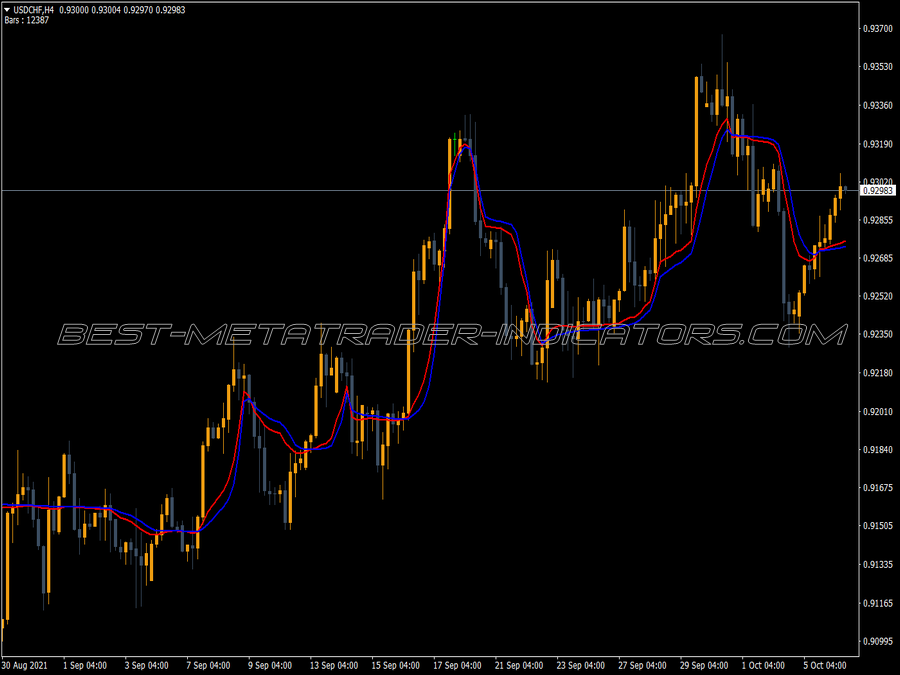

Another trick to identify a price trend with the assistance of moving average is make use of dual or triple moving averages with different period or parameter. You can experiment to use, for instance 10- and 20-day moving average. When 10-day moving average crosses up from below to above the 20-day moving average, it indicates that a trend might be at the beginning of a rising stage. The contrary condition will be true for a declining stage.

And as long as the smaller period moving average moves above the bigger period, price will likely continue moving upward until the smaller crosses down the bigger one. Do you get the point? Absolutely there are some other tricks to identify price trend. So keep visiting Best-MetaTrader-Indicators.com to get more valuable trading tips on technical analysis. See you around, trader!