Submit your review | |

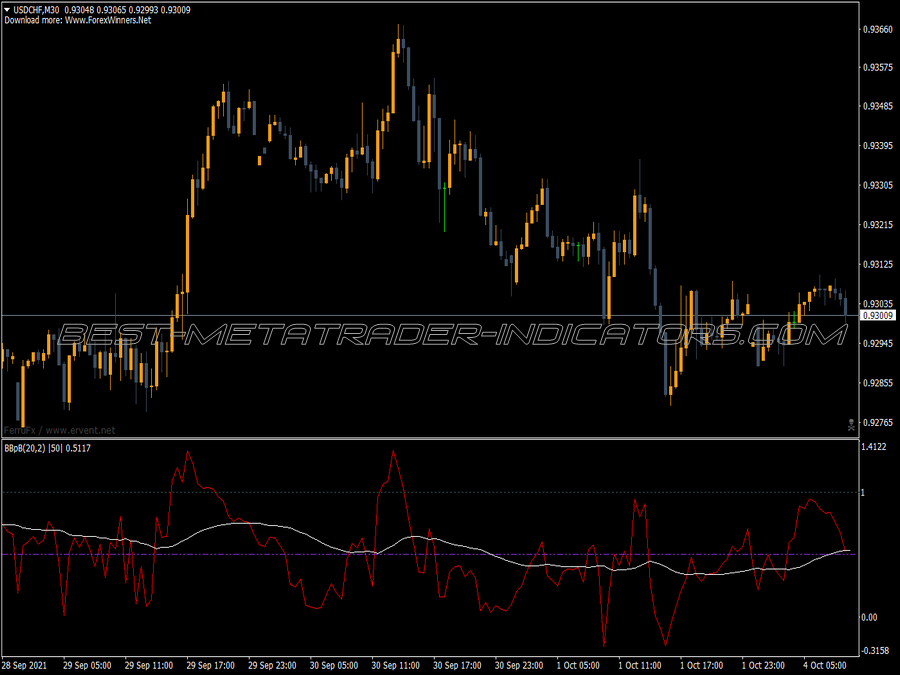

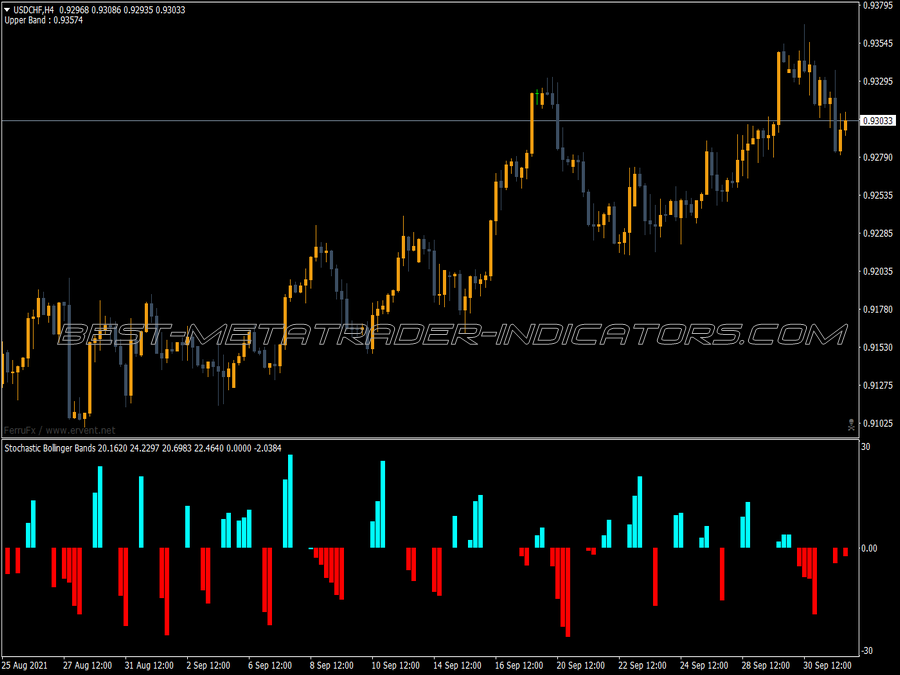

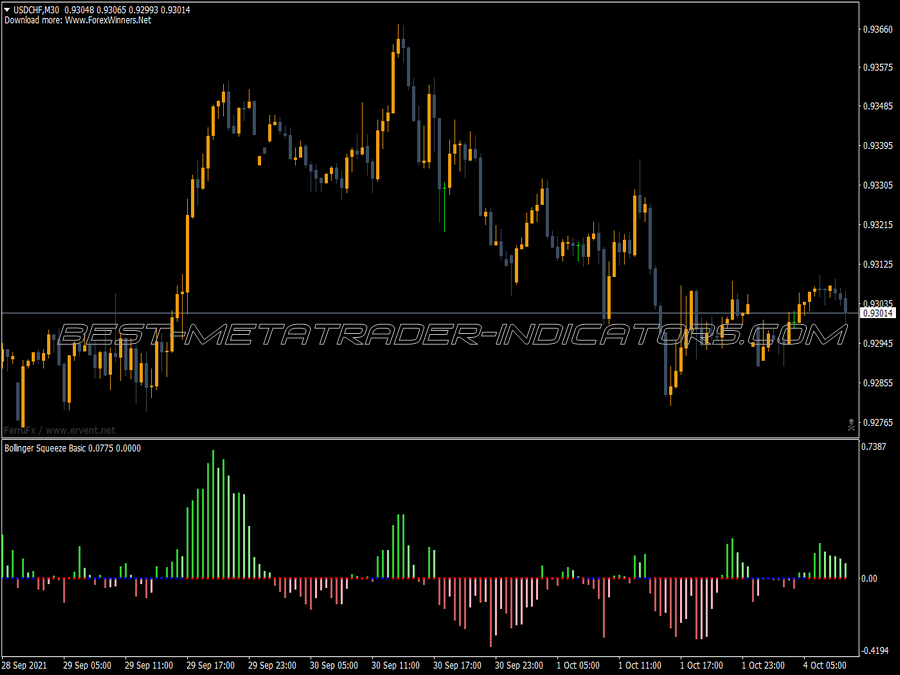

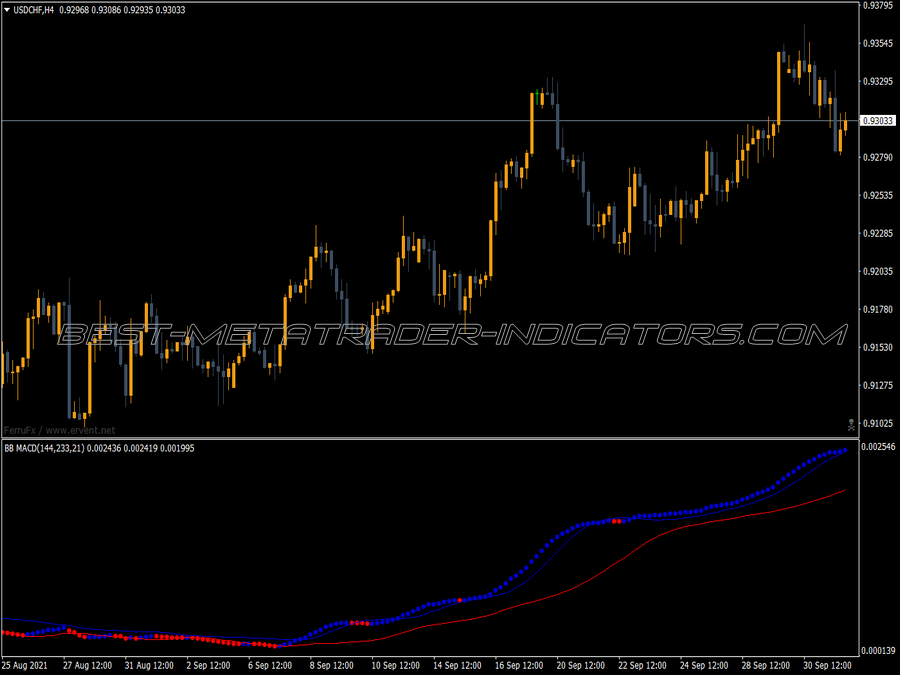

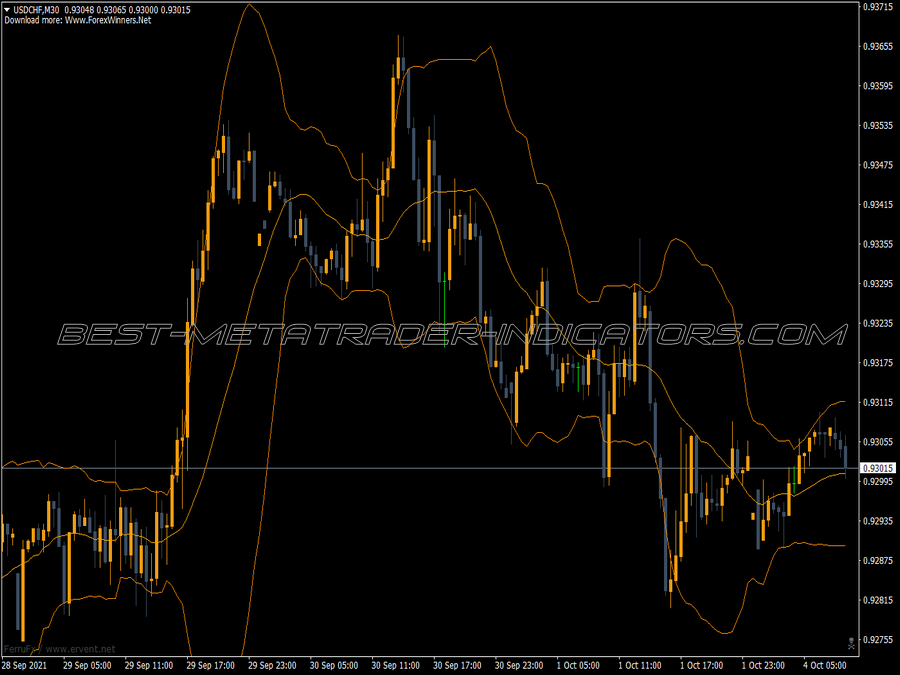

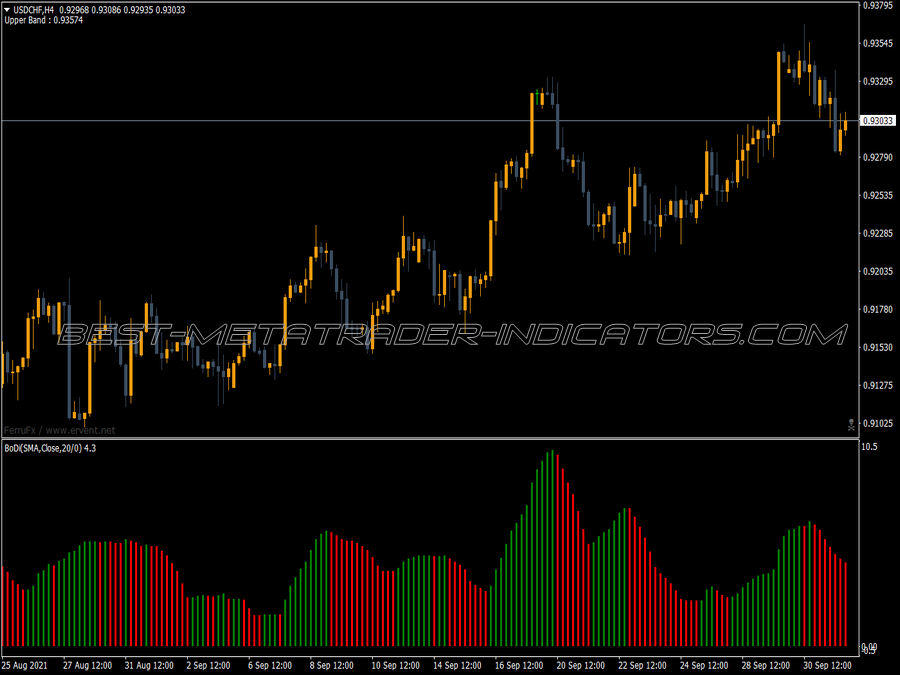

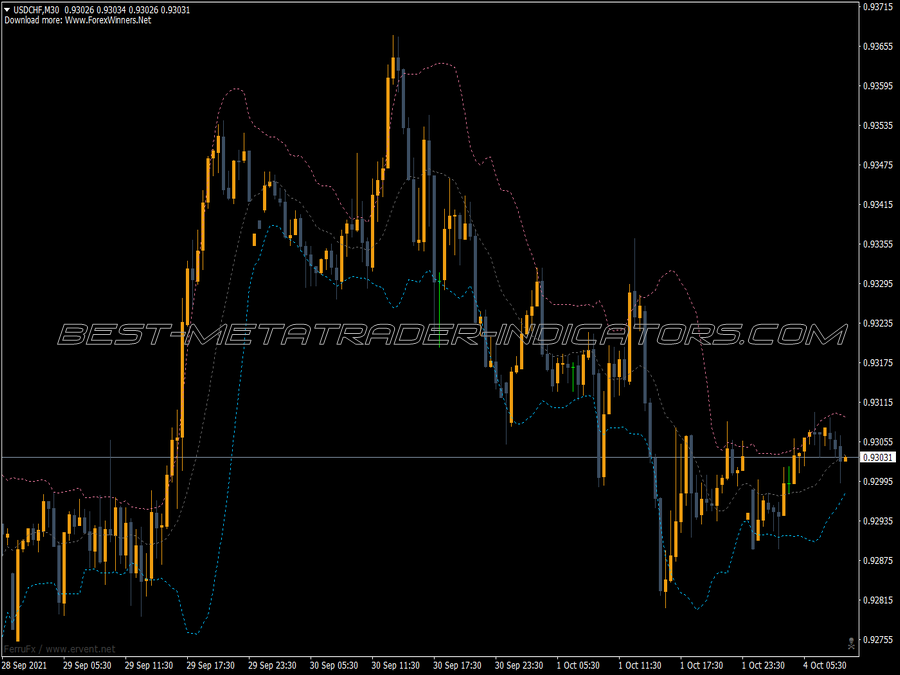

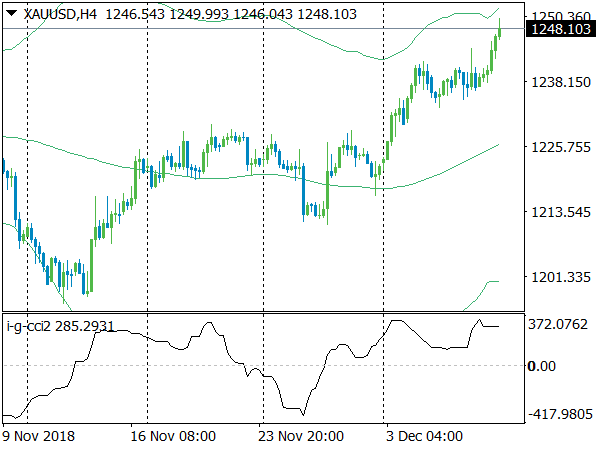

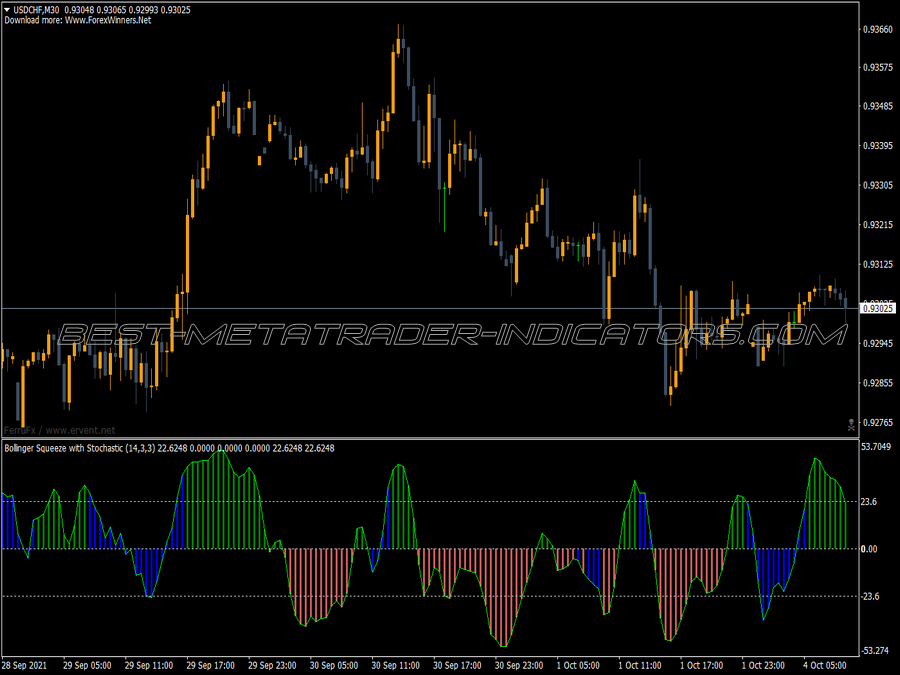

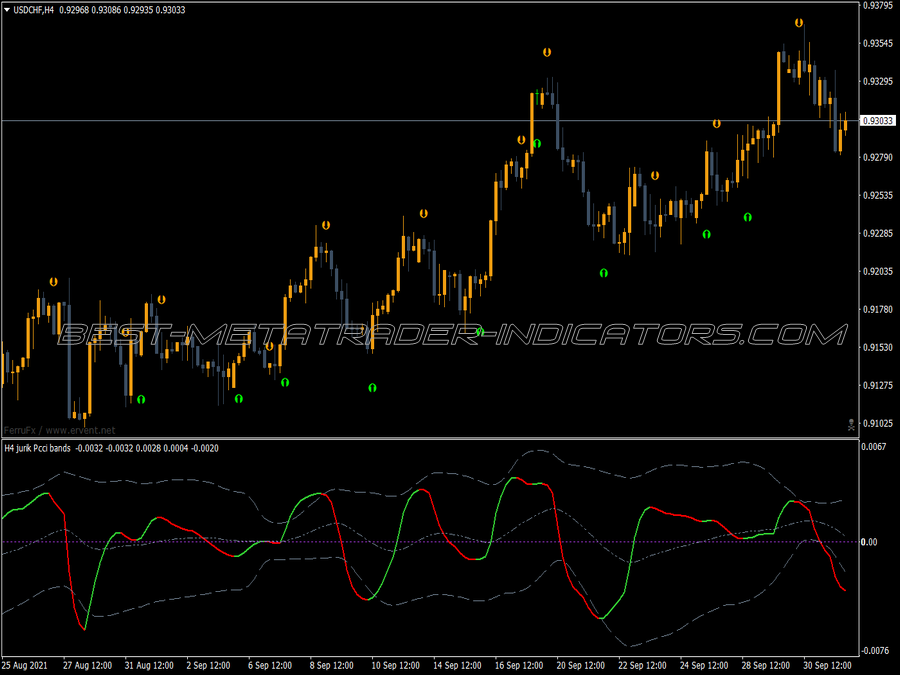

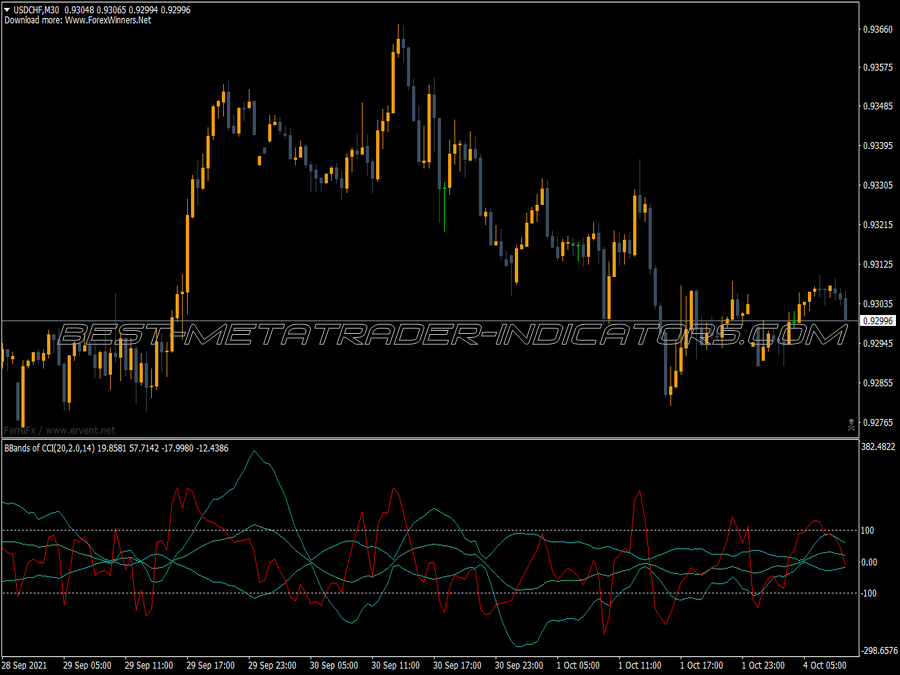

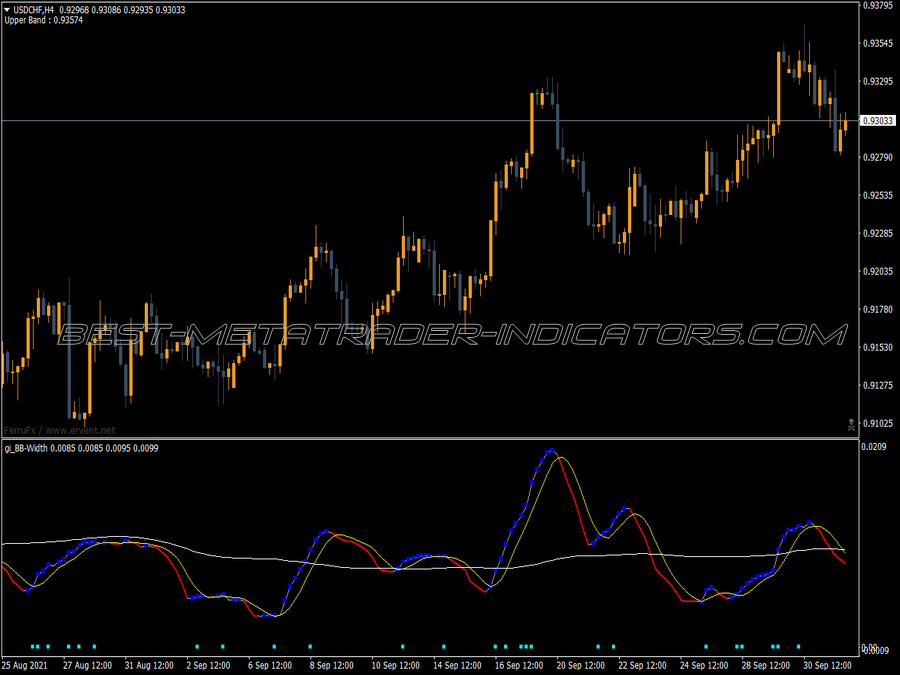

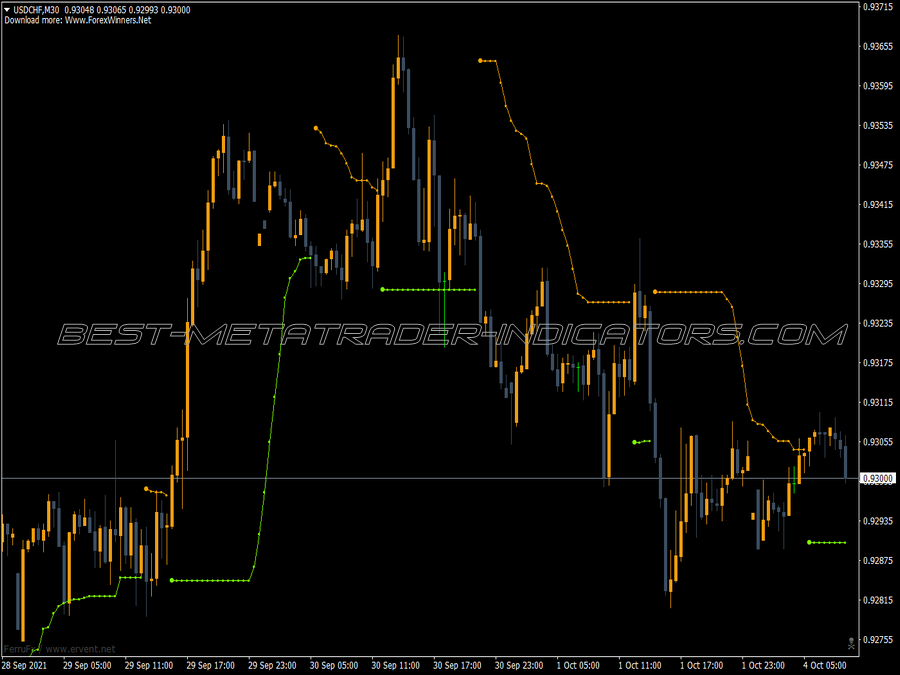

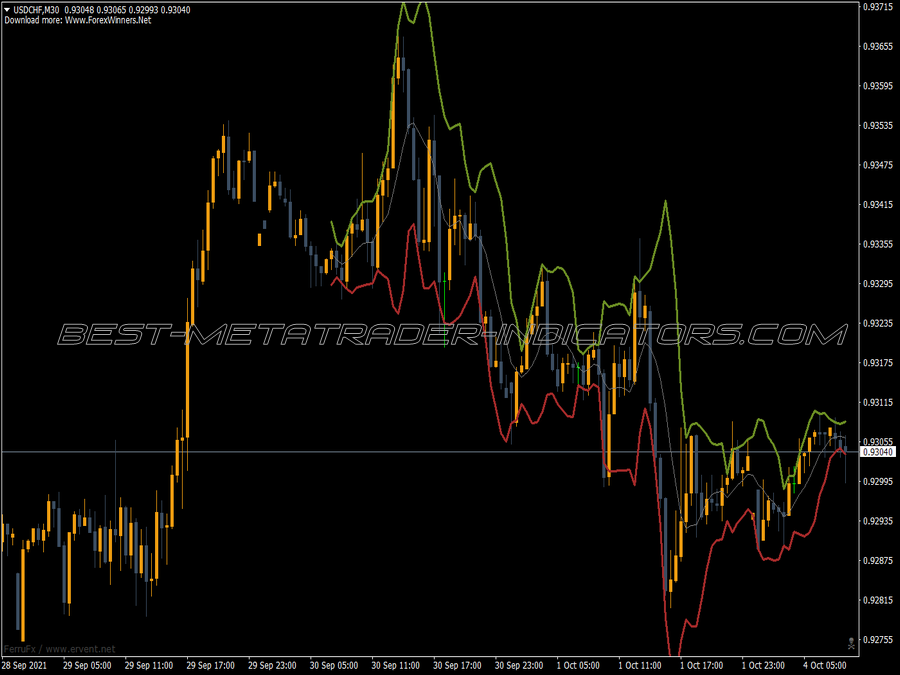

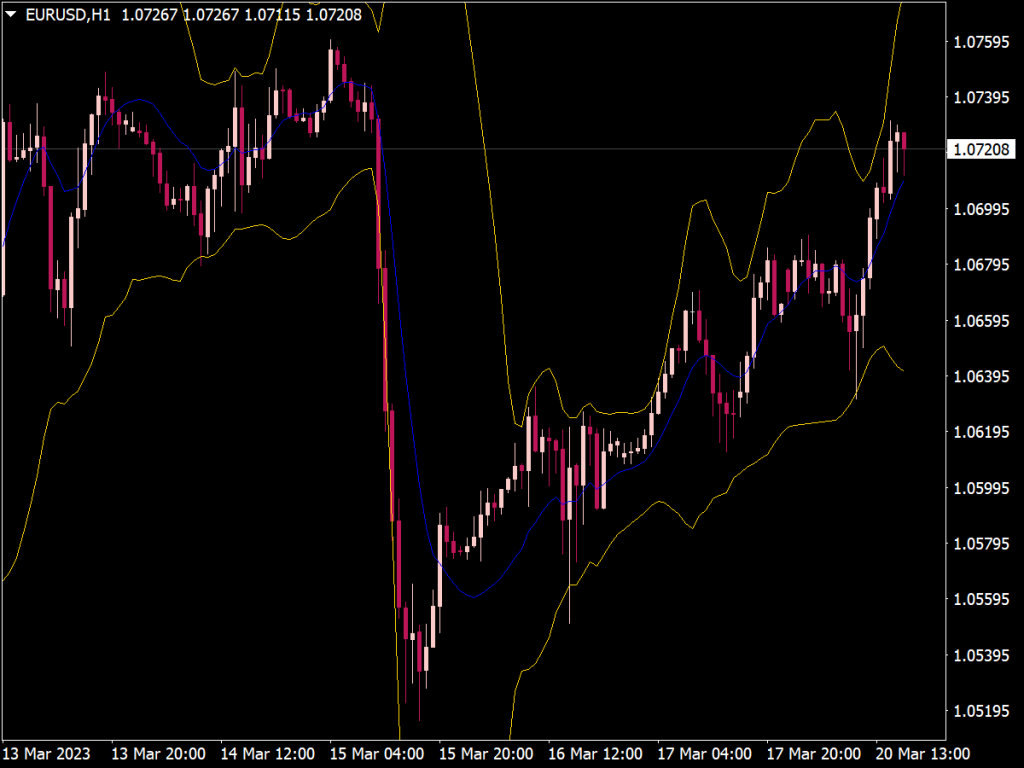

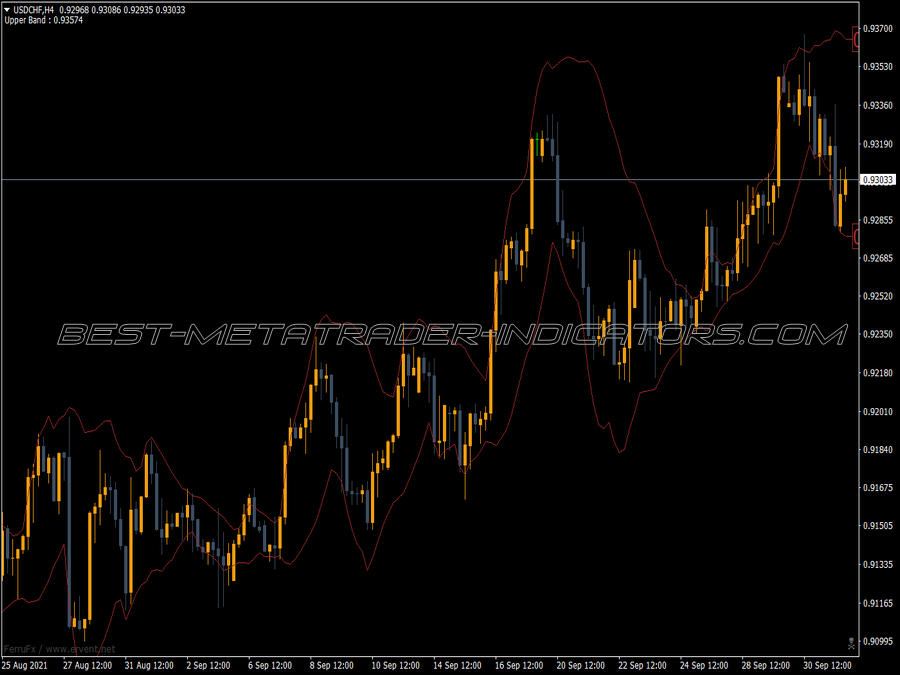

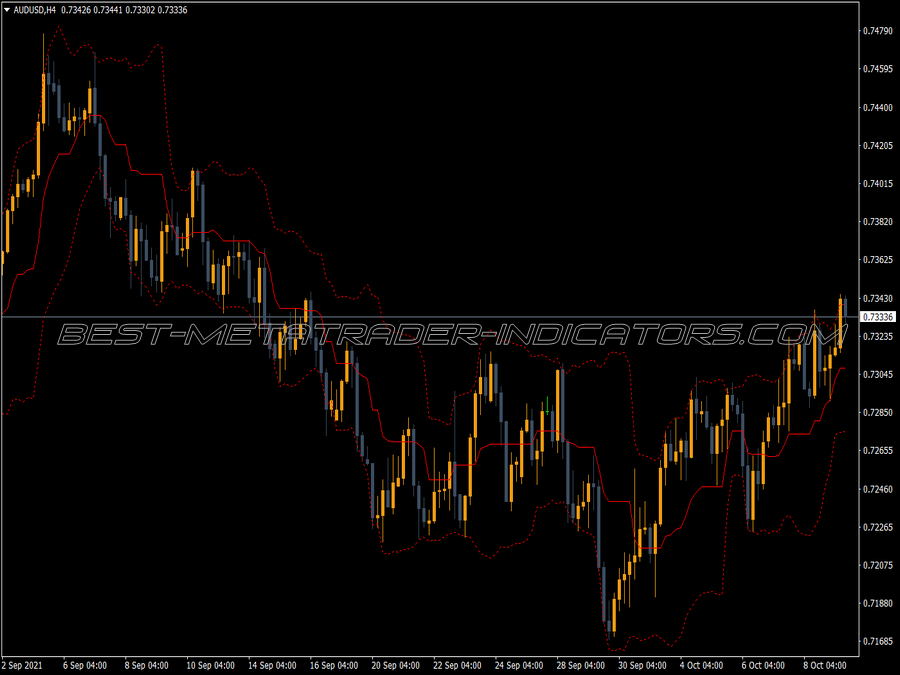

One can also apply the Bollinger Bands to indicators. This method works particularly well for day trading, i.e. in a very short-term area. As always, the Bollinger Bands do not give false signals in retrospect, but it is very difficult to exploit them, since often a minimal movement is already enough to move an indicator from one band to another. The oscillators are particularly suitable for this purpose.

The rigid setting of overbought and oversold levels has many disadvantages, because these levels are constantly changing. It is therefore more sensible to have this determined relatively via the Bollinger Bands. In principle, the same rules apply to the use as for the Bollinger analysis with price data.

However, the indicators are usually more multifaceted than the rates and more individual, each indicator must be set individually. Most require a slightly larger period length and also a slightly higher standard deviation of 2,1 or similar. One must practice the eye here in order to find the right attitude.